Celebrity crypto critic: Overhyped NFTs are just the free drink to lure you into the casino

March 19, 2022 | Tommy Felts

Editor’s note: The following story is part of Startland News’ coverage of the SXSW conference in Austin. Click here to read more stories from the 2022 trip.

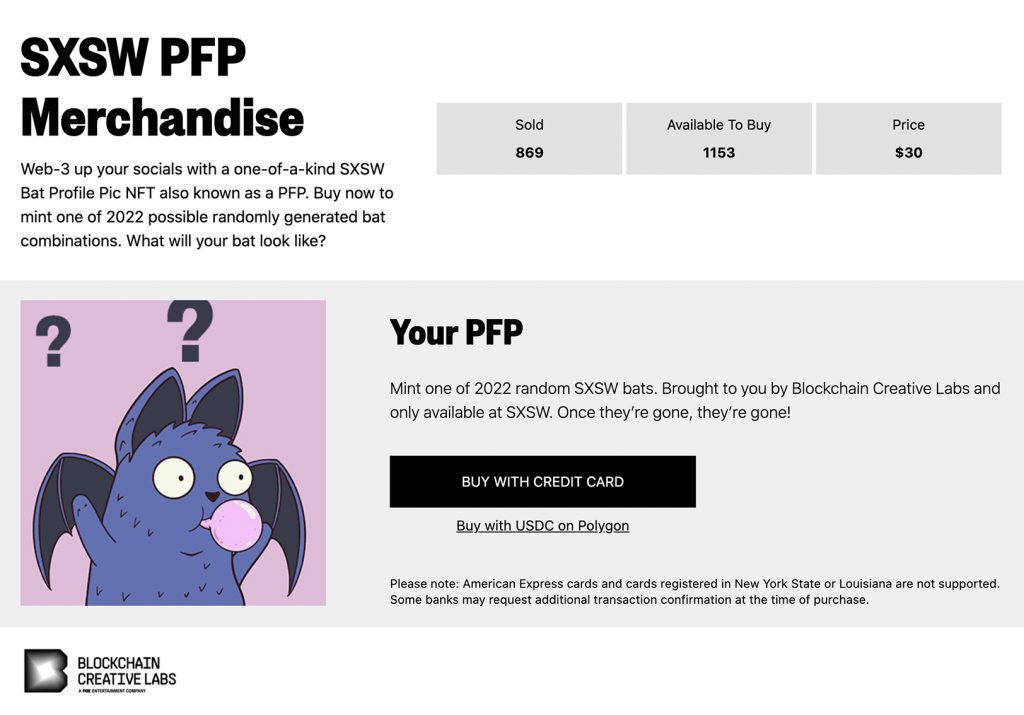

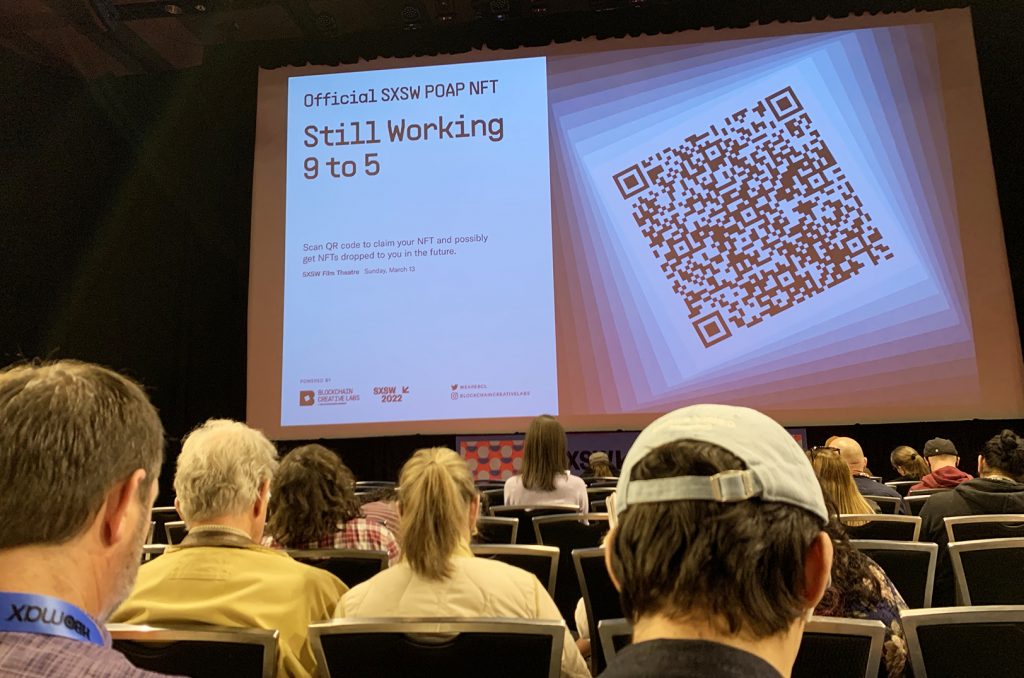

AUSTIN — TV star and economist Ben McKenzie balked at the prospect of downloading a “free” NFT promoted by a vendor this week at SXSW — one of many such offerings he encountered at the tech and culture festival where curiosity and excitement about crypto and its place in the rapidly developing metaverse ran high.

“They’re just bringing you into the casino,” said McKenzie, voicing his pointed skepticism about the process wherein NFT-thirsty conference-goers would scan a QR code, sign up for an account, and download a wallet — all to gain a new NFT sight unseen.

An NFT activation event highlighting “Doodles” in Austin as part of SXSW

Other promotions — from in-person NFT activation events and an official SXSW NFT gallery to NFT giveaways tied to festival movie premieres and collectible die-cut stickers hidden with QR codes throughout the conference — kept the tradable digital art front and center at SXSW.

Click here to explore the SXSW x NFT marketplace.

Even country music icon Dolly Parton — through her marquee SXSW event “Welcome to Dollyverse” — joined in the craze with an event Friday that featured limited-edition NFTs of her new “Run, Rose, Run” album and a limited series of Dolly-inspired NFT artwork.

Non-fungible tokens (NFTs) are unique digital tokens that serve as proof of ownership of an asset, and cannot be replicated. NFTs use blockchain technology, which acts as a digital record of all transactions related to the NFT on a vast network of computers.

Click here to read more about Mark Zuckerberg’s plans to introduce NFTs on Instagram.

