$1M investment in new impact fund to boost minority and women-owned ventures in KC

December 8, 2020 | Startland News Staff

A $1 million cash injection from The Sunderland Foundation will further efforts to bolster the only impact-oriented, opportunity zone fund focused entirely on Kansas City.

What is equity2?

equity2 is a mission driven impact investment firm committed to deploying capital in inclusive and equitable ways. Formed by AltCap in 2019, equity2 is building on a strong track record of deploying capital in Kansas City’s distressed communities.

equity2 Partners announced the investment Tuesday, marking a significant milestone for the mission driven impact investment firm which has committed to deploying capital in inclusive and equitable ways — especially amid the COVID-19 pandemic — through its equity2 Impact Fund.

“The launch of this new fund could not be more timely. Now more than ever it is important that we invest hometown capital in innovative ways to accelerate financing for underserved businesses,” Randy Vance, president and COO of The Sunderland Foundation, said in a release citing the funds ability to build real equity in Kansas City by further elevating and backing the work of minority and women-owned ventures.

“We know this investment is going to create a stronger and more inclusive regional economy,” he added.

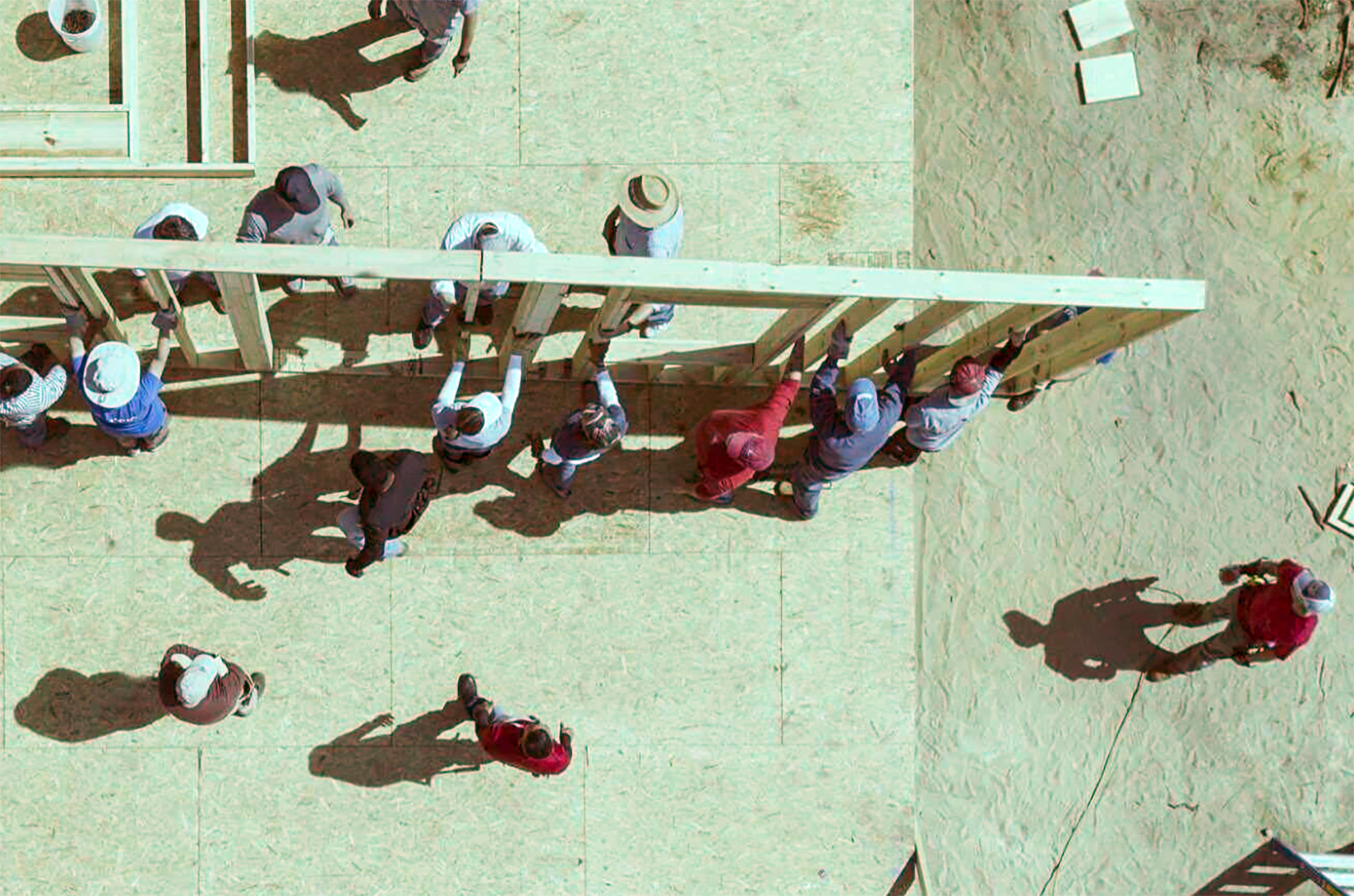

Contributions from the fund are expected to fuel community-focused real estate projects, affordable housing needs, and quality, sought-after and accessible job creation, equity2 said.

Such investments are set to begin in the first quarter of 2021, clustered in the historic Northeast/Paseo Gateway, Central City, Blue River Valley, Swope Park, and Martin City areas, as well as opportunity zones in Wyandotte County.

“This really is one of those unique situations where investors can achieve both the personal financial benefits of a traditional investment, as well as the broader community benefits typically associated with philanthropy,” said Emily Lecuyer, managing director of equity2 and director of impact investments for AltCap.

“We’re excited to work with such a strong institution and to onboard additional partners to make a meaningful and sustained impact in our community.”

equity2 was launched by AltCap in 2019, joining the community development financial institution’s fold of programs and resources that has given entrepreneurs access to $250 million in new markets tax credits and $21 million in small business financing since 2005.

The equity2 Impact Fund is open to accredited investors and accepts qualifying capital gains for opportunity zone tax benefits.

Click here to learn more about the equity2 Impact Fund.

Featured Business

2020 Startups to Watch

stats here

Related Posts on Startland News

How could high-speed, cross-state travel boost Missouri? Hyperloop CEO has three words for KC

Hyperloop One could be gliding down its interchangeable tracks within the next decade, CEO Jay Walder estimated. But is the mystical mass transit system any closer to finding its home, questioned an audience gathered Wednesday for the KC Tech Council CEO speaker series sponsored by RSM and hosted by WeWork. “What if I told you…

CBD modern family: Today’s mom-and-pop shop is selling hemp from a downtown OP storefront

With it’s storefront nestled in a mature, but re-emergent Overland Park neighborhood, walking through the door of 8124 Floyd St. shatters the misconceptions of curious customers, said Heather Steppe. “Its not [shady] … it doesn’t feel like a head shop,” Steppe, co-owner of KC Hemp Co., said of the almost bohemian vibe that radiates from…

Will CBD get me high? Plus three more burning FAQs about the cannabis cousins

Selling CBD is about more than the bottom line, said Heather Steppe, co-owner of KC Hemp Co. “Ninety-percent of what we do is educate. We have people come in here and ask questions and they go home and think about it,” she said from her business’ Downtown Overland Park storefront, noting that the general public…

Niall luxury watches founder, longtime friend: Time to harvest hemp potential in the heartland

With a traditional business mindset and solid entrepreneurial track record, James DeWitt and Michael Wilson could have done just about anything they wanted in life. Uniquely bold, each in their own regard, the longtime friends didn’t want to stick to the status quo as they looked for new ventures after their former acts burned down,…