UMKC, Kauffman launch $100K resiliency grant fund for minority-owned businesses hit by COVID

August 5, 2020 | Startland News Staff

Editor’s note: The Ewing Marion Kauffman Foundation is a financial sponsor of Startland News. This report was produced independently by Startland News’ nonprofit newsroom.

A new $100,000 fund is expected to help minority-owned Kansas City businesses — left out of initial rounds of COVID-19 relief — to build resiliency and come back stronger as the pandemic persists.

“COVID-19 has negatively impacted our entire small business community. However, entrepreneurs of color haven’t been able to access disaster financing and relief funding at the same rate as other business owners,” read an announcement of the Kansas City Minority Business Resiliency Grant.

The fund is expected to award up to $5,000 to at least 20 racial/ethnic minority-owned businesses. The grants are funded by the Ewing Marion Kauffman Foundation and administered by the UMKC Innovation Center in partnership with local financial institutions.

Applications for the fund open noon Monday, Aug. 17. Click here for application details.

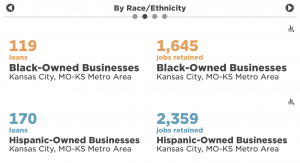

A report produced in June by mySidewalk on behalf of the Kauffman Foundation emphasized the COVID-19 relief gap, specifically examining Paycheck Protection Program recipients. Of the 32,705 loans given to Kansas City businesses, only 119 were awarded to Black-owned businesses and 170 to Hispanic-owned businesses, according to the mySidewalk data.

Click here to review mySidewalk’s PPP findings.

Only businesses that are majority owned by racial/ethnic minority entrepreneurs, as defined by federal regulations, are eligible for the Kansas City Minority Business Resiliency Grant. Click here for guidelines on groups designated as socially disadvantaged.

Eligibility also is based on a business’ location with the Kansas City Metropolitan Statistical Area; documented sales in 2019 that don’t exceed $250,000; negative impact from COVID-19; and no ongoing or previous relationship with the UMKC Innovation Center, UMB Bank, Bank of Blue Valley, Alt-Cap, Bank of Labor, Central Bank of the Midwest or the Kauffman Foundation.

Click here for more information on eligibility and application guidelines.

Recipients can use the funds to help them reopen their businesses, buy supplies to keep their customers and employees safe, open an online shop or channel for their businesses, organize their back office, and otherwise build future resiliency, according to UMKC’s Innovation Center.

Grant awardees will have zero financial repayment — the funds are not a loan — but they will be expected to report on how the funds impacted their businesses. Those results will help incent future financial support for similar grant projects, administrators of the fund said.

Featured Business

2020 Startups to Watch

stats here

Related Posts on Startland News

Show Me Capital: 6 key goals can help fill funding gaps for early-stage Missouri companies

Missouri is leaving millions of dollars on the table that could fuel early-stage startups, which create nearly 80 percent of net new jobs in the state. A new report from MOSourceLink, a program of the UMKC Innovation Center, reveals Missouri is lacking in alternative loans, access to resources, early-stage capital and locally activated venture capital.…

N-GAGE founder gets a grip on weight-lifting pain points (without giving up his day job)

N-GAGE GRIPS will have found success as a startup when Matt Leadbetter’s oldest son thinks he’s cool. “I remember thinking, ‘I have this thing in my head, I just need to make it,’ and I was kinda thinking at the time, ‘Wouldn’t it be cool if when my little boy gets older, he’s impressed with…

Digital Sandbox welcomes four new startups led by emerging, veteran KC founders

The latest round of founders joining Digital Sandbox KC includes relative newcomers to the startup scene alongside a Fountain City Fintech alum and a key player behind one of Kansas City’s biggest exits. The proof-of-concept program announced Friday the addition of four new companies for its fourth quarter: TripleBlind, led by Riddhiman Das, who made…

Are venture-seeking women, minority founders at an unfair disadvantage in KC?

Editor’s note: The following is the second in a series of analyses of Startland’s list of Kansas City’s Top Venture Capital-Backed Companies. On stage with a handful of men, Erin Papworth faced a dilemma. The founder of Nav.It — one of the startups to recently complete Fountain City Fintech’s second accelerator cohort — found herself fighting…