$1M investment in new impact fund to boost minority and women-owned ventures in KC

December 8, 2020 | Startland News Staff

A $1 million cash injection from The Sunderland Foundation will further efforts to bolster the only impact-oriented, opportunity zone fund focused entirely on Kansas City.

What is equity2?

equity2 is a mission driven impact investment firm committed to deploying capital in inclusive and equitable ways. Formed by AltCap in 2019, equity2 is building on a strong track record of deploying capital in Kansas City’s distressed communities.

equity2 Partners announced the investment Tuesday, marking a significant milestone for the mission driven impact investment firm which has committed to deploying capital in inclusive and equitable ways — especially amid the COVID-19 pandemic — through its equity2 Impact Fund.

“The launch of this new fund could not be more timely. Now more than ever it is important that we invest hometown capital in innovative ways to accelerate financing for underserved businesses,” Randy Vance, president and COO of The Sunderland Foundation, said in a release citing the funds ability to build real equity in Kansas City by further elevating and backing the work of minority and women-owned ventures.

“We know this investment is going to create a stronger and more inclusive regional economy,” he added.

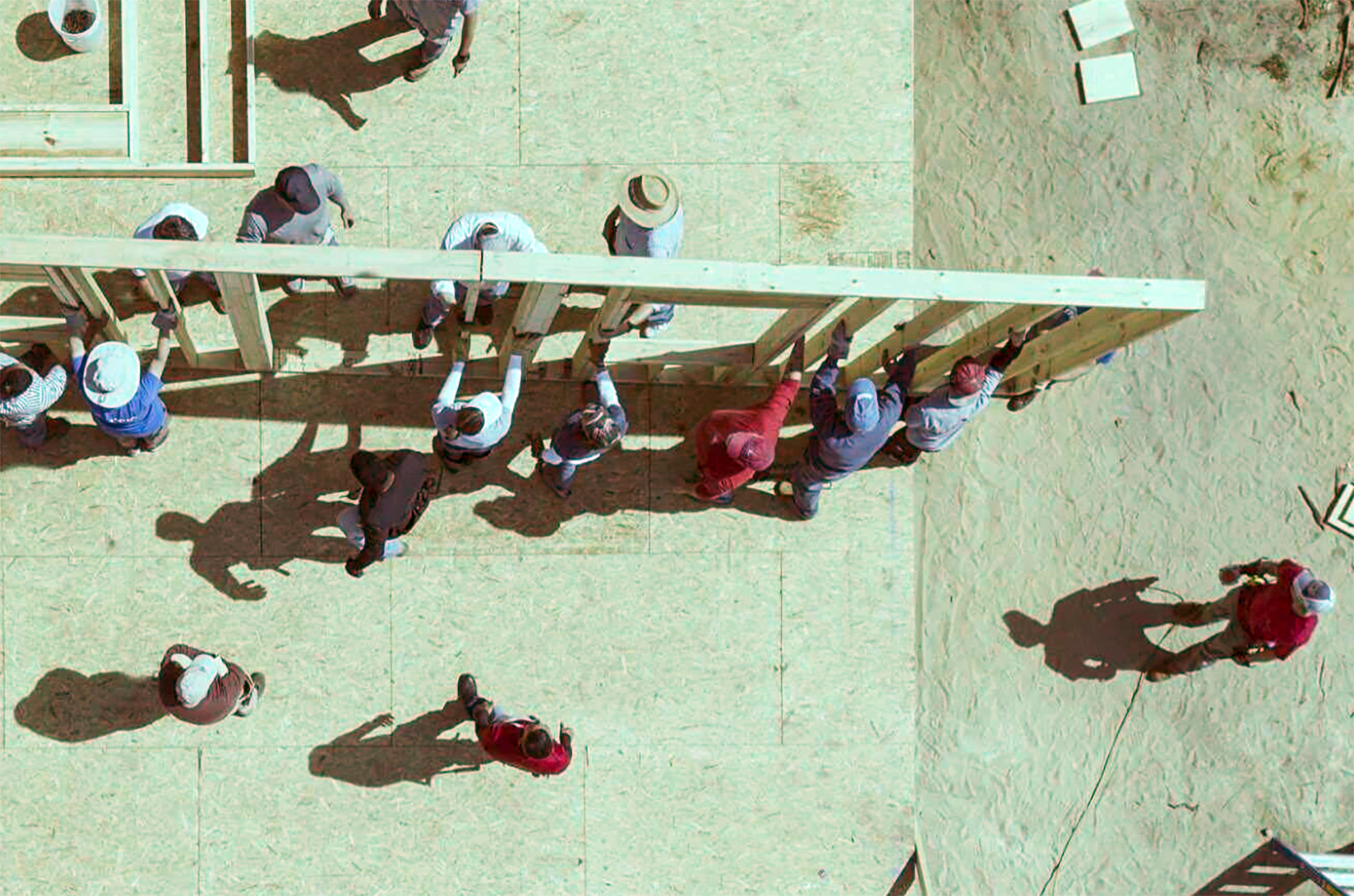

Contributions from the fund are expected to fuel community-focused real estate projects, affordable housing needs, and quality, sought-after and accessible job creation, equity2 said.

Such investments are set to begin in the first quarter of 2021, clustered in the historic Northeast/Paseo Gateway, Central City, Blue River Valley, Swope Park, and Martin City areas, as well as opportunity zones in Wyandotte County.

“This really is one of those unique situations where investors can achieve both the personal financial benefits of a traditional investment, as well as the broader community benefits typically associated with philanthropy,” said Emily Lecuyer, managing director of equity2 and director of impact investments for AltCap.

“We’re excited to work with such a strong institution and to onboard additional partners to make a meaningful and sustained impact in our community.”

