UMKC, Kauffman launch $100K resiliency grant fund for minority-owned businesses hit by COVID

August 5, 2020 | Startland News Staff

Editor’s note: The Ewing Marion Kauffman Foundation is a financial sponsor of Startland News. This report was produced independently by Startland News’ nonprofit newsroom.

[divide]

A new $100,000 fund is expected to help minority-owned Kansas City businesses — left out of initial rounds of COVID-19 relief — to build resiliency and come back stronger as the pandemic persists.

“COVID-19 has negatively impacted our entire small business community. However, entrepreneurs of color haven’t been able to access disaster financing and relief funding at the same rate as other business owners,” read an announcement of the Kansas City Minority Business Resiliency Grant.

The fund is expected to award up to $5,000 to at least 20 racial/ethnic minority-owned businesses. The grants are funded by the Ewing Marion Kauffman Foundation and administered by the UMKC Innovation Center in partnership with local financial institutions.

Applications for the fund open noon Monday, Aug. 17. Click here for application details.

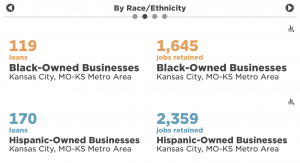

A report produced in June by mySidewalk on behalf of the Kauffman Foundation emphasized the COVID-19 relief gap, specifically examining Paycheck Protection Program recipients. Of the 32,705 loans given to Kansas City businesses, only 119 were awarded to Black-owned businesses and 170 to Hispanic-owned businesses, according to the mySidewalk data.

Click here to review mySidewalk’s PPP findings.

Only businesses that are majority owned by racial/ethnic minority entrepreneurs, as defined by federal regulations, are eligible for the Kansas City Minority Business Resiliency Grant. Click here for guidelines on groups designated as socially disadvantaged.

Eligibility also is based on a business’ location with the Kansas City Metropolitan Statistical Area; documented sales in 2019 that don’t exceed $250,000; negative impact from COVID-19; and no ongoing or previous relationship with the UMKC Innovation Center, UMB Bank, Bank of Blue Valley, Alt-Cap, Bank of Labor, Central Bank of the Midwest or the Kauffman Foundation.

Click here for more information on eligibility and application guidelines.

Recipients can use the funds to help them reopen their businesses, buy supplies to keep their customers and employees safe, open an online shop or channel for their businesses, organize their back office, and otherwise build future resiliency, according to UMKC’s Innovation Center.

Grant awardees will have zero financial repayment — the funds are not a loan — but they will be expected to report on how the funds impacted their businesses. Those results will help incent future financial support for similar grant projects, administrators of the fund said.

Featured Business

2020 Startups to Watch

stats here

Related Posts on Startland News

From the pitch to the Plaza: KC Current flipping the switch on new retail shop in iconic shopping district

Add team gear to the holiday shopping list this weekend. The Kansas City Current is kicking off a new permanent retail shop on the Country Club Plaza — just in time for the 2025 Plaza Lighting Ceremony. The Current Shop is set to open Wednesday, Nov. 26, in the former Starbucks building at 302 Nichols…

Kauffman wraps three fast-paced rounds of capacity building: Meet the year’s final grantees

A revised strategy to help nonprofit organizations strengthen their internal effectiveness and long-term stability — while still aligning with the Kauffman Foundation’s focus areas — next must showcase outcomes, said Allison Greenwood Bajracharya, announcing a final round of capacity building grant winners for 2025. Built with intentional versatility, capacity building grants are meant to meet…

Five stocking stuffer gift ideas that brew support for women-owned KC businesses

Editor’s note: The following holiday feature is presented by nbkc bank, where small businesses find big support [divide] Shopping with intention this season is just one way Kansas City gift-givers can squeeze local impact into each nook and cranny of those holiday stockings, said Melissa Eggleston, highlighting a sleigh-ful of women-owned businesses shoppers should bank…

Their brands survived legal bruises; here’s what still keeps these founders up at night

A brand worth building is worth safeguarding, said Bo Nelson, joining a chorus of battle-tested entrepreneurs at GEWKC who encouraged emerging business owners to trademark their own peace of mind early by locking down intellectual property — like designs, names and unique processes — from the start. “If you do have something that you genuinely,…