UMKC, Kauffman launch $100K resiliency grant fund for minority-owned businesses hit by COVID

August 5, 2020 | Startland News Staff

Editor’s note: The Ewing Marion Kauffman Foundation is a financial sponsor of Startland News. This report was produced independently by Startland News’ nonprofit newsroom.

A new $100,000 fund is expected to help minority-owned Kansas City businesses — left out of initial rounds of COVID-19 relief — to build resiliency and come back stronger as the pandemic persists.

“COVID-19 has negatively impacted our entire small business community. However, entrepreneurs of color haven’t been able to access disaster financing and relief funding at the same rate as other business owners,” read an announcement of the Kansas City Minority Business Resiliency Grant.

The fund is expected to award up to $5,000 to at least 20 racial/ethnic minority-owned businesses. The grants are funded by the Ewing Marion Kauffman Foundation and administered by the UMKC Innovation Center in partnership with local financial institutions.

Applications for the fund open noon Monday, Aug. 17. Click here for application details.

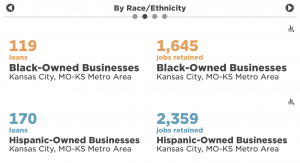

A report produced in June by mySidewalk on behalf of the Kauffman Foundation emphasized the COVID-19 relief gap, specifically examining Paycheck Protection Program recipients. Of the 32,705 loans given to Kansas City businesses, only 119 were awarded to Black-owned businesses and 170 to Hispanic-owned businesses, according to the mySidewalk data.

Click here to review mySidewalk’s PPP findings.

Only businesses that are majority owned by racial/ethnic minority entrepreneurs, as defined by federal regulations, are eligible for the Kansas City Minority Business Resiliency Grant. Click here for guidelines on groups designated as socially disadvantaged.

Eligibility also is based on a business’ location with the Kansas City Metropolitan Statistical Area; documented sales in 2019 that don’t exceed $250,000; negative impact from COVID-19; and no ongoing or previous relationship with the UMKC Innovation Center, UMB Bank, Bank of Blue Valley, Alt-Cap, Bank of Labor, Central Bank of the Midwest or the Kauffman Foundation.

Click here for more information on eligibility and application guidelines.

Recipients can use the funds to help them reopen their businesses, buy supplies to keep their customers and employees safe, open an online shop or channel for their businesses, organize their back office, and otherwise build future resiliency, according to UMKC’s Innovation Center.

Grant awardees will have zero financial repayment — the funds are not a loan — but they will be expected to report on how the funds impacted their businesses. Those results will help incent future financial support for similar grant projects, administrators of the fund said.

Featured Business

2020 Startups to Watch

stats here

Related Posts on Startland News

Amid success, the Kansas City Startup Village is shrinking

It’s Nov. 13, 2012, and Kansas City’s Spring Valley neighborhood is in a frenzy. TV vans line the streets near 4454 State Line Road, the first house to receive Google’s ultra fast Internet service in the Kansas City, Kan. neighborhood. Reporters jockey for access to a handful of entrepreneurs and techies that moved to area…

Why coastal investors ignore the Midwest and what’s next for federal startup policy

Here are this week’s watercooler conversation-starters on why inland states struggle to find funding, coming issues in federal entrepreneurship policy and the success of innovation districts that are cropping up around the U.S. (and in Kansas City). More in this series here. International Business Times: Finding venture capital far from the coasts Of the $48.3…

Ebb and flow: The Kansas City Startup Village by the numbers

Startland News created an infographic on the growth and shrinkage of the Kansas City Startup Village since its 2012 founding. Here’s a colorful interpretation of its ebb and flow, as presented by Startland’s Kat Hungerford. Read more about the KCSV’s history, successes and possible future here.

Shawnee passes tax measure to attract startups

A tax incentive program that aims to attract high-growth startups to the City of Shawnee unanimously passed a city vote, paving the way for firms to tap a variety of benefits to alleviate initial costs. The city council voted 8-0 on the “Startup Workforce Relocation and Expansion Program,” which aims to encourage job growth and…