McKenzie’s distrust goes far deeper than just the over-saturation of NFTs and potentially predatory behavior at the conference, he said, explaining in detail his views that cryptocurrencies represent a now-widespread fraudulent financial practice — demonstrating the worst aspects of pyramid schemes — masked by hype, marketing and celebrity endorsements.

“Now, yes, you may get a thing. You may get a jpeg on the blockchain that you can look at,” McKenzie said to audience laughter during a SXSW session questioning the legitimacy of cryptocurrencies. “I’m an artist; I support artists; Digital art can be great. But I don’t understand why it needs to be on the blockchain.”

Click here to read why the designer behind one of KC’s most iconic young brands is testing the waters of crypto.

Gambling from your phone

The star of popular TV shows like “The OC,” “Southland,” and “Gotham,” McKenzie has a unique insight into the worlds of performance and shilling — and even outright lying — he said. His background in economics and foreign affairs help fill in the rest of the gaps, he told SXSW.

McKenzie began his takedown of cryptocurrency with a simple enough point: People understand what money is; it’s a medium of exchange, a way to buy goods and services.

“What’s weird about cryptocurrencies is that they’re not actually used to buy things. Not directly. Back in the day, prior to 2011, they were used to buy drugs, but then the Silk Road got shut down,” McKenzie said, referencing the now-defunct Silk Road black market on the dark web. “Now [cryptocurrencies are] basically traded amongst each other. But if they’re not used to buy things, they’re not really money.”

“In poker, you might call that a tell.”

So if cryptocurrencies aren’t money — if NFTs don’t hold real-world monetary value — what are they?

“People put money into them, and they expect to make money off of them. Under law, that’s an investment contract; that’s a security,” McKenzie said. “Securities have been regulated in the United States since the 1930s. Because prior to them being regulated, a lot of bad stuff happened.”

