Startup veterans hope to save community banks from fintech ‘feeding frenzy’

November 3, 2020 | Austin Barnes

The future of small business lending has arrived — and it’s being built by a team of Kansas City tech veterans, at a critical time for the industry, said Hugh Khan.

“Small financial institutions are dying; they’re going away. Since the Great Recession, 40 percent are gone,” added Khan, founder and principal of Highploom.

“They’re not big enough to afford tech and [when big banks offer competitive services] their only way out is to get acquired or be replaced. … It’s a $27 trillion space. There’s a feeding frenzy of transformation that’s occurring.”

The newly launched fintech startup — more than two-years in the making and inspired by Khan’s 30-year career in tech — hopes to curb the dominance of big banking, designed to help local operations stay afloat with its affordable digital platform that overhauls the lending process through automation and digitization, Khan explained.

Click here to learn more about Highploom and how it works.

“If you have local customers, you have to engage with them digitally. Customers want the convenience of digital, but also want a physical presence,” he said of industry trends, known to double revenue when executed correctly.

Customer engagement has proven itself to be a common blindspot for banks, Khan added, detailing the importance of the Highploom platform and why it could prove to be transformative for the industry.

“Our technology enables financial institutions to serve their customers at scale across all product lines — in a highly curated, bespoke fashion — meaning we can, within seconds, create a customer portal that is a banker’s first point of contact,” Khan said, noting he, his brother, and co-founder Clayton Richardson have invested more than $1 million of their own money to get Highploom off the ground.

“We own all of our patents and all of our technology. We’re not partnering or using anything else, so we can provide technology to financial institutions at a much better rate and [they can] actually leapfrog the big banks with this technology,” he said.

Despite impressive resumes for both Khan and Richardson, Highploom hasn’t been realized without community support, Khan noted.

The startup took part in the Spencer Fane-backed STARTUP Lab, which helped its founders further realize the company as it took on customers.

“When the opportunity came to actually partner with them, we were at the right time and the right stage to get really superior legal help and also strategic help,” he said.

Click here to read more about the Kansas City law firm’s STARTUP Lab and its impact on another startup — Helix Health.

“They’re in the space and they know a lot of customers. The feedback on our strategy and the plan and the space that we got from them and are getting from them is invaluable.”

Leaning on his experience at such companies as Perceptive Software and an early iteration of Cerner, Khan said, perfecting the platform in private was key to rolling out the startup in a way that would deliver immediate benefit to customers — not just talk or empty promises of unrealized solutions.

“I wanted to figure out how we could look at the biggest problem that small businesses have, which is access to capital. Small financial [and] community institutions do a lot of relationship lending,” he explained.

“That’s the ecosystem I wanted to help. When digital currencies — which, of course, are our future — when they become relevant and more embedded in our regulatory and economic system, we could [help] transition some of the smaller financial institutions,” Khan said.

As the company comes online publicly, timing is everything, Khan said, noting the impacts of the COVID-19 pandemic on small banks and the crucial role they play in helping small businesses and communities navigate rough waters.

“We spent over a million dollars building this thing [at the time] without a customer — which is crazy and high risk; it’s not what everybody would do,” he said. “But fortunately I was in a position to take that risk. So now we have the basic system, how can we help solve the problem?”

Featured Business

2020 Startups to Watch

stats here

Related Posts on Startland News

Mycroft hits crowdfunding goal in hours, raises $400K for Mark II

Mycroft’s Mark II crowdfunding campaign raised eight times its goal — and the tech firm is still counting. The Kansas City-based startup set out to raise $50,000 on Kickstarter and garner support from early adopters for its voice assistant product Mark II — similar to Amazon’s Alexa, Apple’s Siri or Microsoft’s Cortana. Mycroft “blew through”…

Negro leagues’ only three women players inspire ‘Beauty of the Game’ by KC designer Cherry

Toni Stone, Connie Morgan and Mamie Johnson — the only three women to play in the Negro baseball leagues — remain an inspiration to female entrepreneurs in male-dominated industries some 50 years later, said Thalia Cherry. “It’s still important for us to carve out a great space for ourselves, a great niche, and do the…

Ranking: KC defies gender pay gap, again earns No. 2 for Women in Tech

Second only to Washington, D.C., in a new national ranking, Kansas City boasts a noteworthy statistic: Women in tech jobs are paid, on average, 2 percent more than their male counterparts. It’s the fourth consecutive year Kansas City has earned a No. 2 on the list of the Best Cities for Women in Tech. But…

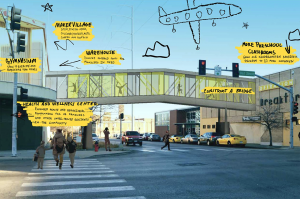

Operation Breakthrough expansion helps give every child a chance, Mayor Sly James says

It’s the beginning of a new chapter for Operation Breakthrough, said Kansas City Mayor Sly James. The mayor joined a packed crowd of supporters on an icy Thursday morning to share the Kansas City-based organization’s formal announcement of its $17 million capital campaign and expansion project. The effort — dubbed “Big Dreams, Bright Futures” —…