Startup veterans hope to save community banks from fintech ‘feeding frenzy’

November 3, 2020 | Austin Barnes

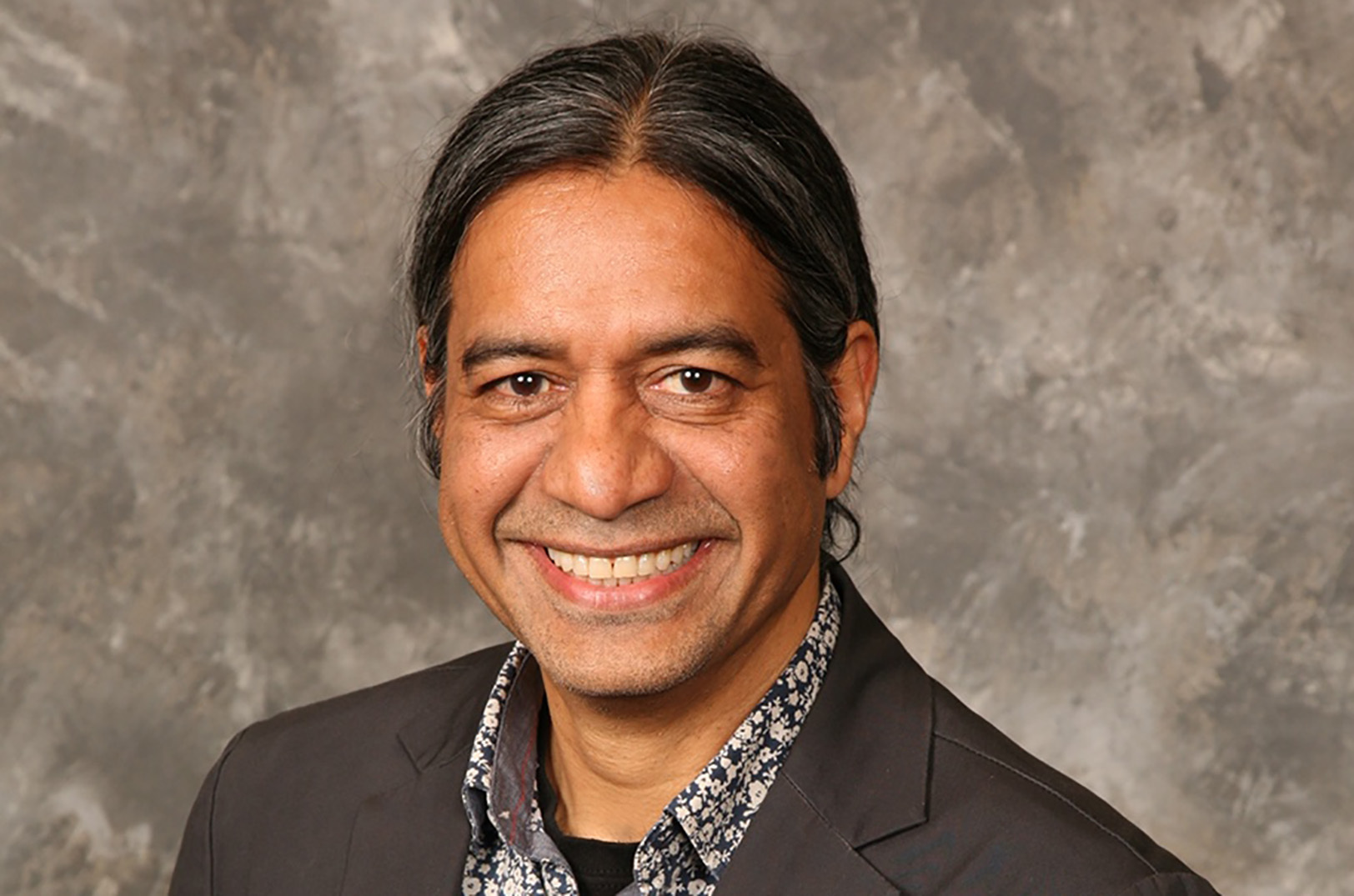

The future of small business lending has arrived — and it’s being built by a team of Kansas City tech veterans, at a critical time for the industry, said Hugh Khan.

“Small financial institutions are dying; they’re going away. Since the Great Recession, 40 percent are gone,” added Khan, founder and principal of Highploom.