“Cryptocurrencies have been flourishing in an environment where regulation has been … let’s just say lacking,” he continued, acknowledging President Biden’s March 9 executive order to establish guidelines for crypto is a step in the right direction.

Among McKenzie’s noteworthy concerns: Most trading volume in current cryptocurrencies markets comes from overseas exchanges, which often are run through shell corporations, he noted — behavior that belies little of advocates’ promises of financial liberation and economic equity through crypto, he said.

“So unlicensed and unregistered securities are being traded largely on unlicensed and unregistered exchanges through shell corporations in the Caribbean? That seems kind of sketchy,” McKenzie said. “I thought cryptocurrency was the future of money? I thought crypto was supposed to offer us a democratized, decentralized utopia where the unbanked would be banked?”

“Surely for the average American investor, crypto can’t just be reduced to gambling on unregistered securities through apps on your phone, can it?”

Overlooking the flaws

McKenzie wasn’t alone in challenging the popular narrative about crypto at the conference.

“I’ve never seen, at least in the past decade, a technological innovation that’s as divisive within tech,” said Jacob Silverman, author and journalist at “The New Republic,” during the SXSW conversation. “People are really at odds. People at gaming companies don’t like it. Salesforce employees were striking over the possibility of introducing NFTs. And I think that speaks to the insufficiency and over-salesmanship of the technology.”

Click here to read more about how a Kansas City esports company is leaning into NFTs.

In addition to what they characterized as lying and overhyped statements of crypto’s applications — Silverman and McKenzie agreed its only proven uses have been in drug trafficking and money laundering — Silverman, author of the upcoming book “Easy Money,” took issue with the high risk and waste related to the industry.

“One thing that frustrates all of us is that there really is very little underlying value. If this stuff crashes, it could all go to zero because there aren’t [goods or services really being produced]. And that’s where you get to this negative-sum game,” Silverman said, pivoting into growing criticism of how cryptocurrencies are obtained. “You’re using all this electricity, you’re chewing through computer equipment like crazy … computer equipment that could be put to other uses — even if it is just people playing Call of Duty, which arguably is more productive than mining bitcoin — but it really emphasizes how you’re just wasting resources.”

Too few people are asking questions — and those who do often are dismissed under the argument that cryptocurrency is too new to operate efficiently or without flaws, added Edward Ongweso, a staff writer at Motherboard/VICE Media. They’re asked to trust crypto on faith — in the name of innovation and progress, he told the SXSW crowd.

“A lot of the advocates and the loudest proponents speak in a language where they’re talking about what will emerge eventually; why they believe that given enough time, investment or support, this or that feature might emerge,” Ongweso said. “But it’s similar to the overlap in discussions about Web3 or the metaverse, where this thing in the future is what we’re supposed to be working toward, and that in and of itself is supposed to be enough to overlook all the flaws.”

Magic internet money

Once a believer puts their money into crypto, it’s next to impossible to access it again as usable currency, the panel agreed.

A person like talk show host Jimmy Fallon — who in January revealed he’d purchased a $216,000 Bored Ape NFT — likely won’t see that value returned, without a way to cash out the investment. His best option is to trade against its value on the blockchain.

“It’s going to be difficult to get the magic internet money [back] out,” Ongweso said. “[A lot of these systems are] kind of fantastical and wouldn’t be allowed to happen with other assets or securities [in traditional finance]. And [if you behaved in this way] you wouldn’t be allowed near assets or securities again.”

Each time crypto-backed assets are developed and pushed out further, much of it is done just for the sake of doing it, he continued, or for pushing out some new wave that generates greater returns than before.

“[No one is] actually thinking about the risks this is introducing into the ecosystem; not thinking about how some people are going to lose their shirts and not be able to be made whole again,” Ongweso said.

The scheme is instead built on getting a constant flow of new money into the system — just like a Ponzi or MLM setup, where the actual money (or fiat), not cryptocurrency, is filtered upward, McKenzie said.

That’s how dubious NFT ads wind up packed between plays during the Super Bowl with “movie stars and athletes hawking it to try and get those last few bucks” before government regulation kicks in, he said.

