$1M investment in new impact fund to boost minority and women-owned ventures in KC

December 8, 2020 | Startland News Staff

A $1 million cash injection from The Sunderland Foundation will further efforts to bolster the only impact-oriented, opportunity zone fund focused entirely on Kansas City.

What is equity2?

equity2 is a mission driven impact investment firm committed to deploying capital in inclusive and equitable ways. Formed by AltCap in 2019, equity2 is building on a strong track record of deploying capital in Kansas City’s distressed communities.

equity2 Partners announced the investment Tuesday, marking a significant milestone for the mission driven impact investment firm which has committed to deploying capital in inclusive and equitable ways — especially amid the COVID-19 pandemic — through its equity2 Impact Fund.

“The launch of this new fund could not be more timely. Now more than ever it is important that we invest hometown capital in innovative ways to accelerate financing for underserved businesses,” Randy Vance, president and COO of The Sunderland Foundation, said in a release citing the funds ability to build real equity in Kansas City by further elevating and backing the work of minority and women-owned ventures.

“We know this investment is going to create a stronger and more inclusive regional economy,” he added.

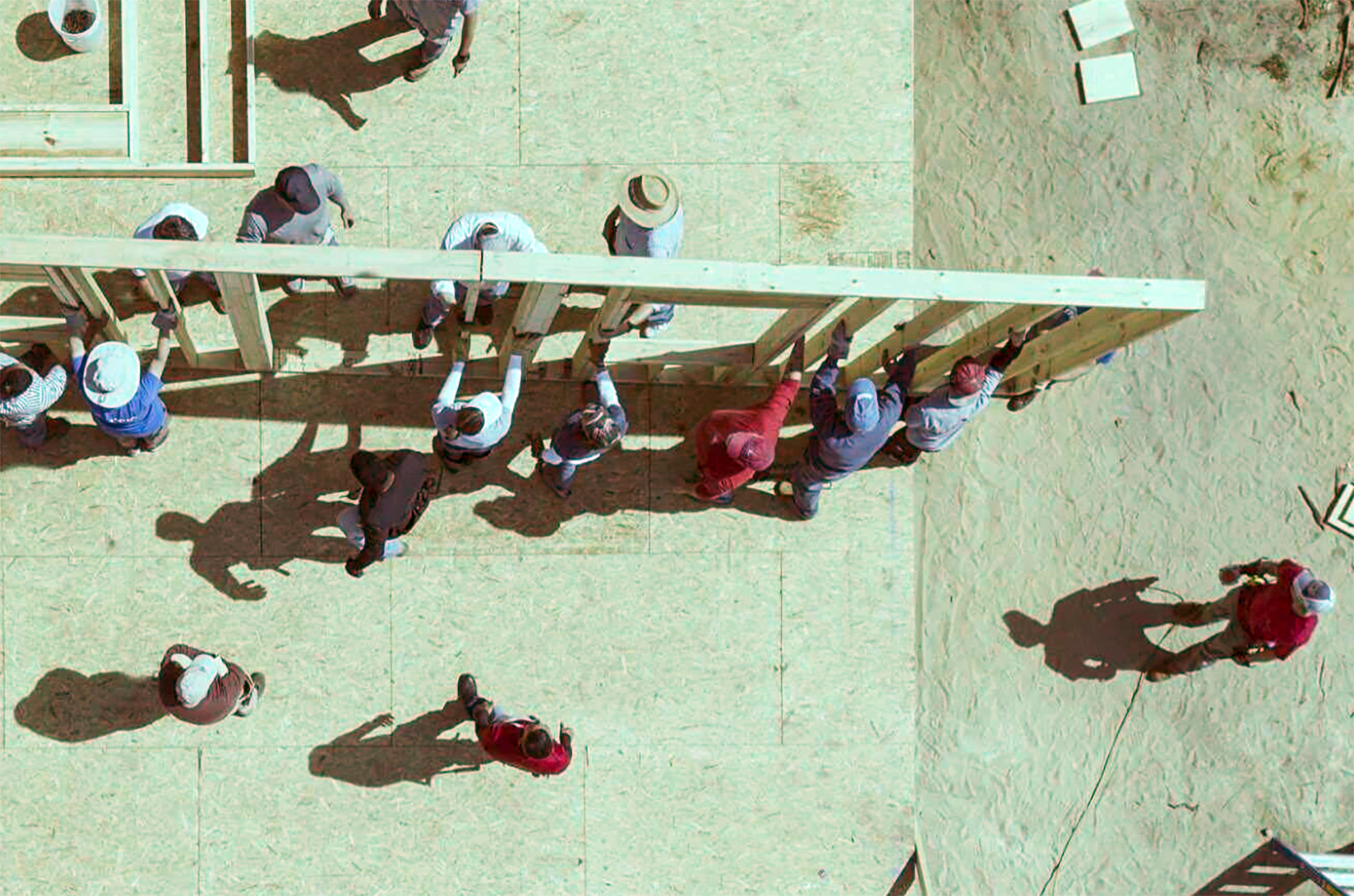

Contributions from the fund are expected to fuel community-focused real estate projects, affordable housing needs, and quality, sought-after and accessible job creation, equity2 said.

Such investments are set to begin in the first quarter of 2021, clustered in the historic Northeast/Paseo Gateway, Central City, Blue River Valley, Swope Park, and Martin City areas, as well as opportunity zones in Wyandotte County.

“This really is one of those unique situations where investors can achieve both the personal financial benefits of a traditional investment, as well as the broader community benefits typically associated with philanthropy,” said Emily Lecuyer, managing director of equity2 and director of impact investments for AltCap.

“We’re excited to work with such a strong institution and to onboard additional partners to make a meaningful and sustained impact in our community.”

equity2 was launched by AltCap in 2019, joining the community development financial institution’s fold of programs and resources that has given entrepreneurs access to $250 million in new markets tax credits and $21 million in small business financing since 2005.

The equity2 Impact Fund is open to accredited investors and accepts qualifying capital gains for opportunity zone tax benefits.

Click here to learn more about the equity2 Impact Fund.

Featured Business

2020 Startups to Watch

stats here

Related Posts on Startland News

More than a makeover: ‘Queer Eye’ gives Wesley Hamilton an opportunity to thank the shooter who put him in a wheelchair

Wesley Hamilton’s clear vision for his potential impact took away the nerves while in front of cameras for Netflix’s “Queer Eye,” he said. “Me being able to get on a show with that type of exposure and spread my message to those within my community and outside of it… I’m just really excited for the…

Sickweather spent 8 years and $100K+ to obtain a patent; Is IP protection worth the cost?

Graham Dodge wanted to check a box for investors seeking security for his crowdsourced sickness forecasting startup Sickweather, he said. Obtaining a patent for the technology, however, proved a tougher task to chart. “We just wanted to protect ourselves to build value in the company,” said Dodge, CEO of Sickweather, as well as Garnish Health,…

RiskGenius announces Series B, partnerships with trio of world’s largest insurance carriers

Customers are pushing for the growth of RiskGenius, a top Kansas City startup providing software-based natural language processing tools for improved quality and accuracy in the insurance industry, said CEO Chris Cheatham. RiskGenius announced Monday an undisclosed Series B round led by Hudson Structured Capital Management Ltd., doing business as HSCM Bermuda. The financing round…