UMKC, Kauffman launch $100K resiliency grant fund for minority-owned businesses hit by COVID

August 5, 2020 | Startland News Staff

Editor’s note: The Ewing Marion Kauffman Foundation is a financial sponsor of Startland News. This report was produced independently by Startland News’ nonprofit newsroom.

A new $100,000 fund is expected to help minority-owned Kansas City businesses — left out of initial rounds of COVID-19 relief — to build resiliency and come back stronger as the pandemic persists.

“COVID-19 has negatively impacted our entire small business community. However, entrepreneurs of color haven’t been able to access disaster financing and relief funding at the same rate as other business owners,” read an announcement of the Kansas City Minority Business Resiliency Grant.

The fund is expected to award up to $5,000 to at least 20 racial/ethnic minority-owned businesses. The grants are funded by the Ewing Marion Kauffman Foundation and administered by the UMKC Innovation Center in partnership with local financial institutions.

Applications for the fund open noon Monday, Aug. 17. Click here for application details.

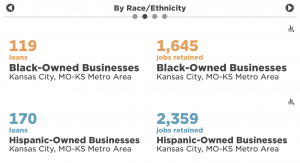

A report produced in June by mySidewalk on behalf of the Kauffman Foundation emphasized the COVID-19 relief gap, specifically examining Paycheck Protection Program recipients. Of the 32,705 loans given to Kansas City businesses, only 119 were awarded to Black-owned businesses and 170 to Hispanic-owned businesses, according to the mySidewalk data.

Click here to review mySidewalk’s PPP findings.

Only businesses that are majority owned by racial/ethnic minority entrepreneurs, as defined by federal regulations, are eligible for the Kansas City Minority Business Resiliency Grant. Click here for guidelines on groups designated as socially disadvantaged.

Eligibility also is based on a business’ location with the Kansas City Metropolitan Statistical Area; documented sales in 2019 that don’t exceed $250,000; negative impact from COVID-19; and no ongoing or previous relationship with the UMKC Innovation Center, UMB Bank, Bank of Blue Valley, Alt-Cap, Bank of Labor, Central Bank of the Midwest or the Kauffman Foundation.

Click here for more information on eligibility and application guidelines.

Recipients can use the funds to help them reopen their businesses, buy supplies to keep their customers and employees safe, open an online shop or channel for their businesses, organize their back office, and otherwise build future resiliency, according to UMKC’s Innovation Center.

Grant awardees will have zero financial repayment — the funds are not a loan — but they will be expected to report on how the funds impacted their businesses. Those results will help incent future financial support for similar grant projects, administrators of the fund said.

Featured Business

2020 Startups to Watch

stats here

Related Posts on Startland News

Village veteran SquareOffs launches long-awaited social opinion site, tops $2M+ in funding

SquareOffs hopes its new consumer-facing destination website — showcasing interactive “microdebates” aggregated across a growing network of publishers and influencers — moves digital conversations back to civility. A fresh round of funding will help, said Jeff Rohr. “We are all tired of the toxicity that fills our social media feeds and dominates comments at the bottom…

Startup Road Trip: Huck Adventures goes west, using AI to turn outdoors into a social setting

Startland News’ Startup Road Trip series explores innovative and uncommon ideas finding success in rural America and Midwestern startup hubs outside the Kansas City metro. This series is possible thanks to the Ewing Marion Kauffman Foundation, which leads a collaborative, nationwide effort to identify and remove large and small barriers to new business creation. BOULDER,…

Pivoting back to a full-time franchise hustle: ‘Worst thing you can do is stop,’ Yogurtini owner says

Running a franchise can require as much passion and perseverance as any other entrepreneurial endeavor — including those in the startup space, said Isaac Collins. Would-be business owners shouldn’t get caught up in the jargon of what is and isn’t “real” hustle when trying to craft a livelihood for themselves or their families, he said. A…