“They’re not big enough to afford tech and [when big banks offer competitive services] their only way out is to get acquired or be replaced. … It’s a $27 trillion space. There’s a feeding frenzy of transformation that’s occurring.”

The newly launched fintech startup — more than two-years in the making and inspired by Khan’s 30-year career in tech — hopes to curb the dominance of big banking, designed to help local operations stay afloat with its affordable digital platform that overhauls the lending process through automation and digitization, Khan explained.

Click here to learn more about Highploom and how it works.

“If you have local customers, you have to engage with them digitally. Customers want the convenience of digital, but also want a physical presence,” he said of industry trends, known to double revenue when executed correctly.

Customer engagement has proven itself to be a common blindspot for banks, Khan added, detailing the importance of the Highploom platform and why it could prove to be transformative for the industry.

“Our technology enables financial institutions to serve their customers at scale across all product lines — in a highly curated, bespoke fashion — meaning we can, within seconds, create a customer portal that is a banker’s first point of contact,” Khan said, noting he, his brother, and co-founder Clayton Richardson have invested more than $1 million of their own money to get Highploom off the ground.

“We own all of our patents and all of our technology. We’re not partnering or using anything else, so we can provide technology to financial institutions at a much better rate and [they can] actually leapfrog the big banks with this technology,” he said.

Despite impressive resumes for both Khan and Richardson, Highploom hasn’t been realized without community support, Khan noted.

The startup took part in the Spencer Fane-backed STARTUP Lab, which helped its founders further realize the company as it took on customers.

“When the opportunity came to actually partner with them, we were at the right time and the right stage to get really superior legal help and also strategic help,” he said.

Click here to read more about the Kansas City law firm’s STARTUP Lab and its impact on another startup — Helix Health.

“They’re in the space and they know a lot of customers. The feedback on our strategy and the plan and the space that we got from them and are getting from them is invaluable.”

Leaning on his experience at such companies as Perceptive Software and an early iteration of Cerner, Khan said, perfecting the platform in private was key to rolling out the startup in a way that would deliver immediate benefit to customers — not just talk or empty promises of unrealized solutions.

“I wanted to figure out how we could look at the biggest problem that small businesses have, which is access to capital. Small financial [and] community institutions do a lot of relationship lending,” he explained.

“That’s the ecosystem I wanted to help. When digital currencies — which, of course, are our future — when they become relevant and more embedded in our regulatory and economic system, we could [help] transition some of the smaller financial institutions,” Khan said.

As the company comes online publicly, timing is everything, Khan said, noting the impacts of the COVID-19 pandemic on small banks and the crucial role they play in helping small businesses and communities navigate rough waters.

“We spent over a million dollars building this thing [at the time] without a customer — which is crazy and high risk; it’s not what everybody would do,” he said. “But fortunately I was in a position to take that risk. So now we have the basic system, how can we help solve the problem?”

Featured Business

2020 Startups to Watch

stats here

Related Posts on Startland News

Ag tech startup Farmobile raises $18M round for global expansion

Ag tech company Farmobile has reaped a substantial Series B funding round that positions the firm to rapidly accelerate across the world. The Overland Park-based company announced Friday that it raised $18.1 million to expand its data platform to help farmers mitigate risks and generate a revenue from the data they own. The round includes…

10-year-old Leawood inventor in the running for $250K

Kansas City entrepreneurs are known for their Midwestern hospitality, collaborative nature and humility. And each of those traits are expressed by 10-year-old inventor Julia Luetje of Leawood, whose entrepreneurial spirit is now on the national stage as part of a Frito-Lay’s Dreamvention competition. “I invented the Storm Sleeper because I used to be afraid of…

Face it: Zoloz tech lets you to pay with a smile

With a recently revealed new brand and broader strategic focus, Kansas City-based Zoloz is expanding its biometrics security offerings to include another unique human attribute: a user’s face. Formerly known as EyeVerify, Zoloz unveiled three new products — Zoloz Connect, Real ID and Smile — that CEO Toby Rush said will ensure trust and security…

Minddrive fuels youth development through hands-on STEM

Carlos Alonzo, a 15-year-old engineer at Minddrive, was always good at math. In the seventh grade, Alonzo’s teachers gave him the opportunity to skip ahead and take algebra. Although he enjoyed it and did well in the class, he ran into a problem: His school didn’t offer him an advanced class for eighth grade. That one-year…