Destiny launches full-brand pivot to ‘Finotta’, expanding from debt solution to banking API platform

February 2, 2021 | Channa Steinmetz

Established financial institutions are at a crossroads when it comes to competing against online platforms with banking options, said Parker Graham.

“Facebook, Google and others have banking capabilities that are so fine-tuned to customer service and customer interaction,” said Graham, founder and CEO of Kansas City fintech startup Finotta, formerly known as Destiny Wealth. “Banks and credit units really need to have the same abilities to be able to compete in this new world of banking.”

Finotta is an API-based solution that helps financial institutions create personalized user experiences in their current mobile banking applications, without having to move core providers.

“If you look at credit unions or banks specifically, most of their technology that a customer uses is the same across every single channel,” Graham stated. “You can really only do four things in a banking application right now.”

By implementing personalization in mobile banking applications, customers will have a curated experience depending on whether they are new to banking, trying to get out of debt, build wealth, etc., he continued.

“A big part of our mission is to provide that competitive edge to those financial institutions.”

Finotta — previously Destiny — rebranded at the end of 2020 to let its clients know the brand handles much more than debt, Graham explained. (Destiny was one of Startland News’ Kansas City Startups to Watch in 2020.)

“Every time we tried to reach out to somebody and tell them about our fuller platform, it was always, ‘Oh yeah, you focus on debt,’” Graham recalled. “We would spend 15 minutes just explaining what we actually do now, so it was decided to make a full-brand pivot.”

‘Roller coaster’ year

Throughout 2020, the startup rode the rollercoaster of up-down-up-down-up challenges and successes, Graham shared.

It began in March, during the early stages of the COVID-19 pandemic, when the banking industry had to rework its operational procedures in order to achieve safer customer service, Graham said — adding that upgrading technology was the last thing on their minds.

“But then that wave passed and the focus was back on how to innovate,” Graham continued. “Then when the [Payment Protection Program] came out, it was all hands on deck to service their business customers. So we were pushed to the backburner again.”

Banks and credit unions soon realized the importance of their online and mobile banking, which gave Finotta the opportunity to introduce its platform, Graham said.

“One of the hardest things in banking is creating a personal relationship [with a customer] through a digital channel,” he noted. “Banks aren’t equipped to do that — we’re trying to help them be better equipped and to facilitate it.”

Headed into 2021, Finotta is launching with its first couple of financial institutions.

A high point during Finotta’s wild 2020 ride was taking part in the Nex Cubed accelerator program, Graham stated.

“I learned more in that time with them, than I’ve probably any other thing I have been through,” Graham shared. “From a culture perspective to a sales perspective to everything in between, Nex Cubed did a great job. They continue to do a great job for us and are our biggest cheerleaders from a corporate investor perspective.”

New team, new ideas

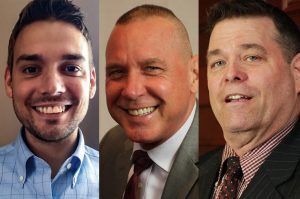

Along with rebranding, Finotta’s team was revamped with Destiny’s previous co-founders stepping away and new members bringing fresh ideas to the startup.

“It was the best move for them and the best move for us,” Graham explained. “Now we have this fresh group that has all this new life blood and new energy, and they’ve been a huge blessing.”

The current team count for Finotta is four employees, but the company is actively hiring full stack developers, Graham said — noting that its No. 1 goal in the first quarter of 2021 is to grow as fast as possible.

Click here to learn more about current openings at Finotta.

For all other founders who survived the unprecedented challenges of 2020, Graham urged them to get together once it is safe and the pandemic is over.

“I think the majority of us founders really experienced the roller coaster of customers being there and not being there,” Graham said. “Shout out to any entrepreneur who is currently doing something … Let’s all grab a beer and be happy about the fact that we’re still alive and get to fight another day.”

Featured Business

2021 Startups to Watch

stats here

Related Posts on Startland News

‘Get a glimpse of your future’ — Investors want data with your pitch

Editor’s Note: This content is sponsored by Mid-Continent Public Library but independently produced by Startland News. For more on the tools discussed in this article, click here. Imagine this. Your wearable tech firm is thriving — so much, in fact, that you need an injection of investment capital to maintain sustainable growth. You’ve booked some…

Launch It Successfully hopes to reduce early stage frustration, struggle for startups

A new accelerator program produced by key leaders of software development firm Illumisoft is helping innovators start their businesses by “cutting through the nonsense,” said Tyler Prince. “We want to help entrepreneurs succeed,” he said. “I think we live in an age when change happens so rapidly.” Launch It Successfully’s goal is to assist early…