NFTs are just the latest hype vehicle to pull people into crypto after its most recent surge peaked in November and sent industry enthusiasts and marketers scrambling, the panel agreed.

“Think about where the money is coming from and where it’s going,” said Silverman, encouraging people to look up the founders, financiers and venture capitalists behind the brand names offering, for example, NFTs to Super Bowl viewers or SXSW attendees.

In addition to endorsements from and direct financial ties to celebrities like Kim Kardashian and Floyd Mayweather — both currently facing lawsuits over a crypto “pump and dump” scam — a lot of industry backers have “colorful” financial and criminal histories, he said.

“Once you start peering under the hood, the warning signs appear pretty quickly,” Silverman said. “Celebrities are the end point of this; they’re the megaphone. They’re a tool being used by monied interests because they’re sympathetic and have fans. It shows a certain desperation in the industry to get more money in the door.”

Not only is crypto non-scalable, it remains a technology in search of a legal and legitimate use, Silverman and McKenize emphasized, facts that will help contribute to the industry’s eventual decline once the mask comes off, they said.

And such a fall won’t be without its victims, they said, pointing to history.

The SXSW panel repeatedly drew parallels not only to the 1930s economic collapse and Silk Road, but called upon lessons from scandals like the penny stock trades of the 1980s and the dot-com bubble bust at the birth of the Internet and ecommerce — even referencing Softbank’s exploitive inflation of assets like WeWork and Uber, which had massive investments but no model for sustainability, they said.

“There’s this joke that crypto is speed-running the last half-millennia of financial mistakes: wash trading, insider trading, manipulated markets, massive conflicts of interest,” said McKenzie. “There’s a lot of money involved, potentially trillions of dollars. It’s easy pickings.”

Related: The Man Behind Ethereum Is Worried About Crypto’s Future (TIME)

As crypto has soared in value and volume, Vitalik Buterin has watched the world he created evolve with a mixture of pride and dread, writes @andrewrchow.

“Crypto itself has a lot of dystopian potential if implemented wrong,” @VitalikButerin tells TIME https://t.co/BO1cGyjMYH

— TIME (@TIME) March 19, 2022

This story is possible thanks to support from the Ewing Marion Kauffman Foundation, a private, nonpartisan foundation that works together with communities in education and entrepreneurship to create uncommon solutions and empower people to shape their futures and be successful.

For more information, visit www.kauffman.org and connect at www.twitter.com/kauffmanfdn and www.facebook.com/kauffmanfdn

2022 Startups to Watch

stats here

Related Posts on Startland News

LISTEN: Fermenting a clean future through products from meat alternatives to skin creams and baby formula

On this episode of Startland News’ Plug and Play Topeka founder podcast series, we chat with Francesca Gallucci of Natáur, a Baltimore-based biotech company that’s reimagining how essential nutrients are made. Combining synthetic biology, metabolic engineering, and eco-friendly fermentation, they’re producing bio-based taurine (and other naturally occurring sulfur compounds) without relying on petroleum. Gallucci takes…

KCMO slashes fees for outdoor dining permits, launches dining trail for grant winning projects

Kansas City has officially eliminated outdoor dining permit fees, reducing the cost from $850 to zero, thanks to the momentum created by a city-led initiative to encourage investment in outdoor dining experiences, city leaders announced this week, unveiling new plans to promote funded businesses and their projects. Launched in 2024, the Outdoor Dining Enhancement Program…

World Cup will produce KC small biz millionaires in just weeks, leaders say, but it’s only the start

Kansas City can’t look at the World Cup in 2026 as one big event where businesses are going to make good money for a while, and then everything goes back to normal, said Wes Rogers. “This has to be the beginning of the next chapter of our city,” the 2nd District Councilman for Kansas City,…

Missouri Starters Coalition debuts effort to boost homegrown jobs, future founders

Entrepreneurs across Missouri gained a new champion this week as regional and national advocates launched a new coalition to support builders in the face of systemic, confidence-shaking roadblocks as they seek to drive job creation and higher lifetime incomes. The Missouri Starters Coalition on Thursday unveiled its founding members — Back2KC, Cortex, E-Factory, Keystone Innovation…