A high-tech funder planted seeds in 135+ Missouri startups; three bloomed into $1B+ unicorns in the past six months

May 13, 2021 | Tommy Felts

When news broke this week that St. Louis-based plant tech firm Benson Hill reached a $2 billion valuation, it marked the third “unicorn” minted among MTC-funded companies in the past six months, said Jack Scatizzi.

“Early-stage investing takes patience and the results can’t be rushed,” said Scatizzi, executive director of the Missouri Technology Corporation, noting MTC’s first investment in Benson Hill came in 2013 — about eight years before the company’s headline-making announcement.

MTC is a public-private partnership created by the Missouri General Assembly to promote entrepreneurship and foster the growth of new and emerging high-tech companies. To date, it has made direct investments of just under $44 million into more than 135 early-stage Missouri-based high growth technology-focused companies, which have raised more than $1 billion in additional private capital.

Benson Hill — a food technology company that uses artificial intelligence, data and a variety of breeding techniques to create innovative food and ingredient products — announced its merger Monday with Star Peak Corp II, a special-purpose acquisition company, a process which resulted in the valuation at $2 billion.

Elements derived from Benson Hill’s technology are key for plant-based meat alternatives, as well as in-the works animal feed — both expected to be crucial in the fight against climate change, according to a report in the Wall Street Journal.

MTC invested $175,000 in Benson Hill’s initial seed round, which led to the company putting the bulk of its operations in Missouri (St. Louis). The organization made additional investments in Benson Hill’s Series A and Series B rounds, as well as participated in company-sponsored stock buyback programs to ensure that the state’s initial investment was returned to be redistributed throughout the state’s entrepreneurial ecosystems, Scatizzi said.

“Early-stage funding is critical to the success of companies and is typically the hardest capital to find,” he explained. “Once a product has completed research and development or beta testing and the company has demonstrated a commercial need for the product, specifically the ability to find customers willing to pay for the product/service, there are more sources of capital available.”

Click here to see MTC’s full portfolio.

Among the Kansas City startups to take advantage of MTC’s co-investment funding: backstitch, Little Hoots, Moblico, Mycroft, Pathfinder Health Innovations, PayIt, Popbookings, Proviera Biotech, SCD Probiotics, Sickweather, SoftVu, StoryUp, Transportant, Venture360, and VideoFizz. Today, many of these startups are now listed among Kansas City’s Top VC-Backed Companies.

That’s why MTC’s role — at the beginning of the journey — is so critical to the continued development of the state’s entrepreneurs and business ecosystems, Scatizzi said.

The Benson Hill valuation comes on the heels of two other recent unicorn announcements from MTC-funded companies, he added. A “unicorn” is a startup valued at $1 billion or more.

St. Louis startup Gainsight was acquired by Vista Equity Partners for $1.1 billion in December. And Aclaris Therapeutics, a Pennsylvania biopharmaceutical company with significant ties back to St. Louis, posted positive Phase 2a clinical trial data and its market cap broke at $1 billion in January, according to Scatizzi.

Those wins didn’t happen overnight, he added.

MTC first invested in Gainsight (formerly Jbara Software ) in 2012. It funded Confluence Life Science — later acquired by Aclaris Therapeutics — in 2011.

“MTC’s investment and the matching private funds are leveraged by companies to de-risk the investment opportunity so that it will become more attractive to sources of later-stage capital,” Scatizzi said. “The more investment opportunities that MTC can help de-risk, the more growth capital that will be invested into Missouri which will create a significant economic development impact.”

In some respects, Scatizzi continued, the trio of unicorn companies offer an even more sizable bump to Missouri than to their own bottom lines.

Gainsight and Aclaris both have offices/labs in the St. Louis area. And at the time Benson Hill opened its new $52 million headquarters in St. Louis, the company had more than 180 employees with at least 20 open positions, CEO Matt Crisp.

