$1M investment in new impact fund to boost minority and women-owned ventures in KC

December 8, 2020 | Startland News Staff

A $1 million cash injection from The Sunderland Foundation will further efforts to bolster the only impact-oriented, opportunity zone fund focused entirely on Kansas City.

What is equity2?

equity2 is a mission driven impact investment firm committed to deploying capital in inclusive and equitable ways. Formed by AltCap in 2019, equity2 is building on a strong track record of deploying capital in Kansas City’s distressed communities.

equity2 Partners announced the investment Tuesday, marking a significant milestone for the mission driven impact investment firm which has committed to deploying capital in inclusive and equitable ways — especially amid the COVID-19 pandemic — through its equity2 Impact Fund.

“The launch of this new fund could not be more timely. Now more than ever it is important that we invest hometown capital in innovative ways to accelerate financing for underserved businesses,” Randy Vance, president and COO of The Sunderland Foundation, said in a release citing the funds ability to build real equity in Kansas City by further elevating and backing the work of minority and women-owned ventures.

“We know this investment is going to create a stronger and more inclusive regional economy,” he added.

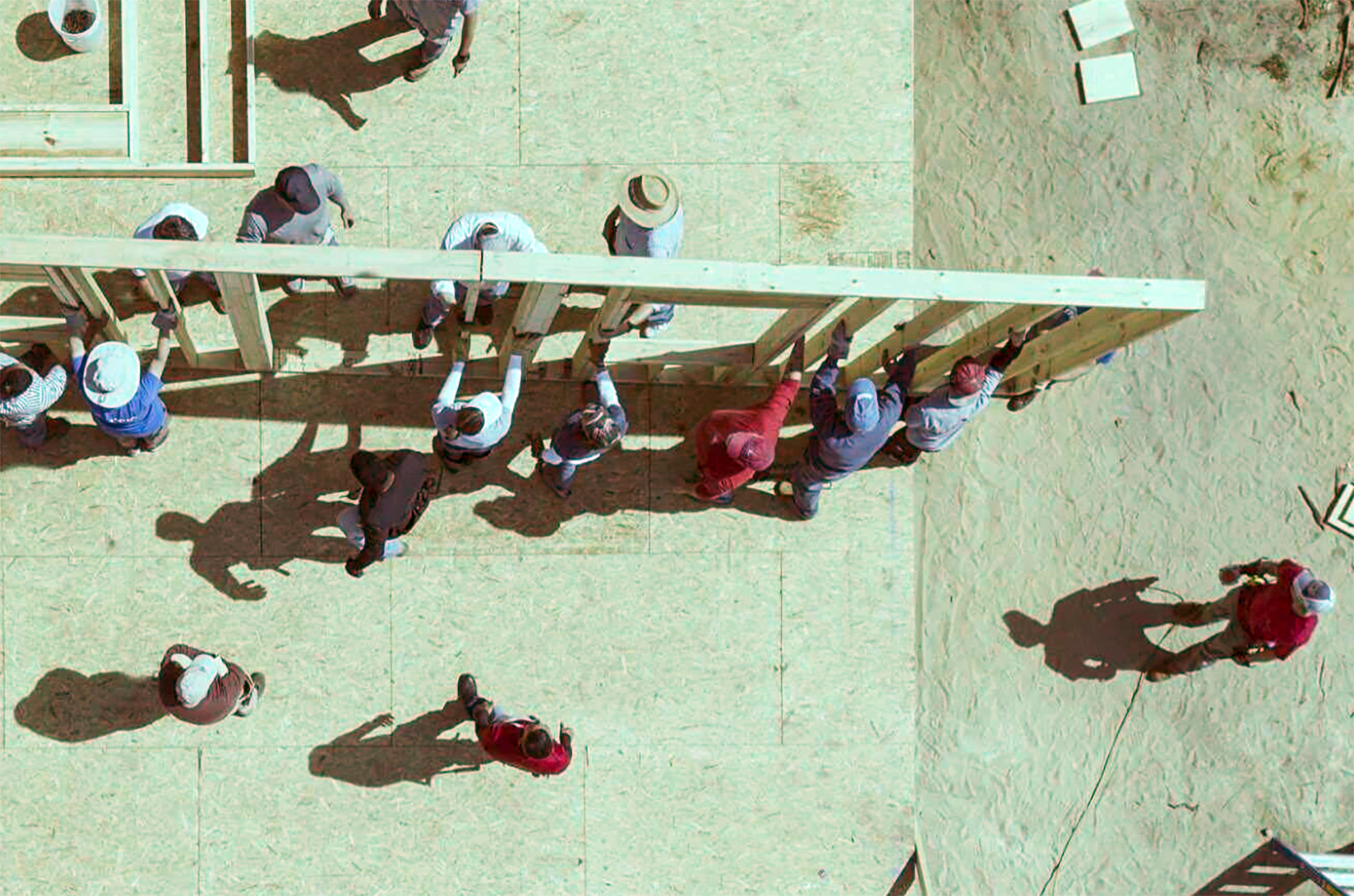

Contributions from the fund are expected to fuel community-focused real estate projects, affordable housing needs, and quality, sought-after and accessible job creation, equity2 said.

Such investments are set to begin in the first quarter of 2021, clustered in the historic Northeast/Paseo Gateway, Central City, Blue River Valley, Swope Park, and Martin City areas, as well as opportunity zones in Wyandotte County.

“This really is one of those unique situations where investors can achieve both the personal financial benefits of a traditional investment, as well as the broader community benefits typically associated with philanthropy,” said Emily Lecuyer, managing director of equity2 and director of impact investments for AltCap.

“We’re excited to work with such a strong institution and to onboard additional partners to make a meaningful and sustained impact in our community.”

equity2 was launched by AltCap in 2019, joining the community development financial institution’s fold of programs and resources that has given entrepreneurs access to $250 million in new markets tax credits and $21 million in small business financing since 2005.

The equity2 Impact Fund is open to accredited investors and accepts qualifying capital gains for opportunity zone tax benefits.

Click here to learn more about the equity2 Impact Fund.

Featured Business

2020 Startups to Watch

stats here

Related Posts on Startland News

Innovation versus inclusive prosperity: Can hub developers create both in Kansas City?

Place and prosperity go hand-in-hand, said William Dowdell. Less clear, however, is how developers and communities will strike a balance in their efforts to generate innovation and wealth in Kansas City. “Geography is a big part of this. When we talk about expanding opportunity and bringing innovation, we also have to look at those spaces…

Rightfully Sewn awarded first government grant to expand workforce development effort

A $25,000 grant from the U.S. Small Business Administration is expected to help push Rightfully Sewn closer to its goal of community impact through seamstress training. The Crossroads-based venture — with its glimmering atelier focused on economic development via the fashion industry — was among 12 winners of the SBA’s Makerspace Training, Collaboration and Hiring…

With an athletic look and fit, North KC’s TiScrubs aims to be the ‘Nike of scrubs’

The endurance and durability of TiScrubs help give medical professionals servicing children the air of an athlete stepping onto the field, said Natalie Busch. Founder of the North Kansas City startup, Busch saw the need for updated medical wear when working Team Smile, a nonprofit run by her husband, Bill, which partners with sports teams…

KCRise Fund launches second fund; first investments in backstitch, Bungii, Daupler

KCRise Fund today announced the launch of its second fund — KCRise Fund II — along with three new investments in high-growth, early-stage Kansas City tech companies. Backstitch, Bungii and Daupler are the latest startups to join the KCRise Fund family, and the first three portfolio companies for the new fund. All three are featured…