UMKC, Kauffman launch $100K resiliency grant fund for minority-owned businesses hit by COVID

August 5, 2020 | Startland News Staff

Editor’s note: The Ewing Marion Kauffman Foundation is a financial sponsor of Startland News. This report was produced independently by Startland News’ nonprofit newsroom.

A new $100,000 fund is expected to help minority-owned Kansas City businesses — left out of initial rounds of COVID-19 relief — to build resiliency and come back stronger as the pandemic persists.

“COVID-19 has negatively impacted our entire small business community. However, entrepreneurs of color haven’t been able to access disaster financing and relief funding at the same rate as other business owners,” read an announcement of the Kansas City Minority Business Resiliency Grant.

The fund is expected to award up to $5,000 to at least 20 racial/ethnic minority-owned businesses. The grants are funded by the Ewing Marion Kauffman Foundation and administered by the UMKC Innovation Center in partnership with local financial institutions.

Applications for the fund open noon Monday, Aug. 17. Click here for application details.

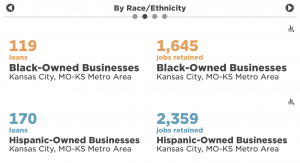

A report produced in June by mySidewalk on behalf of the Kauffman Foundation emphasized the COVID-19 relief gap, specifically examining Paycheck Protection Program recipients. Of the 32,705 loans given to Kansas City businesses, only 119 were awarded to Black-owned businesses and 170 to Hispanic-owned businesses, according to the mySidewalk data.

Click here to review mySidewalk’s PPP findings.

Only businesses that are majority owned by racial/ethnic minority entrepreneurs, as defined by federal regulations, are eligible for the Kansas City Minority Business Resiliency Grant. Click here for guidelines on groups designated as socially disadvantaged.

Eligibility also is based on a business’ location with the Kansas City Metropolitan Statistical Area; documented sales in 2019 that don’t exceed $250,000; negative impact from COVID-19; and no ongoing or previous relationship with the UMKC Innovation Center, UMB Bank, Bank of Blue Valley, Alt-Cap, Bank of Labor, Central Bank of the Midwest or the Kauffman Foundation.

Click here for more information on eligibility and application guidelines.

Recipients can use the funds to help them reopen their businesses, buy supplies to keep their customers and employees safe, open an online shop or channel for their businesses, organize their back office, and otherwise build future resiliency, according to UMKC’s Innovation Center.

Grant awardees will have zero financial repayment — the funds are not a loan — but they will be expected to report on how the funds impacted their businesses. Those results will help incent future financial support for similar grant projects, administrators of the fund said.

Featured Business

2020 Startups to Watch

stats here

Related Posts on Startland News

Nickel & Suede couple create their hook with style, influence and fast-selling leather earrings

Feeling is believing, said Kilee Nickels, the fashion inspiration behind Nickel & Suede. “You may not remember you’re wearing our earrings until someone compliments you,” she said of the light-weight, leather statement accessories that earned the business she co-founded a top spot on Inc. 5000’s 2018 fastest-growing companies list. Based in Liberty, the company boasted…

Culture Lab to Fountain City Fintech startups: Before you hire, define your culture

Bringing Culture Lab programming to the Fountain City Fintech accelerator’s inaugural cohort is part of a deeper effort to call attention to workplace culture in Kansas City, said Frank Keck. “We’ve been able to help each of these six cohort companies really define who they are, why are they doing what they’re doing, and help…

Investors deal BacklotCars $8M; KC-based startup hitting the gas on disruption

Disrupting the used car space has driven a Series A funding round to $8 million for Kansas City-based startup BacklotCars, the company announced Tuesday. “This investment comes at a great time. We are growing rapidly in our existing markets and expanding our national footprint. We expect to continue to add new features – to accompany…

ebbie navigates journey from established insurance industry to tech startup mode

Olathe-based ebbie is injecting innovation into the risk-averse insurance industry, said Brian Hess. “We looked for spaces where we could come in and say, ‘We can make this a lot better,’” said Hess, operations officer at ebbie. “Fast forward to now, and we went through the development phase and the build, and we have successfully…