$1M investment in new impact fund to boost minority and women-owned ventures in KC

December 8, 2020 | Startland News Staff

A $1 million cash injection from The Sunderland Foundation will further efforts to bolster the only impact-oriented, opportunity zone fund focused entirely on Kansas City.

What is equity2?

equity2 is a mission driven impact investment firm committed to deploying capital in inclusive and equitable ways. Formed by AltCap in 2019, equity2 is building on a strong track record of deploying capital in Kansas City’s distressed communities.

equity2 Partners announced the investment Tuesday, marking a significant milestone for the mission driven impact investment firm which has committed to deploying capital in inclusive and equitable ways — especially amid the COVID-19 pandemic — through its equity2 Impact Fund.

“The launch of this new fund could not be more timely. Now more than ever it is important that we invest hometown capital in innovative ways to accelerate financing for underserved businesses,” Randy Vance, president and COO of The Sunderland Foundation, said in a release citing the funds ability to build real equity in Kansas City by further elevating and backing the work of minority and women-owned ventures.

“We know this investment is going to create a stronger and more inclusive regional economy,” he added.

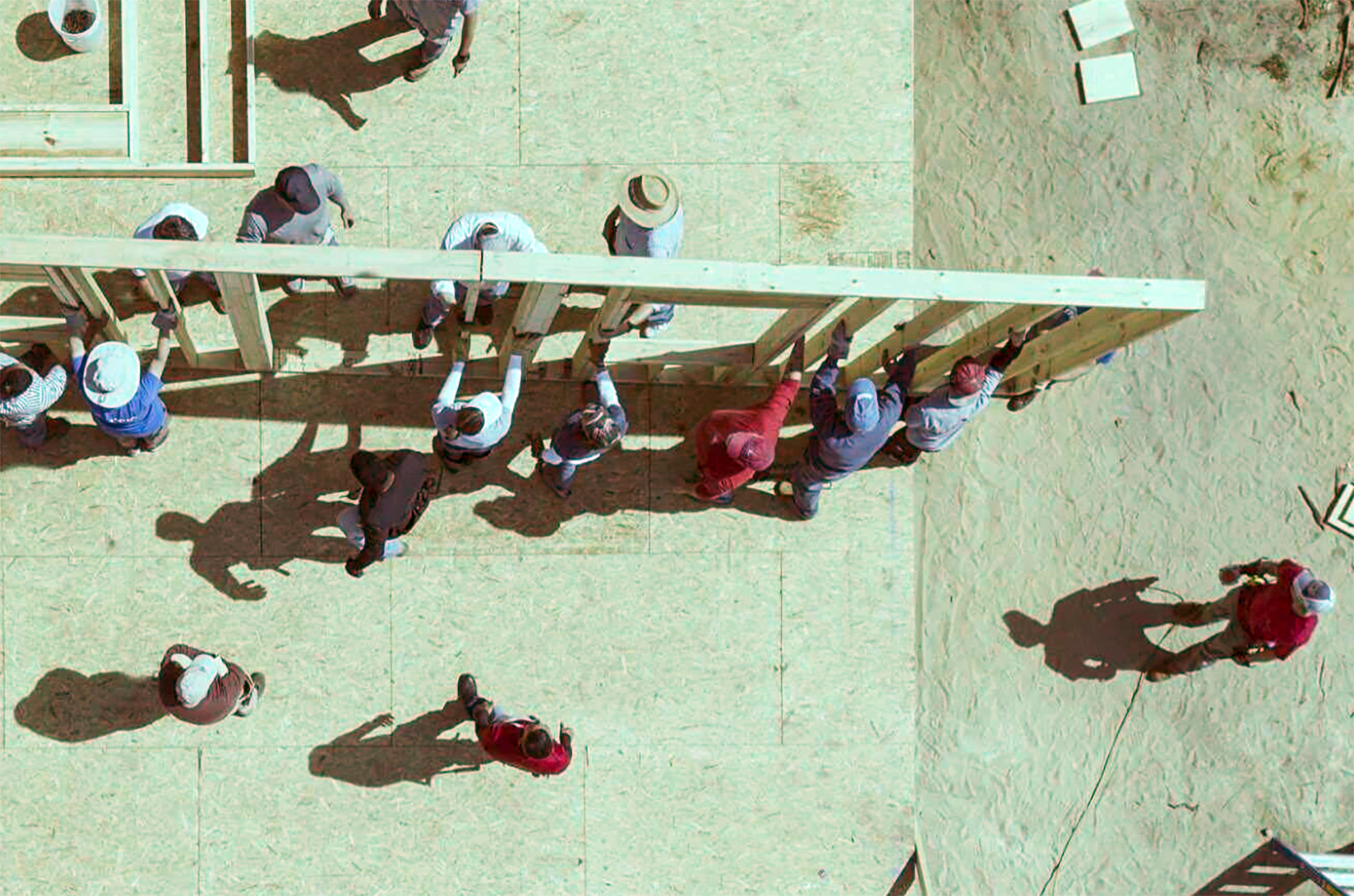

Contributions from the fund are expected to fuel community-focused real estate projects, affordable housing needs, and quality, sought-after and accessible job creation, equity2 said.

Such investments are set to begin in the first quarter of 2021, clustered in the historic Northeast/Paseo Gateway, Central City, Blue River Valley, Swope Park, and Martin City areas, as well as opportunity zones in Wyandotte County.

“This really is one of those unique situations where investors can achieve both the personal financial benefits of a traditional investment, as well as the broader community benefits typically associated with philanthropy,” said Emily Lecuyer, managing director of equity2 and director of impact investments for AltCap.

“We’re excited to work with such a strong institution and to onboard additional partners to make a meaningful and sustained impact in our community.”

equity2 was launched by AltCap in 2019, joining the community development financial institution’s fold of programs and resources that has given entrepreneurs access to $250 million in new markets tax credits and $21 million in small business financing since 2005.

The equity2 Impact Fund is open to accredited investors and accepts qualifying capital gains for opportunity zone tax benefits.

Click here to learn more about the equity2 Impact Fund.

Featured Business

2020 Startups to Watch

stats here

Related Posts on Startland News

Events Preview: SEMPO Cities, IoT Launch

There are a boatload of entrepreneurial events hosted in Kansas City on a weekly basis. Whether you’re an entrepreneur, investor, supporter or curious Kansas Citian, we’d recommend these upcoming events for you. WEEKLY EVENT PREVIEW SEMPO Cities Kansas City When: October 29 @ 12:00 pm – 7:00 pm Where: Sprint Accelerator We’re excited to announce that…

High-profile judges for Kauffman contest includes Marcelo Claure, VCs

A star-studded lineup of businesspeople from around the nation will be judging 15 startups in the Kauffman Foundation’s One in a Million pitch contest. The competition, which will take place on Nov. 17 and 18 during Global Entrepreneurship Week, will award $10,000 to one startup that previously participated in the foundation’s 1 Million Cups program. Those evaluating…

5 takeaways from Midwest tech investment report

Lead Bank and investment research firm CB Insights recently analyzed the Midwest tech investing scene and distilled their findings into a report. The nearly 40-page report looks at investment trends, performance, major players and more. Here are five takeaways from the report. 1) The Midwest accounted for a small piece of the national tech investment…

As the Royals roll, this KC tech startup wants to develop its future pitchers

A local startup hopes to cultivate the next Wade Davis or Yordano Ventura with the help of its pitching technology. In early 2015, Kansas City-based Precise Play launched its digital pitch analyzer, which the company is selling to baseball academies, schools and private leagues. Precise Play founder Victor Villarreal said that his machine has been…