Black & Veatch spinout gives Atonix Digital the startup space to scale on its own

February 23, 2021 | Channa Steinmetz

A newly independent Atonix Digital is leaning into growth opportunities after being spun out of its corporate home at Black & Veatch earlier this year.

“The benefit to Black & Veatch is: they get to stay on their core business model. The benefit to Atonix Digital is: we get to be more nimble, pursue new industries and grow our partner network,” said Matt Kirchner, who serves as the chief product officer for Atonix Digital.

Elevator pitch: Atonix Digital is a computer software company that helps plant managers and operators improve operations by detecting, diagnosing and resolving issues to avoid unplanned shutdowns, improve asset efficiency and gain insight into asset performance. Unlike other analytics software, the Atonix Platform is built for asset experts rather than data scientists and drives a process that ensures issue resolution rather than simply identifying them.

Elevator pitch: Atonix Digital is a computer software company that helps plant managers and operators improve operations by detecting, diagnosing and resolving issues to avoid unplanned shutdowns, improve asset efficiency and gain insight into asset performance. Unlike other analytics software, the Atonix Platform is built for asset experts rather than data scientists and drives a process that ensures issue resolution rather than simply identifying them.

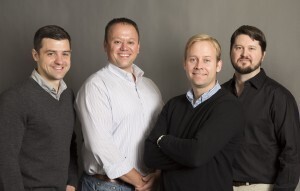

Leadership team: Paul McRoberts, chief executive officer; Jacque Hansen, chief financial officer and chief marketing officer; Brian Schumacher, chief technology officer; Matt Kirchner, chief product officer

Founding year: 2018

Amount raised to date: Undisclosed

Noteworthy investors: Undisclosed

Current employee count: Undisclosed

Black & Veatch announced in January it was selling its wholly owned subsidiary — a startup-style company within the engineering firm — to the Atonix leadership team.

Atonix Digital is an Overland Park-based software company focused on operational intelligence; the company’s products are powered by ASSET360 — a cloud-based data analytics platform that improves the efficiency of operations and planning for complex and distributed assets, according to its website.

Click here to learn more about Atonix Digital’s analytics platform.

Although breaking away from Black & Veatch during a global pandemic might seem like faulty timing, Kirchner explained, Atonix Digital was not strongly affected by the pandemic — and was even impacted favorably because of its stronger reliance on technology.

“Because we provide hosted software that gives our users insight into the operations of their facility, users can leverage our software from wherever they are and still keep an eye on their operating assets,” Kirchner explained. “So as our customers became more distributed, they leaned into our software even more to keep an eye on their facilities from a distance.”

As a newly independent software company, Atonix Digital is able to target industries outside of Black & Veatch’s engineering focus, Kirchner noted.

“Our heritage came out of power generation, and that still represents a fair amount of our business,” he said. “But our growth areas — where I think we will continue to grow this year — have really been oil and gas, petrochemical, and pulp and paper. Water and wastewater and other manufacturing [industries] are still interesting to us.”

Atonix Digital anticipates some hiring growth in 2021, Kirchner noted. The team’s main goals are to expand and serve new types of facilities, as well as work with a larger network of partners.

Black & Veatch will remain a partner with Atonix Digital and continue to leverage Atonix’s software to remotely monitor facilities.

“When we go to market with the Black & Veatch team, it’s a combination of their engineering services plus our software that forms a complete solution,” Kirchner explained. “So we offer our software through our partner network — where our partners can provide complimentary services with our software — and we offer our software to customers who want to be the user of our software directly.”

High efficiency and effectiveness are the pillars of what sets Atonix Digital’s software apart from other solutions, Kirchner noted.

“We can get our software up and fully operational a lot faster than our competitors; we’re up and running in six-to-eight weeks,” he said. “The other thing that customers speak highly about is that our software drives a process. It doesn’t just use analytics and math for the sake of math. We’re using our analytics to detect, diagnose and resolve issues.”

Although growing into more industries is the goal for 2021, advancing its software will maintain at the forefront of Atonix Digital’s priorities, Kirchner added.

“Much of our strategy is a continuation of what it was before,” he shared. “Helping industrial customers prevent failures, reduce production downtime and operate more efficiently are what we aim to accomplish when enhancing our software. We’re still heavily invested in improving how we do that.”

Featured Business

2021 Startups to Watch

stats here

Related Posts on Startland News

Events Preview: Athena League, ReversED

There are a boatload of entrepreneurial events hosted in Kansas City on a weekly basis. Whether you’re an entrepreneur, investor, supporter or curious Kansas Citian, we’d recommend these upcoming events for you. WEEKLY EVENT PREVIEW Think Big’s Anniversary Happy Hour When: January 28 @ 4:30 pm – 6:00 pm Where: Think Big Coworking Come mix and mingle…

KC’s Smart City ‘Living Lab’ to tackle domestic terrorism threats

Since 2013, more than 160 active shooter situations have taken place in the United States. Imagine for a moment if those events could be prevented or mitigated through the use of technology, such as drones, social media analysis and other sensors. That future is closer than ever according to leaders of Kansas City’s Smart City…

A vibrant arts culture leads to innovation and why hometown investors are vital

Here’s this week’s dish on why the arts community shouldn’t be a benched player on the sidelines of a city’s economy game; the importance of hometown investors to thriving startup communities; and what universities are doing to keep the talent pipeline strong for an entrepreneurial future. Check out more in this series here. The Atlantic…

ClaimKit snags $1.8M from local VC Flyover Capital

Insurance tech startup ClaimKit is tapping an area venture capital fund to help launch its second software offering that quickly analyzes policies. The company raised $1.8 million to launch RiskGenius, which helps to identify and categorize insurance clauses in commercial policies. Leawood-based venture capital firm Flyover Capital led the round, which included participation from the…