Missouri wants to match investors’ funds for promising young startups; founders have until Monday to apply

February 3, 2022 | Blythe Dorrian

A pair of competitive startup funding programs backed by the State of Missouri are poised to boost companies with Show Me potential, said Jack Scatizzi as the deadline rapidly nears for this year’s IDEA Funds.

“We invest both state and federal funding into the most promising high growth-potential startups,” said Scatizzi, executive director of the Missouri Technology Corporation (MTC). “These companies usually leverage technology or innovation.”

To support Missouri’s innovation and technology-focused entrepreneurs grow their companies, the Missouri Technology Corporation operates a state-sponsored venture capital fund (IDEA Fund). The IDEA Fund is tasked with making direct investments in the state’s most promising early-stage high growth companies in a manner that is catalytic and drives economic development within the state. For investments to be catalytic in nature and offset the state’s risk, MTC requires matching funds from private investors — generally, local angel investors or Midwest-focused seed-stage venture funds.

IDEA Funds branch into two categories focused on commercialization: TechLaunch, a pre-seed fund designed for companies that have raised less than $250,000 of outside capital (It supports up to $100,000 for the purpose of business development); and Seed Capital Co-Investment, which was created for companies with between $500,000 to $2 million in outside capital.

MTC’s 2022 fiscal budget includes $2 million to allocate among qualifying Missouri businesses.

The deadline to apply for funding is Feb. 7. Click here to learn more about TechLaunch and here to explore Seed Capital Co-Investment.

For a startup to be considered for either program, prospective companies must have a focus area in animal health, applied engineering (software), biomedical science, defense and homeland security, or plant science.

“Those categories identify the core areas of the state,” Scatizzi said, noting Missouri’s rich track record within such fields as agtech, insurance tech, fintech, and its growing influence in industries like geospatial.

MTC is a public-private partnership created by the Missouri General Assembly to promote entrepreneurship via a state-sponsored venture capital program — specifically boosting early-stage, high growth-potential companies to produce outsized economic development returns for the state.

The IDEA Fund co-investment programs were developed to support Missouri’s early-stage, entrepreneurs developing technologies, and creating jobs across Missouri. The direct investment programs support technology startups through matching equity or convertible debt investments for the purpose of technology and business development.

Over the past decade, MTC has invested more than $45 million into almost 140 early-stage Missouri-based high-growth technology-focused companies, which have raised over $1.1 billion in additional private capital.

MTC uses a matching fund requirement to ensure the state’s capital will be invested in the Missouri’s most attractive early-stage investment opportunities.

In 2020, MTC’s portfolio companies created more than 480 new jobs and employed over 1,000 people for an average of 17 people employed per portfolio company with almost a third of MTC’s portfolio companies employing at least 20 full-time employees.

“This is a way to drive economic development, specifically to create higher paying jobs,” Scatizzi said.

Click here to see MTC’s full portfolio.

Among the Kansas City startups to take advantage of MTC’s co-investment funding: backstitch, Little Hoots, Moblico, Mycroft, Pathfinder Health Innovations, PayIt, Popbookings, Proviera Biotech, SCD Probiotics, Sickweather, SoftVu, StoryUp (Healium), Transportant, Venture360, and VideoFizz. Today, many of these startups are now listed among Kansas City’s Top VC-Backed Companies.

Featured Business

2022 Startups to Watch

stats here

Related Posts on Startland News

AI-generated bedtime stories are just the first chapter in JQ Sirls epic venture to make the publishing industry more inclusive

Every great children’s story deserves the opportunity to be published, JQ Sirls said, adding his own footnote that more people are qualified than they think to create them. “I could put 1,000 people in one room and tell them all to write a short story about their childhood. While many of them may have a…

‘When puppets talk people listen’: It’s not just storytelling anymore for one of KC’s most beloved children’s theaters

A Kansas City arts institution known for years as the Mesner Puppet Theater is animated with new life, said Meghann Henry, detailing a mission pivot for the freshly sewn and rebranded What If Puppets. Evolution at the nonprofit has taken a turn toward early childhood education since the retirement of Paul Mesner in 2016 —…

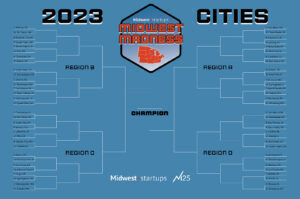

M25 drops Midwest Madness bracket for best startup hub: 4-seed KC faces up-hill battle (Here’s how to vote)

Bracket update: Since this story’s original publication, Kansas City has advanced to the Midwest Madness bracket’s Round of 32. Voting on Kansas City’s next match-up — against 5-seed Lafayette, Indiana — begins Tuesday, March 21. As sports fans fill out March Madness brackets this week, a Chicago-based venture capital firm is encouraging Midwestern founders, investors…

Startups, investors on ‘red alert’ as Silicon Valley Bank collapse ripples into new tech downturn fears

Editor’s note: This story was originally published by Missouri Business Alert, a member of the KC Media Collective, which also includes Startland News, KCUR 89.3, American Public Square, Kansas City PBS/Flatland, and The Kansas City Beacon. Click here to read the original story. Silicon Valley Bank collapsed in rapid fashion on Friday to become the second-largest bank…