How LendingStandard’s new marketplace tapped into a record-setting real estate trend

February 16, 2021 | Startland News Staff

A KCK startup opened a funding pipeline with its latest offering that exceeded $860 million in its first seven months of operation.

MultifamilyDebt.com — a multifamily lending marketplace fueled by Kansas City, Kansas-based LendingStandard — announced the achievement Monday, signaling rapid growth in the midst of a record-setting era for real estate.

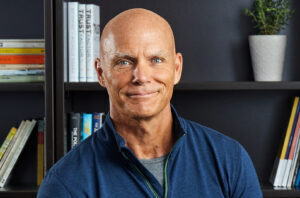

“Providing quality loans and fast documentation with personal service is rare for properties under $5 million and investors are looking for better solutions,” Andy Kallenbach, CEO of both MultifamilyDebt and LendingStandard, explained in a release.

“Our goal is to cut through the inefficiency and frustration that multifamily borrowers have experienced for far too long,” added Craig Hughey, vice president of product management.

The fast-growing company has so-far focused its efforts on small balance loans, Kallenbach said, noting the company offers loan options across the buyer spectrum and simplifies the loan application process.

“It has been surprising to see the variety of projects from $40 million new construction to $100 million bridge loans,” he said. “I believe it is a testament to our focus in connecting multifamily with the right lender and not blasting a deal out to see what sticks.”

The MultifamilyDebt platform uses an online profile to match borrowers with lending options pulled from a sourced network of trusted lenders.

“Its proprietary, automated underwriting engine screens, sizes, and closes deals quickly with little human interaction,” the company said in description of its platform, which is backed by funding from Overland Park-based Flyover Capital.

“Multifamilydebt.com completes the lending cycle, streamlining deals from start to close. Applicants are able to input data points on their property or portfolio and receive custom offers from lending partners.”

Click here to learn more about MultifamilyDebt.com or here for more on LendingStandard.

Featured Business

2021 Startups to Watch

stats here

Related Posts on Startland News

Electric Americana: How singer Teri Quinn broke from the pack (and found her own in KC)

Members of the Kansas City-based band Teri Quinn & The Coyotes are carving a distinctive space within the local music scene. From Appalachian banjo riffs to punk-inspired beats, their sound reflects diverse influences — howling loudest from the woman in front. Attendees at Startland News’ Jan. 23 reception for the Kansas City Startups to Watch…

C2FO hits its first billion-dollar day; marks $400B in funding to customers as global finance shifts

A record-breaking year for C2FO serves as a proof point itself, said Sandy Kemper, revealing the Kansas City-built fintech surpassed $400 billion in lifetime funding to its customers in 2024 and achieved $1 billion of daily funding for the first time. “The success of the past year only demonstrates the tremendous need for more efficient…

KC Biohub leader bullish on Tech Hubs funding after region missing from latest grants list

Kansas City is still in the running for a chunk of the remaining $280 million in expected funding for federal Tech Hubs implementation grants, said Melissa Roberts Chapman, emphasizing the region remains primed and competitive in the process despite the KC BioHub not being among the latest awardees announced by the program. Six other projects…

KCMO secures $11.8M to expand city’s EV charging infrastructure, targeting underinvested neighborhoods

A freshly charged tranche of funding is expected to help power Kansas City’s efforts to install 256 new electric vehicle charging points across urban and suburban areas of the city, Mayor Quinton Lucas announced Tuesday. “This project will help cement Kansas City’s commitment to sustainable transportation and access to electric vehicle resources,” Lucas said. “A…