How LendingStandard’s new marketplace tapped into a record-setting real estate trend

February 16, 2021 | Startland News Staff

A KCK startup opened a funding pipeline with its latest offering that exceeded $860 million in its first seven months of operation.

MultifamilyDebt.com — a multifamily lending marketplace fueled by Kansas City, Kansas-based LendingStandard — announced the achievement Monday, signaling rapid growth in the midst of a record-setting era for real estate.

“Providing quality loans and fast documentation with personal service is rare for properties under $5 million and investors are looking for better solutions,” Andy Kallenbach, CEO of both MultifamilyDebt and LendingStandard, explained in a release.

“Our goal is to cut through the inefficiency and frustration that multifamily borrowers have experienced for far too long,” added Craig Hughey, vice president of product management.

The fast-growing company has so-far focused its efforts on small balance loans, Kallenbach said, noting the company offers loan options across the buyer spectrum and simplifies the loan application process.

“It has been surprising to see the variety of projects from $40 million new construction to $100 million bridge loans,” he said. “I believe it is a testament to our focus in connecting multifamily with the right lender and not blasting a deal out to see what sticks.”

The MultifamilyDebt platform uses an online profile to match borrowers with lending options pulled from a sourced network of trusted lenders.

“Its proprietary, automated underwriting engine screens, sizes, and closes deals quickly with little human interaction,” the company said in description of its platform, which is backed by funding from Overland Park-based Flyover Capital.

“Multifamilydebt.com completes the lending cycle, streamlining deals from start to close. Applicants are able to input data points on their property or portfolio and receive custom offers from lending partners.”

Click here to learn more about MultifamilyDebt.com or here for more on LendingStandard.

Featured Business

2021 Startups to Watch

stats here

Related Posts on Startland News

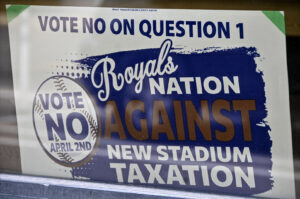

Crossroads small biz owners to Royals: Come back with a better plan (and put it in writing)

It didn’t have to be this way, said Crossroads business owners, blaming Tuesday’s failed stadium sales tax initiative on what they viewed as a lack of transparency and legally binding agreements, too many last-minute deals and changes, and a disregard for community input. Most, however, hope the conversation isn’t entirely finished. Jackson County voters this…

These founders just earned Digital Sandbox KC funds; next comes proving their concepts

A trio of newly funded Digital Sandbox KC companies includes a closely-guarded startup launched by an exited Pipeline founder who also helped bring headline-grabbing sports tech to the forefront of the Kansas City innovation scene. Mission Hills, Kansas-based Chemniscient (pronounced kemʹniSH(Ə)nt) is currently operating confidentially and is not disclosing any product information to the public…

Voters hand Royals, Chiefs a resounding defeat on sales tax that would’ve funded stadium projects

Editor’s note: The following story was published by KCUR, Kansas City’s NPR member station, and a fellow member of the KC Media Collective. Click here to read the original story or here to sign up for KCUR’s email newsletter. The 3/8th-cent sales tax extension would have helped build a new Kansas City Royals stadium downtown as well as fund renovations…

Kelce Jam returning to KC in May with Lil Wayne, Diplo, 2Chainz (plus Takis and Uncrustables)

Travis Kelce’s celebration of the Kansas City Chiefs’ back-to-back Super Bowl championships not only flexes the star tight end’s pull with top-tier artists, but showcases his ability to attract major brand deals. Kelce Jam returns Saturday, May 18 to Azura Amphitheater in Bonner Springs, Kansas, with musical performances personally curated by the three-time Super Bowl…