UMKC, Kauffman launch $100K resiliency grant fund for minority-owned businesses hit by COVID

August 5, 2020 | Startland News Staff

Editor’s note: The Ewing Marion Kauffman Foundation is a financial sponsor of Startland News. This report was produced independently by Startland News’ nonprofit newsroom.

A new $100,000 fund is expected to help minority-owned Kansas City businesses — left out of initial rounds of COVID-19 relief — to build resiliency and come back stronger as the pandemic persists.

“COVID-19 has negatively impacted our entire small business community. However, entrepreneurs of color haven’t been able to access disaster financing and relief funding at the same rate as other business owners,” read an announcement of the Kansas City Minority Business Resiliency Grant.

The fund is expected to award up to $5,000 to at least 20 racial/ethnic minority-owned businesses. The grants are funded by the Ewing Marion Kauffman Foundation and administered by the UMKC Innovation Center in partnership with local financial institutions.

Applications for the fund open noon Monday, Aug. 17. Click here for application details.

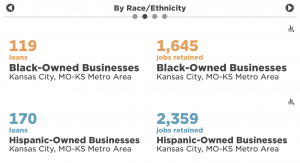

A report produced in June by mySidewalk on behalf of the Kauffman Foundation emphasized the COVID-19 relief gap, specifically examining Paycheck Protection Program recipients. Of the 32,705 loans given to Kansas City businesses, only 119 were awarded to Black-owned businesses and 170 to Hispanic-owned businesses, according to the mySidewalk data.

Click here to review mySidewalk’s PPP findings.

Only businesses that are majority owned by racial/ethnic minority entrepreneurs, as defined by federal regulations, are eligible for the Kansas City Minority Business Resiliency Grant. Click here for guidelines on groups designated as socially disadvantaged.

Eligibility also is based on a business’ location with the Kansas City Metropolitan Statistical Area; documented sales in 2019 that don’t exceed $250,000; negative impact from COVID-19; and no ongoing or previous relationship with the UMKC Innovation Center, UMB Bank, Bank of Blue Valley, Alt-Cap, Bank of Labor, Central Bank of the Midwest or the Kauffman Foundation.

Click here for more information on eligibility and application guidelines.

Recipients can use the funds to help them reopen their businesses, buy supplies to keep their customers and employees safe, open an online shop or channel for their businesses, organize their back office, and otherwise build future resiliency, according to UMKC’s Innovation Center.

Grant awardees will have zero financial repayment — the funds are not a loan — but they will be expected to report on how the funds impacted their businesses. Those results will help incent future financial support for similar grant projects, administrators of the fund said.

Featured Business

2020 Startups to Watch

stats here

Related Posts on Startland News

Missouri governor signs bill to end KC ‘border war,’ awaits Kansas response

Missouri Gov. Mike Parson signed a bill Tuesday placing restrictions on tax incentives offered to businesses moving from certain counties in Kansas to Missouri. The bill represents a step toward ending the economic development “border war” between the two states. “This is really about being competitive with real competitors,” said Parson, who was in Kansas…

Wave’s $405M acquisition a move toward ‘bigger, bolder, faster’ H&R Block, CEO says

The $405 million acquisition of Wave Financial wasn’t about H&R Block’s image — it was a move to join like-minded companies in the trenches of innovation, no matter the weight either surging business holds, said Jeff Jones. “We knew strategically that industry makes Wave a fit with H&R Block, and then it was a matter…

Into the weeds: Your corner CBD store might’ve just lost its bank thanks to a slow-to-innovate industry

Banking as a mom-and-pop CBD shop can be treacherous, said Kyle Steppe. “Our first week in business, our bank shut us down and liquidated all of our assets,” said Steppe, who operates KC Hemp Co. with his wife, Heather. Their downtown Overland Park storefront is one of many independent, regional CBD sites suffering from the…

Crowdfunding sites won’t pay your medical bills, Sickweather CEO says, launching reciprocating donation platform

Crowdfunding can help, but such tactics are unlikely to cover the medical bills of a person struggling with mounting healthcare costs, Graham Dodge said. “The unrealistic amount of self promotion needed to reach people outside your own personal network — which can happen if the media picks up on your story — is the main…