KC’s favorite BBQ: Interest in these 10 restaurants surged with curbside curiosity, Lelex Prime says

December 28, 2020 | Austin Barnes

Editor’s note: The following report was produced with analytical support from Lelex Prime, a non-financial, content partner of Startland News.

Kansas Citians had impressive appetites in the early days of the COVID-19 pandemic, Brendan Reilly said, downloading a massive haul of Lelex Prime-collected data that analyzed trends in one of the metro’s favorite categories — barbecue.

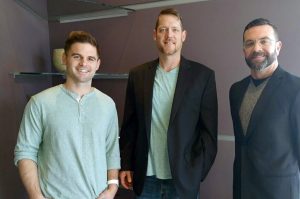

“There was significant growth in interest among all major restaurants. Jack Stack saw the most interest,” said Reilly, co-founder and principal at the fast-growing Kansas City-based artificial intelligence startup. Lelex Prime’s latest hobby-cull examined trends in a space its team was curious about during downtime in 2020 — and shared exclusively with Startland News.

The search revealed Kansas Citians were most curious about menus and delivery or curbside options at these 10 metro restaurants — ranked in order of popularity, as documented by Lelex Prime analysts:

- Fiorella’s Jack Stack Barbecue

- Q39

- Gates Bar-B-Q

- Joe’s Kansas City Bar-B-Que

- Smokehouse Barbecue

- Slap’s BBQ

- Zarda Bar-B-Q

- Rosedale Bar-B-Q

- Arthur Bryant’s Barbeque

- Blind Box BBQ

Lelex Prime data also revealed interest in Jack Stack was nearly two times higher than other restaurants in the top five, with a majority of internet users most craving the restaurant’s signature cheesy corn bake.

Over the summer months, online searches surged as consumers looked to buy sauce from Slap’s, Roscoe’s BBQ, Arthur Bryant’s, Wabash BBQ and Blues Garden, and rub from Plowboys Barbeque.

Click here to read a more in-depth look at how Q39 doubled its sales during the pandemic.

“I’m a vegetarian — go Peaceful Pig — but growing up I was a Gates guy. This [data] illustrates a large part of what we build out in our models — the impact that our experiences and information we are exposed to have on our behavior,” Reilly explained, breaking down the science behind Lelex Prime’s analysis and the power in understanding consumer behaviors.

“I thought for sure Gates was No. 1 — because it’s what I grew up being exposed to and eating the most.”

The data was collected using a process that monitors hundreds-of-millions of points in online communication and language data, ranging from blog posts to news articles, social media posts, videos, pictures, recipes, and online menus, Reilly explained.

“We find patterns in the data and are able to quantify consumer interest in a topic. … The possibilities are endless,” he said.

“We have a system that can accurately predict how humans make decisions, what’s driving those decisions, and where consumer interest is going to go.”

The startup — backed by such local investors as the Fountain Innovation Fund — currently works alongside Fortune 500 companies, helping them understand how non-related trends impact sales.

“An example could be, ‘Yogurt sales are impacted by the rise of people wearing athleisure wear,’ with our models we are able to know where consumer interest currently is, why it exists, and where it is going,” Reilly said.

“This is a big deal for any company looking to innovate their products or connect better with their customers.”

Click here to learn more about Lelex Prime and Reilly’s vision for the future of consumer marketing.

This story is possible thanks to support from the Ewing Marion Kauffman Foundation, a private, nonpartisan foundation that works together with communities in education and entrepreneurship to create uncommon solutions and empower people to shape their futures and be successful.

For more information, visit www.kauffman.org and connect at www.twitter.com/kauffmanfdn and www.facebook.com/kauffmanfdn

Featured Business

2020 Startups to Watch

stats here

Related Posts on Startland News

Nearly $5M remains in Kansas angel tax credits as Aug 31 deadline looms; startups urged to apply

The clock is ticking for Kansas angel tax credits to be awarded to growing startups in 2018, said Rachèll Rowand. “We are looking for innovative businesses in Kansas that are under five years old,” said Rowand, program manager for the Kansas Department of Commerce, which administers the state’s angel tax program. “The biotechnology industry is…

Startland list reflects big wins across KC — but don’t get comfortable, warns founder

Kansas City has traction, said Davyeon Ross, but the city and its support network must keep the ball moving. “It’s impressive how much these startups and companies are contributing to the community and the economy,” said Ross co-founder and COO of ShotTracker, reacting to data within Startland’s 2018 list of Top Venture Capital-Backed Companies in…

Think globally, invest locally: Are KC dollars worth more than outside capital?

Hometown capital is validating, said Darcy Howe, but it isn’t everything. Half of the firms in Startland’s 2018 list of Top Venture Capital-Backed Companies in Kansas City received 50 percent or more of their funding from KC investors — a promising indicator of local support that suggests to outside investors that a company is ready…