$1M investment in new impact fund to boost minority and women-owned ventures in KC

December 8, 2020 | Startland News Staff

A $1 million cash injection from The Sunderland Foundation will further efforts to bolster the only impact-oriented, opportunity zone fund focused entirely on Kansas City.

What is equity2?

equity2 is a mission driven impact investment firm committed to deploying capital in inclusive and equitable ways. Formed by AltCap in 2019, equity2 is building on a strong track record of deploying capital in Kansas City’s distressed communities.

equity2 Partners announced the investment Tuesday, marking a significant milestone for the mission driven impact investment firm which has committed to deploying capital in inclusive and equitable ways — especially amid the COVID-19 pandemic — through its equity2 Impact Fund.

“The launch of this new fund could not be more timely. Now more than ever it is important that we invest hometown capital in innovative ways to accelerate financing for underserved businesses,” Randy Vance, president and COO of The Sunderland Foundation, said in a release citing the funds ability to build real equity in Kansas City by further elevating and backing the work of minority and women-owned ventures.

“We know this investment is going to create a stronger and more inclusive regional economy,” he added.

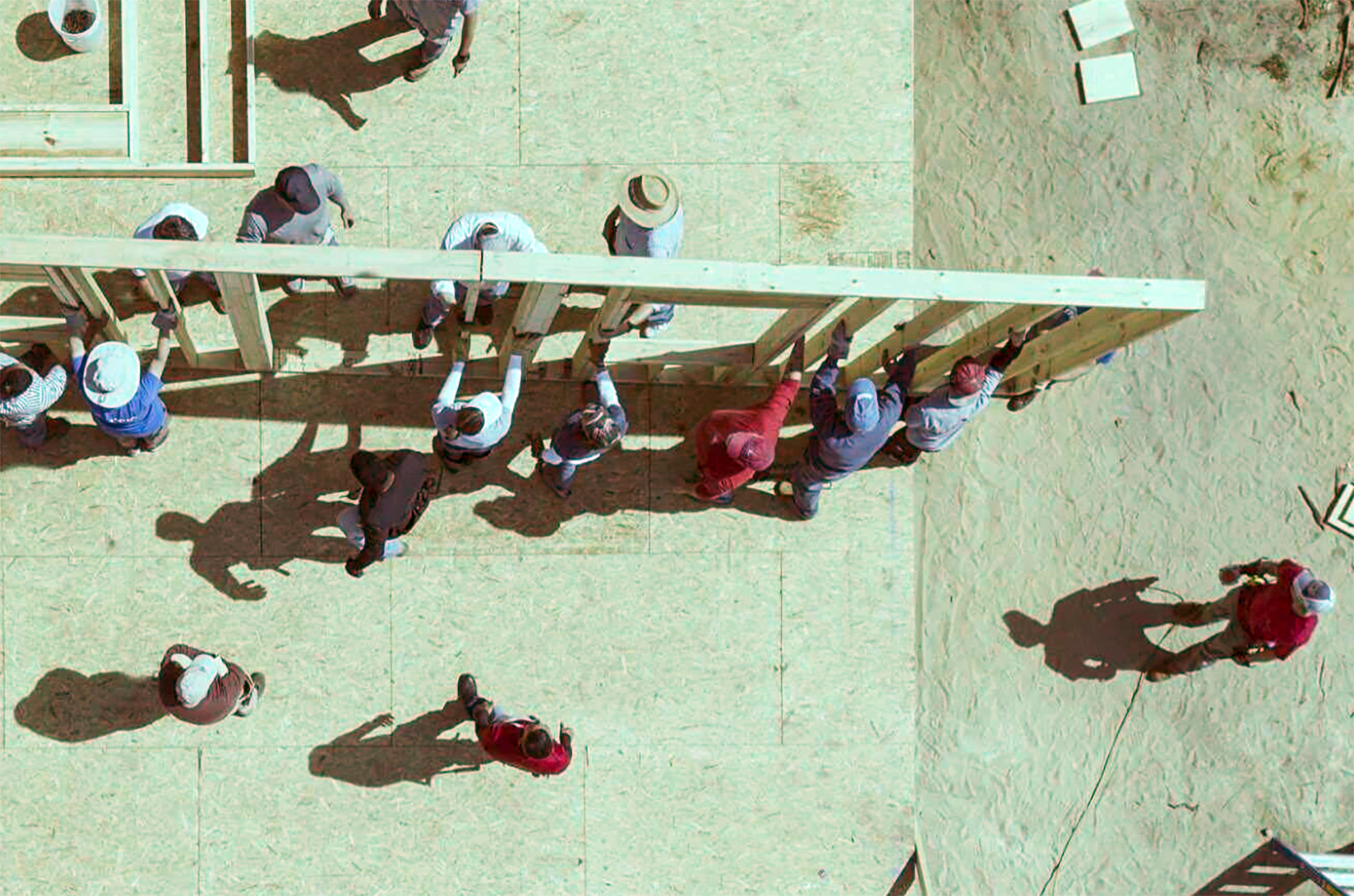

Contributions from the fund are expected to fuel community-focused real estate projects, affordable housing needs, and quality, sought-after and accessible job creation, equity2 said.

Such investments are set to begin in the first quarter of 2021, clustered in the historic Northeast/Paseo Gateway, Central City, Blue River Valley, Swope Park, and Martin City areas, as well as opportunity zones in Wyandotte County.

“This really is one of those unique situations where investors can achieve both the personal financial benefits of a traditional investment, as well as the broader community benefits typically associated with philanthropy,” said Emily Lecuyer, managing director of equity2 and director of impact investments for AltCap.

“We’re excited to work with such a strong institution and to onboard additional partners to make a meaningful and sustained impact in our community.”

