Hometown startups want their due; sister-led QuickHire’s $1.4M round could be just the start

December 6, 2021 | Tommy Felts

QuickHire’s potential for success is enhanced — not limited — by the young tech startup’s south-central Kansas geography, said Deborah Gladney, one half of a sister-led Wichita venture that recently announced its $1.4 million round boosted by a leading Kansas City fund.

“Being from Wichita, we’ve come to know and appreciate everything this city has to offer,” said Gladney, who co-founded the tech platform for career “upskilling” with her sister, Angela Muhwezi-Hall. The duo are believed to be the first Black women entrepreneurs in Kansas to raise $1 million in seed funding. “Wichita has a budding economy and established ecosystem that lends well to any entrepreneur looking to start a business.”

And the diversity of the city — Kansas’ largest metro — makes Wichita far more representative of the country than Silicon Valley, she added, which is critical for a founder seeking product market fit.

Other Wichita startups also are making headlines.

Plot, a Wichita-built construction communication platform founded this fall and led by Techstars Kansas City alum Chris Callen, recently announced the backing of Koch Industries, which made an undisclosed financial investment.

And Knowledge as a Service, Inc. (KaaS) — the developer of Ringorang, which uses microlearning and gamification to improve human performance through habit formation — this week unveiled an undisclosed investment by real estate firm Bonavia. Related plans between Kaas and Bonavia call for a new 5,500-square-foot headquarters for the Wichita startup that reflects a vision “back toward emphasizing Wichita’s entrepreneurial spirit and a future that both innovates and disrupts,” the company said.

“It’s not unique to Wichita, but there is a new group of founders that are attacking big global opportunities, quickly learning relevant playbooks from the many resources that are available, and getting the best of both worlds locally and globally,” said Josh Oeding, founder of Wichita entrepreneurial support organization NXTUS and a founder and managing member of Accelerate Venture Partners, a Wichita angel investment group.

Click here to learn more about how NXTUS has been impacting area startups.

Among Oeding’s on-the-ground range of Wichita startups worth watching: from Plot, Kaas, and Greenfield Robotics to Pipeline alumni like Lawn Buddy, Jenny Dawn Cellars and Buddy Brands to Bitcoin infrastructure startup Voltage, fuel delivery system Soya, and a cleantech solution that turns heat into air conditioning called Hyperboreon. Companies like Unified, Viaanix, mmnt, and ZipSip, the World’s first adjustable drink holder, also deserve a closer look, he said.

Expanding the hometown footprint without leaving home

With more than 60 paying clients (from Fuzzy’s Taco Shop to Homewood Suites by Hilton), QuickHire targets workers and businesses in Wichita and Kansas City, matching them with career advancement opportunities.

The company is growing fast — capitalizing on prolonged challenges in the service industry largely attributed to the ongoing COVID-19 pandemic. It plans to expand across the Midwest and add skilled-labor verticals in 2022.

Click here to learn more about QuickHire.

“These labor trends have become obvious to everyone in the hospitality and restaurant industries, but Angela and Deborah had the foresight to see this coming, and were able to start a company that can solve these problems now, as well as evolve into other sectors long term,” said Ed Frindt, general partner at KCRise Fund, which joined the QuickHire round alongside Sandalphon Capital, October Minority Impact Fund, Tenzing Capital Ventures, Accelerate Venture Partners, Sixty8 Capital, Ruthless for Good, Revolution’s Rise of the Rest Seed Fund and ETF@JFFLabs.

“This group of investors sees their vision, and together will help QuickHire expand its footprint into other geographies that are facing similar challenges with skilled labor shortages,” he added.

KCRise Fund, which widened its target investment area to the entire state of Kansas and Western Missouri with its Fund II, agreed QuickHire’s location — traditionally off the beaten path even for a “hometown” VC — only added to the startup’s appeal, Frindt said.

“There’s a lot of opportunity and strong entrepreneurs, given the high amount of engineering and technology talent in Wichita, but right now it’s still a little overlooked on the capital front,” he said.

‘All over it’

Key players in Wichita have been critical for changing the narrative about the city, Frindt said, specifically pointing to the work of Oeding, the NXTUS leader who also is founder and general partner at QuickHire investor Tenzing Capital — Wichita’s first venture fund.

