$1M investment in new impact fund to boost minority and women-owned ventures in KC

December 8, 2020 | Startland News Staff

A $1 million cash injection from The Sunderland Foundation will further efforts to bolster the only impact-oriented, opportunity zone fund focused entirely on Kansas City.

What is equity2?

equity2 is a mission driven impact investment firm committed to deploying capital in inclusive and equitable ways. Formed by AltCap in 2019, equity2 is building on a strong track record of deploying capital in Kansas City’s distressed communities.

equity2 Partners announced the investment Tuesday, marking a significant milestone for the mission driven impact investment firm which has committed to deploying capital in inclusive and equitable ways — especially amid the COVID-19 pandemic — through its equity2 Impact Fund.

“The launch of this new fund could not be more timely. Now more than ever it is important that we invest hometown capital in innovative ways to accelerate financing for underserved businesses,” Randy Vance, president and COO of The Sunderland Foundation, said in a release citing the funds ability to build real equity in Kansas City by further elevating and backing the work of minority and women-owned ventures.

“We know this investment is going to create a stronger and more inclusive regional economy,” he added.

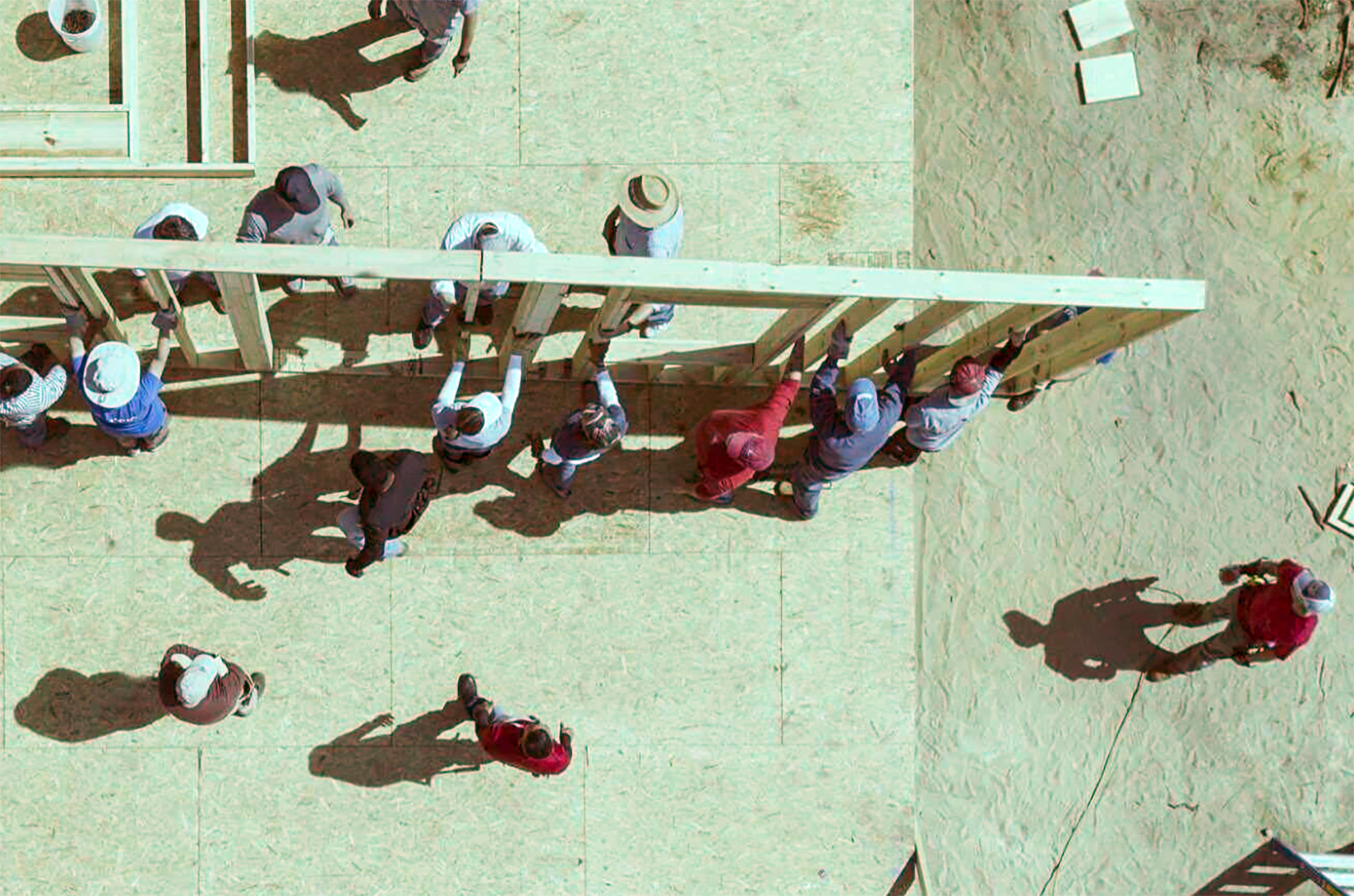

Contributions from the fund are expected to fuel community-focused real estate projects, affordable housing needs, and quality, sought-after and accessible job creation, equity2 said.

Such investments are set to begin in the first quarter of 2021, clustered in the historic Northeast/Paseo Gateway, Central City, Blue River Valley, Swope Park, and Martin City areas, as well as opportunity zones in Wyandotte County.

“This really is one of those unique situations where investors can achieve both the personal financial benefits of a traditional investment, as well as the broader community benefits typically associated with philanthropy,” said Emily Lecuyer, managing director of equity2 and director of impact investments for AltCap.

“We’re excited to work with such a strong institution and to onboard additional partners to make a meaningful and sustained impact in our community.”