equity2 was launched by AltCap in 2019, joining the community development financial institution’s fold of programs and resources that has given entrepreneurs access to $250 million in new markets tax credits and $21 million in small business financing since 2005.

The equity2 Impact Fund is open to accredited investors and accepts qualifying capital gains for opportunity zone tax benefits.

Click here to learn more about the equity2 Impact Fund.

Featured Business

2020 Startups to Watch

stats here

Related Posts on Startland News

KC Outpost at SXSW: LaunchKC sparking interest in Kansas City-fueled Next-Gen tech talk

LaunchKC has landed in Austin for SXSW and is planting a flag in the ground for Kansas City this weekend, said Drew Solomon. Set for Sunday at the popular bar Maggie Mae’s in Austin, KC Outpost returns with presentations featuring expert speakers from Virgin Hyperloop One, Garmin, FishTech Group, Mastercard and other high-profile organizations, said…

Thirsty Coconut buys country’s worth of smoothie machines, hops state line

When opportunity knocks, entrepreneurs must throw risk out the window and do whatever it takes to open the door, said Luke Einsel. “[This was] really the deal of a lifetime,” said Einsel, founder and CEO of Thirsty Coconut, detailing a business deal he struck with 7-Eleven stores across Mexico late last year. The transaction saw…

WIRED together: How mentorship led 22 women to a million-dollar investment

Collaboration among like-minded women forms a dangerous advantage, said Sheryl Vickers and Audrey Navarro. The duo helped found WIRED — Women in Real Estate Development — to foster mentorship and investment among women in the male-dominated and individualistic commercial real estate world. “We believe we have a leg up in the industry because that siloed,…

Founder facing gender bias: Don’t call me a victim; call me investors

It’s like pulling teeth to get key investors and resource organizations to help push female entrepreneurs forward, said Carlanda McKinney, citing implicit bias and a lack of effective support mechanisms. “I don’t think it’s intentional at all. I think it’s a byproduct,” said McKinney, co-founder of Raaxo, an online tech platform used to design and…