In the Black: Why Venture Noire is bringing capital resources from Arkansas to KC’s founders of color

September 14, 2021 | Austin Barnes

It’s time Black-led companies went from over-mentored and under-resourced to well-connected and infused with capital, Keenan Beasley said, announcing plans for establishing more equitable entrepreneurial ecosystems that begin, in part, with a presence in Kansas City.

“Kansas City is a very mature market,” Beasley, founder of Venture Noire, said of what he’s observed among the metro’s startup space and the talented roster of Black and minority founders making names for themselves within it.

“Every entrepreneur that I’ve talked to, so far, in Kansas City is already at the business growth stage — meaning they’re making revenue. What they’re trying to figure out is how to scale.”

While founders in other Heartland cities (unnamed by Beasley) have struggled to move beyond the ideation phase of venture creation, Kansas City-based Black founders and founders of color have a primary need: capital; something Beasley hopes to address head on Sept. 24 when Venture Noire hosts its first entrepreneurial support and networking event, “Let’s Venture.”

“We’re going to showcase a lot more information on what we’re learning and what we’re seeing. … We have some great speakers lined up. I’m excited to learn from everyone in the region,” he told Startland News, adding he’ll tour the region the following day and explore its opportunity zones in an effort to better understand the city with the hope of permanently expanding Venture Noire programming into the metro.

Kansas City-based founders joining Beasley are expected to include Jannae Gammage, The Agency Base; Dan Smith, The Porter House KC; and Thalia Cherry, Cherry Co.

Godfrey Riddle, Civic Saint is set to moderate the discussion presented in partnership with the Ewing Marion Kauffman Foundation. Click here to register.

View this post on Instagram

In addition to community events, Venture Noire — which has until now focused much of its efforts in Arkansas — leads a virtual, 8-week accelerator program called “In the Black,” the Dare to Venture one-on-one mentoring program, and produces a line-up of entrepreneurship-focused podcasts.

Click here to read about the Walton Family Foundation’s $1.3 million grant helped provide the foundation for Venture Noire’s In the Black accelerator.

The organization was founded in 2019, following Beasley’s exit from his millennial-focused creative agency in New York City.

“Typically you come off of these wins and you expect to feel really good and instead I actually felt very isolated. I realized there wasn’t a robust, diverse, startup ecosystem [in New York City] … there wasn’t a community,” he recalled.

“Venture Noire was started to build community — an ecosystem.”

With its initial meetups happening in Beasley’s apartment, the early incarnation of Venture Noire started to reveal the stories and struggles of founders in an eye-opening way, he added.

“This was casual, before we were formed as an organization, [we were inviting] diverse entrepreneurs to come together and I realized there was one key theme and it was this kind of lack of confidence — not in their own personal abilities, but in feeling that the ecosystem was set up for them to win.”

While organizations intended to guide underserved entrepreneurs are in no short supply nationwide, not every group presents opportunities to create genuine community connections or to build necessary knowledge that can grow a business long term, Beasley said.

“Every entrepreneur is not aware [of resources that exist]. When they’re going through their journey, they just feel alone. And I said, ‘OK, we have to change that,’” he said.

“We can build confidence in these entrepreneurs by bringing the ecosystem right to them.”

Not only can Venture Noire bring mobility to the concept of a startup ecosystem, the organization also hopes to focus on creating as much exposure for Black and minority-led ventures as it possibly can, Beasley said.

“There’s now a lot of competition and a lot of talent in the middle of the country. I think our job is to help increase the exposure and to make a lot of these venture capitalists, these private equities, some of these larger banks and institutions, these corporate partners aware of a really thriving and emerging startup ecosystem,” he said, adding the organization also hopes to help create jobs.

“We support [communities] through economic impact … helping entrepreneurs scale and grow their business and create a larger and larger workforce. So I think if we’re doing that, we’re succeeding and that’s something that we’re hyperfocused on.”

This story is possible thanks to support from the Ewing Marion Kauffman Foundation, a private, nonpartisan foundation that works together with communities in education and entrepreneurship to create uncommon solutions and empower people to shape their futures and be successful.

For more information, visit www.kauffman.org and connect at www.twitter.com/kauffmanfdn and www.facebook.com/kauffmanfdn

Featured Business

2021 Startups to Watch

stats here

Related Posts on Startland News

Pint-sized perspective: KC’s Little Hoots takes nostalgia-capturing tech to MIT

From the cute and comedic to the whimsical and wise, every parent can pinpoint a Little Hoots moment that relates to their personal adventure in child-rearing, said Lacey Ellis, founder and CEO of the Kansas City-birthed mobile app that recently turned heads at MIT. “If a picture is worth a thousand words, a hoot is…

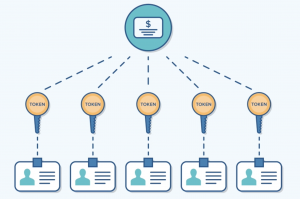

LaunchKC winner bringing cryptocurrency into the investment game with Liquifi

A blockchain-enabled solution from Venture360, called Liquifi, aims to unfreeze startups paralyzed by a lack of access to capital, Rachael Qualls said with excitement. “The main reason more people don’t invest in private companies is there is no way to get money out,” said Qualls, CEO of Venture360. “On average money is tied up for…

Sickweather forecasts flu trouble ahead, urges handwashing and vaccinations

Sickweather’s illness forecasting technology points to a seasonal uptick in influenza rates for Kansas City, said Laurel Edelman, noting a particularly rough patch expected at the end of year. “We actually see more of a dome here in Kansas City,” said Edelman, the chief revenue officer for Sickweather, referring to a chart that plots expected…

Techstars hacks into expert minds for visions of a future dominated by robotics

A Fourth Industrial Revolution is unfolding as consumers and the tech industry alike watch with bated breath, Karen Kerr told a crowd of Techstars Kansas City attendees. “Two things are happening,” Kerr, senior managing director with GE Ventures explained during a panel Thursday that explored the future of the robotics and manufacturing industries. “We’re able…