UMKC, Kauffman launch $100K resiliency grant fund for minority-owned businesses hit by COVID

August 5, 2020 | Startland News Staff

Editor’s note: The Ewing Marion Kauffman Foundation is a financial sponsor of Startland News. This report was produced independently by Startland News’ nonprofit newsroom.

[divide]

A new $100,000 fund is expected to help minority-owned Kansas City businesses — left out of initial rounds of COVID-19 relief — to build resiliency and come back stronger as the pandemic persists.

“COVID-19 has negatively impacted our entire small business community. However, entrepreneurs of color haven’t been able to access disaster financing and relief funding at the same rate as other business owners,” read an announcement of the Kansas City Minority Business Resiliency Grant.

The fund is expected to award up to $5,000 to at least 20 racial/ethnic minority-owned businesses. The grants are funded by the Ewing Marion Kauffman Foundation and administered by the UMKC Innovation Center in partnership with local financial institutions.

Applications for the fund open noon Monday, Aug. 17. Click here for application details.

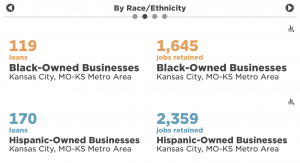

A report produced in June by mySidewalk on behalf of the Kauffman Foundation emphasized the COVID-19 relief gap, specifically examining Paycheck Protection Program recipients. Of the 32,705 loans given to Kansas City businesses, only 119 were awarded to Black-owned businesses and 170 to Hispanic-owned businesses, according to the mySidewalk data.

Click here to review mySidewalk’s PPP findings.

Only businesses that are majority owned by racial/ethnic minority entrepreneurs, as defined by federal regulations, are eligible for the Kansas City Minority Business Resiliency Grant. Click here for guidelines on groups designated as socially disadvantaged.

Eligibility also is based on a business’ location with the Kansas City Metropolitan Statistical Area; documented sales in 2019 that don’t exceed $250,000; negative impact from COVID-19; and no ongoing or previous relationship with the UMKC Innovation Center, UMB Bank, Bank of Blue Valley, Alt-Cap, Bank of Labor, Central Bank of the Midwest or the Kauffman Foundation.

Click here for more information on eligibility and application guidelines.

Recipients can use the funds to help them reopen their businesses, buy supplies to keep their customers and employees safe, open an online shop or channel for their businesses, organize their back office, and otherwise build future resiliency, according to UMKC’s Innovation Center.

Grant awardees will have zero financial repayment — the funds are not a loan — but they will be expected to report on how the funds impacted their businesses. Those results will help incent future financial support for similar grant projects, administrators of the fund said.

Featured Business

2020 Startups to Watch

stats here

Related Posts on Startland News

Tariffs are driving up costs for American coffee roasters: ‘We’ve never seen anything like this’

Editor’s note: The following story was published by Harvest Public Media and KCUR, Kansas City’s NPR member station, and a fellow member of the KC Media Collective. Click here to read the original story or here to sign up for KCUR’s email newsletter. [divide] Coffee has gotten a lot more expensive in the U.S. as tariffs seep into the price…

‘I absolutely refuse to fail’: Sweet Peaches founder battles for national spot in frozen dessert aisles

Editor’s note: This story was originally published by Kansas City PBS/Flatland, a member of the Kansas City Media Collective, which also includes Startland News, KCUR 89.3, American Public Square, The Kansas City Beacon, and Missouri Business Alert. Click here to read the original story. [divide] Denisha Jones is poised to turn America’s devotion to apple pie on…

Kiva KC brings zero-interest microloans to founders shut out of traditional capital

Editor’s note: The Economic Development Corporation of Kansas City (EDCKC) and KC BizCare are partners of Startland News. [divide] Kansas City is betting that a global microlending model — one built on $25 contributions and community belief in everyday entrepreneurs — can help close one of the city’s most stubborn gaps: early-stage capital for founders…

How this startup (and a KC sports icon) turned young players into card-carrying legends overnight

An Overland Park-based custom trading card company and a Kansas City soccer star are teaming up on the pitch with a goal to make youth sports fun again. Stat Legend — launched by Chris Cheatham and Nick Weaver in 2023 — created custom cards for all 250 players who suit up for the Captains Soccer…