Who’s getting funded in KC? The answer requires a long look in the mirror, analysts say

September 21, 2021 | Tommy Felts

Editor’s note: Startland News asked industry experts to take an early look at the data behind the 2021 Kansas City Venture Capital-Backed Companies Report — the culmination of a three-month collaboration between UMKC’s Technology Venture Studio and Startland News, and presented by Mylo, a Lockton Company. Below are some of their leading takeaways, along with video of a roundtable conversation exploring trends reflected with the report.

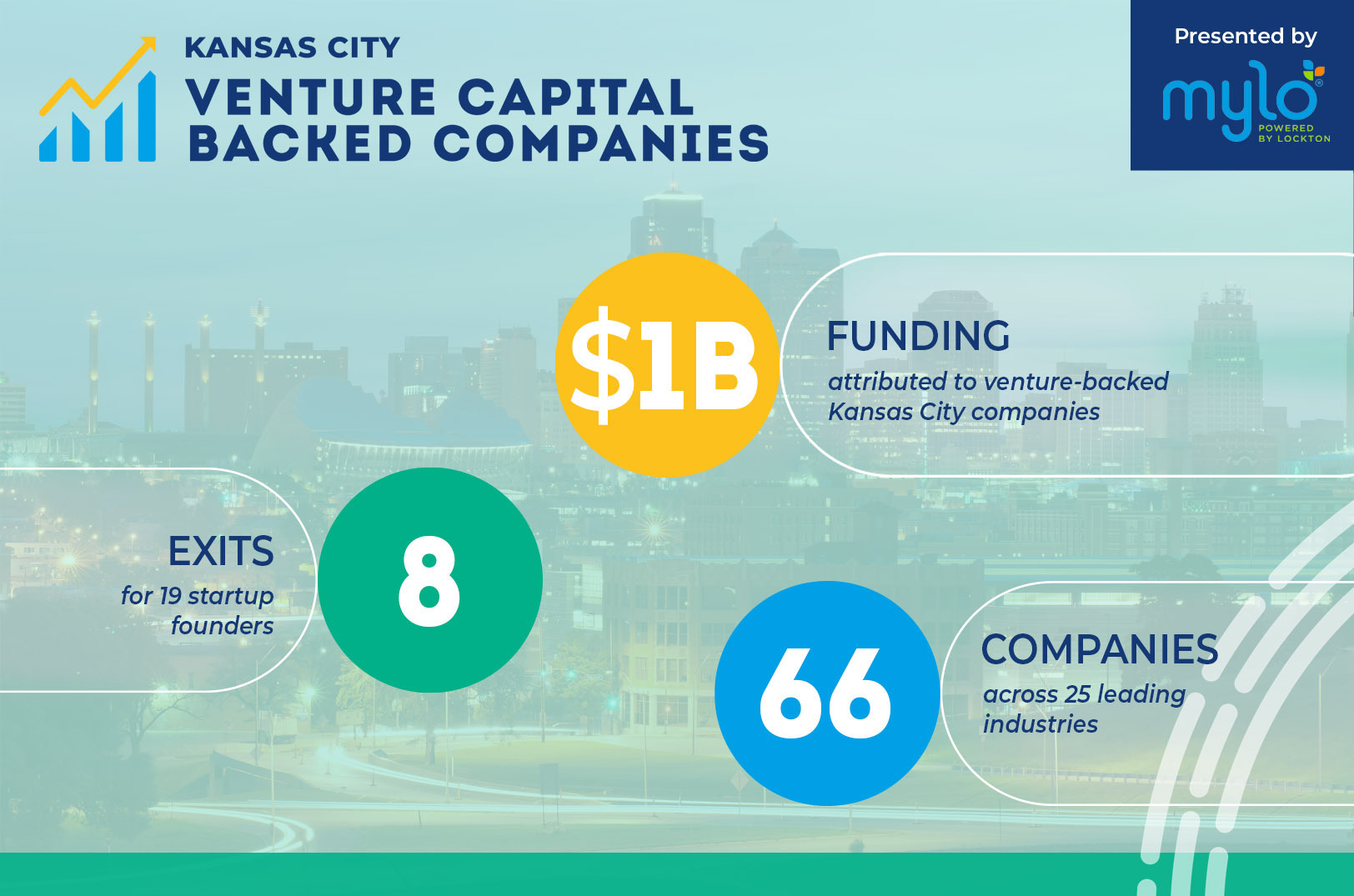

With more than $1 billion tracked in a new report on Kansas City’s venture-backed companies, data from 66 eligible respondents shows fewer metro companies overall are getting new funding — but those wrangling deals are getting more capital in their rounds.

“This mirrors a trend of ‘the haves and the have nots’ in startup/venture funding the past few years,” said Victor Gutwein, founder and managing partner at M25 — an influential venture fund in Chicago. “Basically, VC capital invested has increased, but the number of companies has not increased, and in some cases decreased. This results in bigger and bigger rounds, with VCs piling money into fewer select ‘haves.’”

The 2021 Kansas City Venture Capital-Backed Companies Report indicates a record high of $1.09 billion raised by qualifying, venture-backed companies. The 10 companies with the most capital raised account for a combined $758 million, or 69.9 percent of the total.

Click here for a closer look at the VC-Backed Companies Report, which also shows 11 new venture’s joining the list in 2021.

But today’s funding is only part of the story.

“I still think Kansas City area startups are slower to have dramatic fundraising events and splashy PR than coastal peers, and there’s a goldmine of less-capitalized startups that either have under-weighted growth scores and/or could be growing faster with more capital (some of which may already be in progress and un-reported),” Gutwein said, specifically calling out the potential for locally-based startups like LaborChart, Daupler, TripleBlind, Super Dispatch and Backstitch (the latter two being portfolio companies of Gutwein’s M25 investment firm).

Watch a community expert roundtable conversation about the 2021 report below, then keep reading for more analysis — including why some of Kansas City’s biggest companies aren’t on this year’s list.