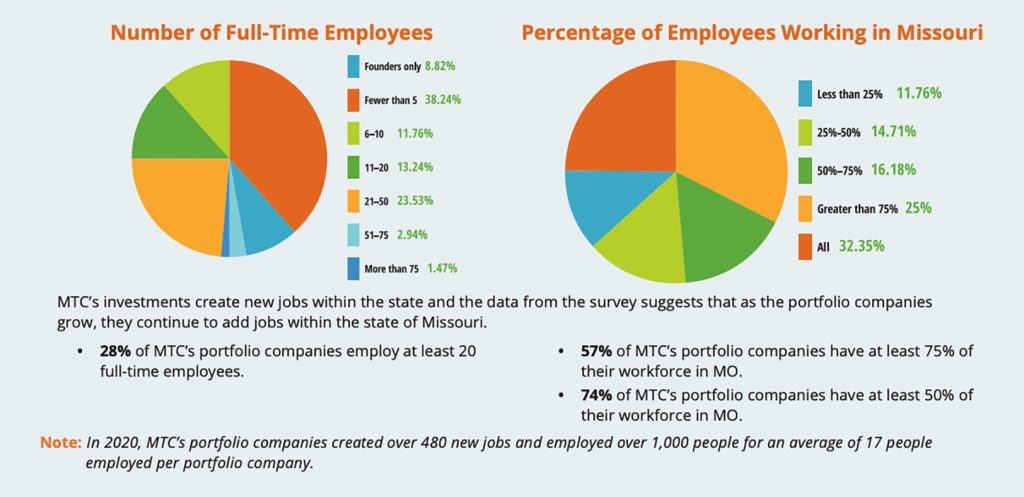

Their success stories are major highlights, but only showcase a portion of MTC’s impact, the program’s leader detailed. MTC published a summary of economic development findings this spring after surveying more than 70 of its portfolio companies.

Click here to read the summary, which delves deeper into MTC’s distribution across markets, commercialization of products by portfolio companies, job creation, investor interest, and diversity of leadership.

For example, MTC’s more than 135 portfolio companies have created more than 320 commercial products and generated more than $277 million in total revenues for the previous fiscal year (July 1, 2019 to June 31, 2020), according to the data. The portfolio also has created more than 480 new jobs, and employed more than 1,000 people during the same fiscal year period.

That feeds an ongoing funding cycle for Missouri and its entrepreneurs, Scatizzi said, noting MTC has generated more than $11 million in returns — meaning about a quarter of the capital invested has already been returned to the organization, allowing MTC to redistribute to the state’s entrepreneurial ecosystems.

Featured Business

2021 Startups to Watch

stats here

Related Posts on Startland News

Mayor: Film projects roll $24M into region’s creative economy as KC productions boom

When Hallmark’s “A Grand Ole Opry Christmas” airs this weekend, Kansas City viewers — and audiences across the globe — will see recognizable locations from throughout the metro, where a significant portion of the movie was filmed. It’s an increasingly common showcase of KC’s versatility, said Quinton Lucas, as the region takes its place on the…

Scout charts pre-seed funding from Midwest investors at KCRise Fund, eGrowth Ventures

The just-announced pre-seed round for an emerging innovator in veterinary medicine software is expected to help the Kansas City-built startup deepen its product capabilities, further strengthen its core technology, and strategically grow its team to meet rising demand. “Closing this round gives us the resources and momentum to execute on our mission,” said Dr. Gonzalo…

Just funded: AltCap Your Biz cycles trio of winners from KC’s diverse hospitality scene

Persistence pays off, said Ruben Alonso, celebrating a decade of the AltCap Your Biz Pitch Competition and its role as an energy boost for Kansas City small businesses. The latest winning founders walked away with $60,000 in checks Wednesday at Union Station. Two of this year’s top three winners were returning finalists, the AltCap CEO…

Innovation check(s): Angels scout potential KC investments at NXTUS nano-pitch event

A startup showcase Tuesday in the heart of Johnson County’s innovation community put impact on display as NXTUS’ Accelerate Venture Partners organized a nano-pitch event for its network of angel investors amid Global Entrepreneurship Week-Kansas City festivities. The Wichita-based entrepreneurial support organization — which has mobilized over $8.5 million for entrepreneurs in the Heartland since…