“COVID has advanced the need for new ways of working, large companies better-utilizing technology to meet their employee and customer needs, and focusing on communities as great places to live,” Oeding said, adding context to Wichita’s increasingly impactful place in the broader marketplace. “All of this contributes to an uplift in the overall innovation economy, of which startups and new venture creation are major contributors.”

And business and community leaders in Wichita are “all over it,” Oeding said.

“QuickHire is a great example of founders utilizing the best of their local startup community while also participating in the global ecosystem,” he said. “They quickly grew their local customer base and secured local angel investment, while being selected to a globally-recognized Techstars program and earning significant national press coverage.”

In fact, the startup’s selection to Techstars’ Iowa program helped solidify KCRise Fund’s interest in Gladney and Muhwezi-Hall’s company, Frindt said, citing an example of a “local” startup maintaining its roots while seeking regional resources (and beyond).

“That’s a big validator for us,” he said, noting the fund’s investments in fellow Techstars alumni like Kansas City’s backstitch, Bellwethr, Daupler, Super Dispatch, and Zego. “The fact that Techstars gave their stamp of approval and credibility, that’s when we knew it was time to take a closer look, and ultimately come in as an institutional investor.”

‘Wichita-proud people’

Oeding admittedly sees high value in the efforts he helped bring to Wichita — from Tenzing Capital and the angel investment group to fintech and community health accelerators backed by NXTUS, he said.

But the opening of Groover Labs, a production development lab, makerspace, and coworking community; the launch of the inaugural Wichita Startup Week in 2021; the growth of Wichita State University’s Office of Innovation and New Ventures; and the work of Founder’s Grove, which empowers entrepreneurs in Wichita’s urban core; each are creating a cumulative impact already being seen across the metro, he added.

QuickHire co-founder Gladney specifically cited NXTUS, Tenzing Capital and Groover Labs “for getting involved and stepping up to help us win.”

“We need more people like them who are eager to get behind our entrepreneurs,” she said.

“QuickHire would not be what it is today if we launched anywhere else,” Gladney continued. “Our first investor and first customers were homegrown, Wichita-proud people who just wanted to see other Wichitans win. Period. Luckily we were able to take their belief in us and turn that into real value for them. But it all started out with the belief and hope that they could play a role in helping launch a Wichita born company.”

This story is possible thanks to support from the Ewing Marion Kauffman Foundation, a private, nonpartisan foundation that works together with communities in education and entrepreneurship to create uncommon solutions and empower people to shape their futures and be successful.

For more information, visit www.kauffman.org and connect at www.twitter.com/kauffmanfdn and www.facebook.com/kauffmanfdn

Featured Business

2021 Startups to Watch

stats here

Related Posts on Startland News

Immigration debate could stall Moran’s revived Startup Act, again

Federal legislation geared toward boosting entrepreneurship would make it easier for foreign-born innovators to obtain permanent resident status in the United States. “The newly-introduced Startup Act promotes public policies that would change our KC startup community for the better,” said Melissa Roberts, vice president of communications and outreach for Enterprise Center of Johnson County, which…

Pipeline alum set to ‘save the world’ through $1M US Army biotech contract

The U.S. Army recently awarded a Missouri biotech startup a $1 million contract for 24 months. Based in Drexel, Missouri, about an hour south of Kansas City, InnovaPrep was selected out of hundreds of proposals for the Department of Defense’s 2016 Rapid Innovation Fund. The contract is expected to advance development of the U.S. Army…

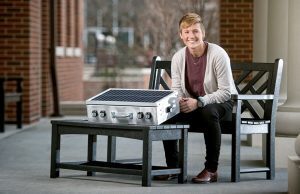

Tech startup wants to bring Sunshine, electricity to hurricane victims

17° 73° Innovation Co. founder Conner Hazelrigg launched a crowdfunding campaign Wednesday to provide disaster relief to Puerto Ricans affected by Hurricane Maria. In response to the island’s electricity shortage, the tech startup wants to deploy its Sunshine Box, a portable solar-charging station that can charge 10 devices at a time. The technology is designed…

Blooom reaches $1 billion in assets under management

Blooom announced Thursday that the Leawood-based financial tech firm has reached $1 billion in assets under management, becoming the fastest, independent robo advisor to pass that threshold. Although it’s not the first robo advisor to reach $1 billion, Blooom did so by stretching its dollar much farther than Silicon Valley fintech counterparts, said co-founder Chris Costello. “This…