Firebrand Ventures closes $40M seed fund for ‘authentic’ founders in emerging communities; adds Leo Morton as advisor

August 26, 2021 | Startland News Staff

A year after two prominent venture capital firms announced their merger, the consolidated Firebrand Ventures II is officially closed — reaching its $40 million target and having already invested in startups from Detroit, Seattle and Toronto.

John Fein and Chris Marks, Firebrand Ventures

“Several years ago we raised our first funds — Boulder-based Blue Note Ventures and Kansas City-based Firebrand Ventures I — because we each saw a huge opportunity to invest in authentic leaders based in emerging startup communities,” said John Fein, managing partner at Firebrand, and Chris Marks, managing director, in a joint statement from the Kansas City firm. “By the time we joined forces in 2020, the ‘work from anywhere’ trend was in full swing and was validation of our approach. In addition to geography, it’s been a top priority to invest in founders who share our core values such as integrity, transparency, and partnership.”

Some of Firebrand I’s notable, previously announced investments include such companies as Kansas City-based Replica and Des Moines’ Dwolla. Other Kansas City investments include Super Dispatch, Zohr and FitBark.

Click here to read more about Replica, one of Startland News’ Kansas City Startups to Watch in 2021. The company announced a $41 million Series B round in April.

Firebrand Ventures’ investment criteria

- Team: Firebrand invests in exceptional teams obsessed with solving a big problem in a better way. Top-notch technical and domain expertise. Strong, authentic leaders capable of attracting world-class talent.

- Location: Firebrand meets founders where they are. There are exceptional companies based all across the US and Canada. The fund focuses on up-and-coming communities that are underserved by venture capital.

- Stage: Firebrand invests between $500,000 and $1 million into seed stage rounds. The fund both leads rounds and co-invests, and takes board seats when appropriate.

- Traction: Firebrand likes to see an early indication of product-market fit, so some revenue traction is strongly preferred.