What’s missing?

Twelve companies dropped off the annual report in 2021 — eight because of exits that ranged from mergers to acquisitions. Two more exits are expected later this year: Cingulate (IPO) and Spear Power Systems (acquisition).

Among the departures:

- BacklotCars — $425 million acquisition by KAR Global

- DisruptOps — merger with Overland Park-based Firemon

- Farmobile — undisclosed acquisition by Canadian firm Ag Growth International

- Health Outcomes Sciences — undisclosed acquisition by Tokyo-based Terumo Corporation

- RFP360 — undisclosed acquisition by Oregon-based competitor RFPIO

- RiskGenius — undisclosed acquisition by industry leader Bold Penguin

- Stackify — undisclosed acquisition by West Coast competitor Netreo

- Zaarly — $3.4 million acquisition by Australia-based Airtasker

The eight exited companies had raised a combined $161.2 million, employ 347 employees, and are an average of 8.5 years old.

“Not all exits are created equal, and they mostly follow a ‘power law’ with an extreme right tail — basically, a very small minority of exits are going to be the large, transformational exits that recycle money back to the investors, founders and team members, giving them the resources to fund new companies and launch new startups,” Gutwein said, noting the BacklotCars deal’s likelihood of having the most obvious, dramatic impact. “What is exciting about the number of exits is that each of these was a journey that could have been very big, and the founders and teams learned a lot along the way.”

“So while the founders of Zaarly, RiskGenius and Farmobile may have set out to go all the way to the NASDAQ and didn’t quite get that far, maybe they learned enough along the way to get them there on their next venture,” he continued. “And that — experienced founders of all levels becoming ‘free agents’ for the next big thing — is what could be the most promising factor for KC’s ecosystem when we notice a large number of exits.”

But the exits also expose a key, underlying shortcoming in Kansas City’s venture capital scene, analysts of the 2021 report said.

The eight exited companies reflect 19 founders — but zero women and only one person of color.

Click here to explore more takeaways from the VC-Backed Companies Report.