equity2 was launched by AltCap in 2019, joining the community development financial institution’s fold of programs and resources that has given entrepreneurs access to $250 million in new markets tax credits and $21 million in small business financing since 2005.

The equity2 Impact Fund is open to accredited investors and accepts qualifying capital gains for opportunity zone tax benefits.

Click here to learn more about the equity2 Impact Fund.

Featured Business

2020 Startups to Watch

stats here

Related Posts on Startland News

Recipe for empathy: These students prepared hundreds of protein-packed, free meals for their food-insecure peers

High school students in the Kansas City area are doing their part to stamp out food insecurity one recipe at a time, Tamara Weber shared. Kids Feeding Kids — a sister program of Pete’s Garden, both founded by Weber — partners with high school FACS and CTE culinary classes to teach students about critical topics…

PopBookings rallies as KC startup looks for its own key hires: ‘We’re back in a big, big way’

After dialing back its event staffing platform’s operations during the pandemic, Kansas City-grown PopBookings is back online in the Midwest — ramping up hiring as it works toward a Series A funding round by year’s end. “Kansas City has a real nurturing feel to it. And this community is why I believe we’ll have our…

$11M renovation in the works for historic hub of Black entrepreneurship; project ties into 18th Street pedestrian mall plans

Editor’s note: The following story was originally published by AltCap, an ally to underestimated entrepreneurs that offers financing to businesses and communities that traditional lenders do not serve. For more than one hundred years, the Lincoln Building has served as a cornerstone of commerce and community in the 18th and Vine district. The historic district —…

MTC’s spring $1.4M investment cycle loops Facility Ally, DevStride into equity deals

Two Kansas City startups are among a handful of Missouri companies receiving a collective $1.4 million in investment allocations through a state-sponsored venture capital program. Facility Ally, led by serial entrepreneur Luke Wade; and DevStride, co-founded by Phil Reynolds, Chastin Reynolds, Aaron Saloff and Kujtim Hoxha; must now complete the Missouri Technology Corporation’s due diligence process…