Source: Firebrand Ventures

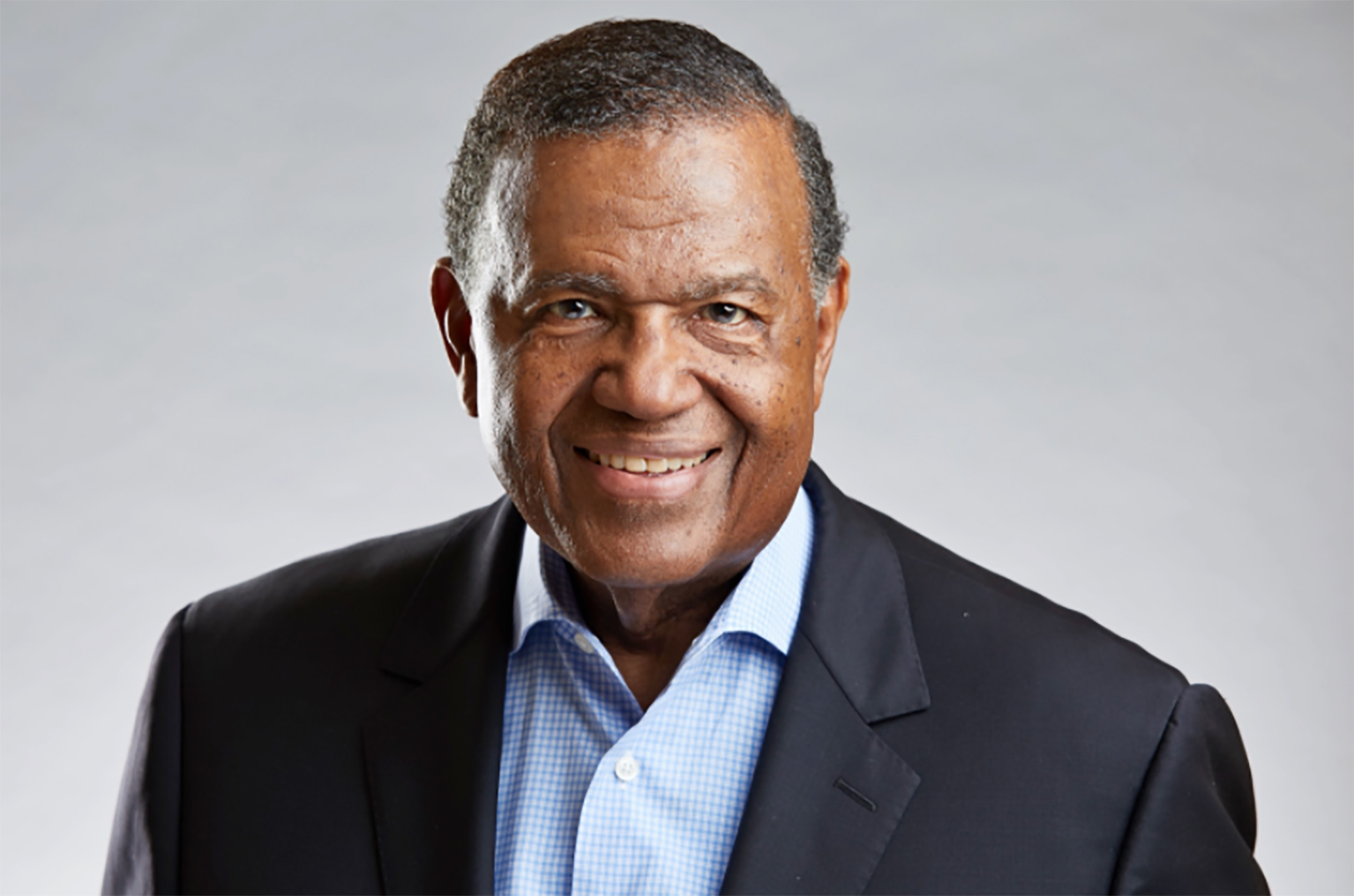

Joining Firebrand in the second fund, Leo Morton is taking an advisory board role with the firm following decades in a wide range of engineering, manufacturing, education, financial, and civic leadership positions. He currently is president and chief operating officer of DeBruce Companies, a private investment firm managing a diverse portfolio of private equity and other asset class investments across a broad range of industries, including biotech, energy, manufacturing, technology, and real estate.

Firebrand also announced the opening of a new Austin office, led by a new principal at the firm. Claire Hansen is a leader in the Austin startup community and has worked alongside startups and investors there since 2015, Fein and Marks detailed. She also previously served as the investment director of the Central Texas Angel Network and as the coordinator for Capital Factory’s accelerator program.

“Prior to joining Firebrand, Claire worked for the U.S. Army as a founding member of Army Futures Command’s Corporate Ventures unit,” Fein and Marks said. “There she was not only responsible for deal flow but also introducing and deploying startup diligence strategies among Army stakeholders.

The Austin office gives Firebrand a third presence outside Fein’s office in Kansas City and Marks’ homebase in Boulder. As was the case for the Firebrand I fund, the majority of the limited partners in Firebrand II are based in Kansas City, Fein said.

“The final closing of Firebrand II reflects the trusting relationships we have built with our existing LPs, as well as the track record of success created by our respective first funds,” Fein and Marks said. “Like many successful startups, a venture capital firm’s journey is a long one. While we’re still at the beginning, we’ve been very deliberate about the people we surround ourselves with. We’ll always be attracted to high-integrity, high-EQ people and we hope the feeling is mutual.”

Featured Business

2021 Startups to Watch

stats here

Related Posts on Startland News

KC’s ‘Horn Doctor’ handcrafts jazz preservation, keeping soul, tradition alive on Vine Street

Across the historic intersection at Kansas City’s 12th and Vine streets, B.A.C. Musical Instruments operates as one of the few remaining American factories handcrafting professional brass instruments. “This is where all the musicians would hang out back in the day,” said founder Mike “Horn Doctor” Corrigan, gesturing toward the Paseo sunken garden beside his shop.…

Autotech startup revs after patent stall; signature tech removes emissions, waste from diesel logistics

Fresh fuel is pumping into NORDEF after the Kansas City autotech company finally received patent approval for its signature product, co-founder William Walls said, pushing the pedal on its mission to disrupt the automotive fluid industry. Four years after applying for a provisional patent for its technology to produce diesel exhaust fluid on-demand — and…

rOOTS KC grows into third location, planting shop in River Market ahead of World Cup

Initially setting its roots as a pop-up plant shop in 2020, Dee Ferguson’s leafy business has grown to three Kansas City locations. The secret is in the soil, she said, describing a strategy for cultivating customers through free, evergreen plant care support and “community-rooted spirit.” “2025 has been a difficult year for all of retail,”…

Summer funding pushes CarePilot to team hires, AI accolades, healthtech product launch

Fresh off its summer capital infusion, a Kansas City-built AI startup that helps doctors focus on patients instead of administrative tasks is earning industry recognition and dropping another new product, said Joseph Tutera, sharing credit for the milestones with behind-the-scenes talent. “We have a young team and they don’t have the encumbrance of a prior…