How LendingStandard’s new marketplace tapped into a record-setting real estate trend

February 16, 2021 | Startland News Staff

A KCK startup opened a funding pipeline with its latest offering that exceeded $860 million in its first seven months of operation.

MultifamilyDebt.com — a multifamily lending marketplace fueled by Kansas City, Kansas-based LendingStandard — announced the achievement Monday, signaling rapid growth in the midst of a record-setting era for real estate.

“Providing quality loans and fast documentation with personal service is rare for properties under $5 million and investors are looking for better solutions,” Andy Kallenbach, CEO of both MultifamilyDebt and LendingStandard, explained in a release.

“Our goal is to cut through the inefficiency and frustration that multifamily borrowers have experienced for far too long,” added Craig Hughey, vice president of product management.

The fast-growing company has so-far focused its efforts on small balance loans, Kallenbach said, noting the company offers loan options across the buyer spectrum and simplifies the loan application process.

“It has been surprising to see the variety of projects from $40 million new construction to $100 million bridge loans,” he said. “I believe it is a testament to our focus in connecting multifamily with the right lender and not blasting a deal out to see what sticks.”

The MultifamilyDebt platform uses an online profile to match borrowers with lending options pulled from a sourced network of trusted lenders.

“Its proprietary, automated underwriting engine screens, sizes, and closes deals quickly with little human interaction,” the company said in description of its platform, which is backed by funding from Overland Park-based Flyover Capital.

“Multifamilydebt.com completes the lending cycle, streamlining deals from start to close. Applicants are able to input data points on their property or portfolio and receive custom offers from lending partners.”

Click here to learn more about MultifamilyDebt.com or here for more on LendingStandard.

Featured Business

2021 Startups to Watch

stats here

Related Posts on Startland News

This stay-at-home mom took risks in search of her identity; starting a business revealed authenticity was already in stock

There’s beauty in stepping out of your comfort zone, said Franki Ferguson. “Even if it scares you,” the founder of Fonti Collections added. Ferguson, a life-long Kansas Citian, launched her online clothing boutique Sept. 18, aiming to offer more than just trendy apparel. Her mission: help women feel empowered and confident — while using entrepreneurship…

KC’s worst food is wasted food: New app helps restaurants keep meals out of the trash can

Kansas City diners can soon dig into affordable, delicious food while helping the planet. Too Good To Go, the world’s largest marketplace for surplus food, will officially launch Nov. 13 in Kansas City. The app connects local food businesses with surplus food to consumers who can buy Surprise Bags of that food for half the…

Vintage-inspired Relikcs streams ‘anti-technology’ into the digital age with high-end audio furniture

A line of West Bottoms-built, high-end stereo consoles capitalizes on a gold rush for vinyl nostalgia, said Paul Suquet, noting their vintage-inspired business bridges the gap between a digital era and “the beauty of analog sound.” “Music is something that connects us,” added Dan Posch, one of Suquet’s partners at Relikcs Furniture, a local maker…

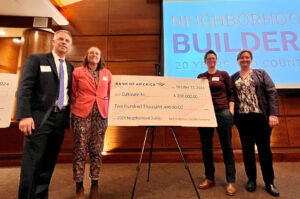

These KC nonprofits showed resiliency; their reward: $200K grants from Bank of America

Bank of America this fall continued the 20-year run for its Neighborhood Builder grants program, awarding two Kansas City nonprofits with $200,000 grants and access to exclusive leadership training resources and a national network of nonprofit peers. The 2024 honorees are Kansas City Girls Preparatory Academy and Cultivate Kansas City — tapped for their work…