Flyover Capital closes its Tech Fund II over $60M, targeting new seed, post-seed startups

September 2, 2021 | Startland News Staff

Tech startups raising seed and post-seed funding will benefit most from the close of Flyover Capital Fund II, the venture capital firm said, announcing Thursday its oversubscribed close.

“The oversubscribed fund brings Flyover Capital’s total assets under management to approximately $110 million,” the Overland Park-based venture capital firm said in a release, outlining plans for its more than $60 million Tech Fund II.

“The new fund will make initial investments at the seed and post-seed stages, targeting initial equity investments between $0.5 million to $2 million in rounds between $1 and $5 million.”

Fund II closed more than $10 million over its target, the venture firm noted, adding it expects to see the same success as its original fund, which invested in tech companies across 10 states and boasts more than $100 million in assets under management. Six startups in the firm’s portfolio have exited — including Kansas City-based EyeVerify (now Zoloz) and RiskGenius.

Other metro companies having received investment from Flyover Capital include Innara Health, Lending Standard, and TripleBlind.

Click here to learn more about Flyover Capital or its portfolio.

“We set out to invest in the next generation of technology success stories outside of the traditional tech hubs,” said Thad Langford, founder and managing partner.

“The longstanding support by our limited partners has allowed us to execute towards that mission. We look forward to continuing to identify world class entrepreneurs, build a differentiated brand, and support founding teams that are creating incredible companies poised to transform the largest industries in Middle America.”

The ability of tech founders to build their companies in cities like Kansas City regardless of its geographic location has strengthened the work of Flyover Capital in its seven years of operation, added Keith Molzer, founder and managing partner.

The firm’s investment team, led by Dan Kerr, who recently became a partner within the firm, is expected to focus heavily on business-to-business and enterprise software focused ventures in its second run.

“We have seen continued growth of the early-stage ecosystem and expect increased remote work and relocations to reinforce the region’s human startup capital,” Kerr said.

Strong support from family offices and institutional investors made the close of Fund II possible, Flyover Capital said, adding it reinforces the firm’s thesis and confirms its momentum in the midwest venture-space.

Featured Business

2021 Startups to Watch

stats here

Related Posts on Startland News

Loud is in season: How one designer plans to yell their angrily sewn message during KC Fashion Week

Dustin Loveland channeled love — and anger — into a debut spring and summer collection that premieres soon at Kansas City Fashion Week 2023. “I’ve had to deal with a lot of anger from the past couple of years for a variety of reasons,” said Loveland, a non-binary freelance designer and sewer in Kansas City.…

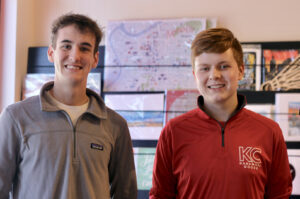

They started their own businesses; now these young founders are widening the pipeline to entrepreneurship for their peers

Aidan Hall felt the support of Kansas City’s entrepreneurial ecosystem when he launched what would become KC Handmade Goods as an eighth grader, he said; years later, the young business owner is working to pay that feeling forward. An Iowa State freshman and Shawnee Mission West graduate, Hall got his start selling duct tape wallets…

Lay off costly corporate conferences: Jewell Unlimited touts mobile-first microlearning in minutes

A learning agency funded by William Jewell College is bringing a fresh approach to professional development, hoping to curate the “unregulated mess” of digital information into mobile-first microlearning modules that will empower workers and help them advance their careers. “Every single thing throughout human history that has ever been learned and codified, it’s already available…

Meet the six competitors pitching for $50K in funding in HERImpact’s return to Kansas City

Editor’s note: 1863 Ventures is an advertiser with Startland News, though this report was produced independently by the nonprofit newsroom. The competition slate is set, as a half-dozen of Kansas City’s most promising emerging social entrepreneurs prepare to pitch for $50,000 in a public, shark-tank-style event for women founders. The live pitch event is set…