equity2 was launched by AltCap in 2019, joining the community development financial institution’s fold of programs and resources that has given entrepreneurs access to $250 million in new markets tax credits and $21 million in small business financing since 2005.

The equity2 Impact Fund is open to accredited investors and accepts qualifying capital gains for opportunity zone tax benefits.

Click here to learn more about the equity2 Impact Fund.

Featured Business

2020 Startups to Watch

stats here

Related Posts on Startland News

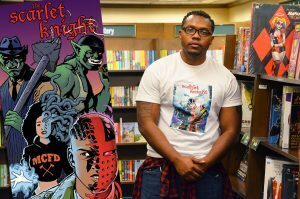

Fund Me, KC: ‘Scarlet Knight’ returns to inner city streets with a moral dilemma about abuse of power

Startland News is continuing its segment to highlight area entrepreneurs’ efforts to accelerate their businesses. This is an opportunity for entrepreneurs — like Juaquan Allen with his Scarlet Knight campaign — to share their crowdfunding stories to gain a little help from their supporters. Who are you? My name is Juaquan “Jay” Allen. I’m a…

Design by fire: Could a Kansas City company 3-D print the Notre Dame spire?

Beyond its status as the biggest in Kansas City, the impact of Dimensional Innovations’ new $2.2 million 3-D printer could reach globally — as the homegrown company considers ways it could help rebuild the historic spire atop the Notre Dame Cathedral, said Nate Borozinski. “This thing gives us an ability — and we think an…

Look inside: Fishtech Group opens its $10M+ Cyber Defense Center in Martin City

Fishtech Group is making a splash within the cyber security industry, showcasing its cloud-era capabilities in a new Cyber Defense Center that sits behind the gates of Fishtech’s sprawling Martin City campus, said Gary Fish. “I’ve been doing security since before it was cool,” said Fish, founder and CEO of Fishtech, as well as an…

Elite investors at exclusive CEO retreat: Don’t waste time; sell us on your billion-dollar idea

Trying to land the backing of a venture capital firm? Throw your pitch deck out the window, Chris Olsen advised a select group of Kansas City CEOs. “A lot of times founders will come and give us their pitch and they’ll start going through it and [they’re telling us] they’re profitable in 18-months. And we’ll…