Gaps remain

Overall, the pre-exit companies included in the report feature 131 founders — and only 19 women (14.5 percent) and 23 Black or founders of color (17.6 percent). Statistics for CEOs of the venture-backed companies are similarly low.

Despite slight progress or the perception of progress — the percentage of non-white founders has risen more than 5 percent, year over year, for example — the startup ecosystem is falling short of its goals for inclusion and leaders need to examine what they’re doing to actually catalyze real change, analysts of the report told Startland News.

“It’s good to see [the data], for better or for worse,” said Donald Hawkins, the Kansas City-based founder of First Boulevard, a neobank built for Black America. “There are a lot of high potential minority entrepreneurs, female entrepreneurs in this city and, statistically … it’s bad.”

“The events of the past year have really opened a lot of people’s eyes, and I think it’s equally as important for entrepreneurs — especially minority entrepreneurs — to recognize the value that we provide the ecosystem too,” he continued, referencing social unrest that spread across the country and globe in the wake of George Floyd’s killing at the hands of Minneapolis police officers. “And a lot of that has to do with density and experience.”

It’s easier to raise capital, Hawkins said, when an entrepreneur is confident enough to recognize they’re accepting an investor’s money in order to generate a real return.

“It’s not a handout. No investor wants to provide an entrepreneur a handout,” he added. “If somebody is lucky enough to invest in my venture, then it’s a partnership and I’m going to work my butt off — not only for them, but my other stakeholders and my team as well.”

Looking at another year’s report with a low headcount for minority and female founders should give the community pause to take a look in the mirror, Hawkins said.

Jump to 16:05 in the roundtable discussion video above to hear more of Hawkins’ perspective on the diversity gap, along with discussion by Caroline VanDeusen, principal, KCRise Fund; Jill Meyer, senior director of UMKC’s Technology Venture Studio; and Tommy Felts, editor in chief at Startland News.

The 2021 Kansas City Venture Capital-Backed Companies Report is made possible through financial support from Mylo, a Lockton Company.

Mylo is an award-winning digital agency with an AI-powered insurance shopping platform that can be seamlessly embedded into the experiences of a wide range of companies. Customers gain instant access to expert coverage recommendations and ideal solutions from top carriers for business, home, auto, life, health and more. We’re proud to be part of Kansas City’s inspiring community of innovators.

Need insurance? Visit www.ChooseMylo.com. Partner with us! www.ChooseMylo.com/Partner-With-Us.

Featured Business

2021 Startups to Watch

stats here

Related Posts on Startland News

WATCH: No reason for ‘lone wolfing’ the startup grind, LaunchKC past winners say as application window narrows

Editor’s note: This article is sponsored by LaunchKC but was independently produced by Startland News. With a July 11 application deadline nearing, LaunchKC past winners emphasized the popular, high-profile grants contest is about much more than chasing a payday. “There’s the community piece. There’s the exposure piece. But once you win — or even once…

Accelerate Tech Learning targets the (urban) core of KC’s programmer shortage

Training would-be programmers from Kansas City’s urban core isn’t about getting rich, said Joshua Clark, co-founder of Accelerate Tech Learning. But unfortunately that means it can be tricky to get underestimated students the costly education to become a certified developer in the world of information technology, added Mauri Trent, Accelerate Tech’s executive vice president of…

With Hy-vee Arena, KC Star project, southward expansion, KC Crew plans to double its players

Where KC Crew plays, growth and development follow, said founder Luke Wade. The adult sports and event company filled Kansas City’s Parade Park every night before the Urban Youth Academy broke ground on East 17th Terrace, for example, Wade said. “So it’s kind of that economic development. The same thing happened with the riverfront when…

Mycroft hopes to build community of investment backers with new online public offering

Adding to its array of successful crowdfunding efforts, Mycroft AI recently launched an online public offering that’s generating significant financial support for the startup. Thanks to 2016 changes to the Securities and Exchange Commission’s equity crowdfunding regulations, the Kansas City-based tech startup’s OPO has already amassed more than $173,000 of its $1.07 million funding goal.…