$1M investment in new impact fund to boost minority and women-owned ventures in KC

December 8, 2020 | Startland News Staff

A $1 million cash injection from The Sunderland Foundation will further efforts to bolster the only impact-oriented, opportunity zone fund focused entirely on Kansas City.

What is equity2?

equity2 is a mission driven impact investment firm committed to deploying capital in inclusive and equitable ways. Formed by AltCap in 2019, equity2 is building on a strong track record of deploying capital in Kansas City’s distressed communities.

equity2 Partners announced the investment Tuesday, marking a significant milestone for the mission driven impact investment firm which has committed to deploying capital in inclusive and equitable ways — especially amid the COVID-19 pandemic — through its equity2 Impact Fund.

“The launch of this new fund could not be more timely. Now more than ever it is important that we invest hometown capital in innovative ways to accelerate financing for underserved businesses,” Randy Vance, president and COO of The Sunderland Foundation, said in a release citing the funds ability to build real equity in Kansas City by further elevating and backing the work of minority and women-owned ventures.

“We know this investment is going to create a stronger and more inclusive regional economy,” he added.

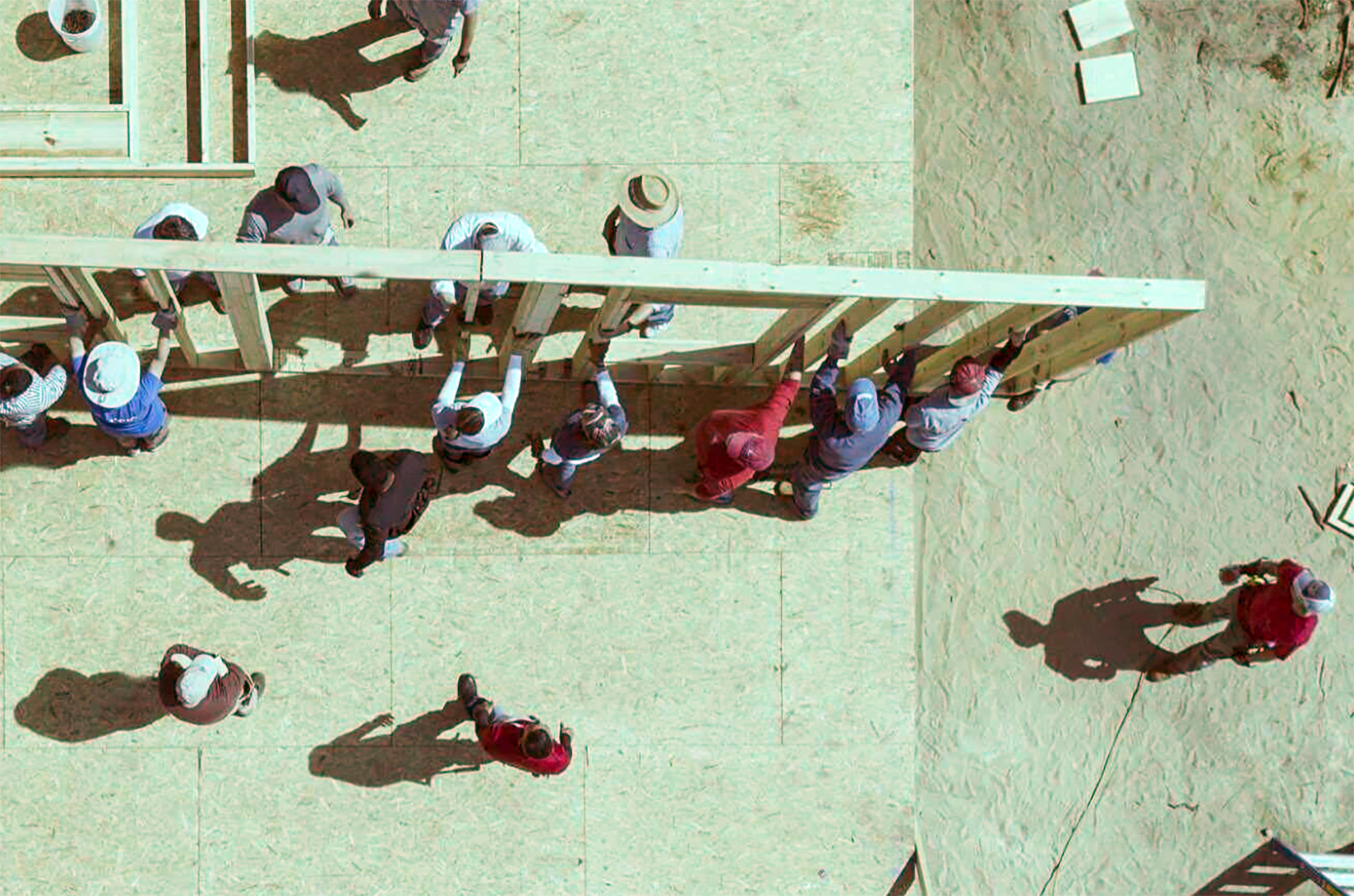

Contributions from the fund are expected to fuel community-focused real estate projects, affordable housing needs, and quality, sought-after and accessible job creation, equity2 said.

Such investments are set to begin in the first quarter of 2021, clustered in the historic Northeast/Paseo Gateway, Central City, Blue River Valley, Swope Park, and Martin City areas, as well as opportunity zones in Wyandotte County.

“This really is one of those unique situations where investors can achieve both the personal financial benefits of a traditional investment, as well as the broader community benefits typically associated with philanthropy,” said Emily Lecuyer, managing director of equity2 and director of impact investments for AltCap.

“We’re excited to work with such a strong institution and to onboard additional partners to make a meaningful and sustained impact in our community.”

equity2 was launched by AltCap in 2019, joining the community development financial institution’s fold of programs and resources that has given entrepreneurs access to $250 million in new markets tax credits and $21 million in small business financing since 2005.

The equity2 Impact Fund is open to accredited investors and accepts qualifying capital gains for opportunity zone tax benefits.

Click here to learn more about the equity2 Impact Fund.

Featured Business

2020 Startups to Watch

stats here

Related Posts on Startland News

Forbes report: Kansas City is a top 5 metro for high-wage jobs

Kansas City is atop yet another national list touting its economic vibrancy. Forbes recently released a report analyzing U.S. cities that create the most high-wage jobs, and Kansas City earned the No. 2 spot. The magazine said the City of Fountains’ low taxes and pro-business regulatory environment helped launch it into the top five cities…

Kansas City legal startup returns with WeWork award, $18K

A co-founder of Kansas City-based Venture Legal is departing from Austin, Texas, on Wednesday with a little more coin in his pocket. Chris Brown traveled to Austin to pitch his company Venture Legal as a finalist for WeWork’s Creator Awards’ South Regional on Tuesday and delivered the winning video pitch in the “Incubate” category. Beating…

Revamped Sprint Accelerator graduates its first cohort of agriculture, digital tech startups

Now in its fourth year, the Sprint Accelerator on Tuesday held a demo day showcasing the seven companies in its 2017 cohort that recently graduated its program. The cohort represents the first graduating class for the corporate partnership-based accelerator program since it parted ways with Techstars, with which it conducted three years of programming. Thanks…

Steve Case to KC entrepreneurs, investors: You can’t sit back now

To nudge more Kansas Citians off of the sidelines and into its budding entrepreneurial ecosystem, former AOL founder Steve Case spoke Friday to a group of local investors at a luncheon. KCRise Fund managing director Darcy Howe hosted a fireside chat with Case for a crowd of investors, potential investors and entrepreneurs. Case told the…