UMKC, Kauffman launch $100K resiliency grant fund for minority-owned businesses hit by COVID

August 5, 2020 | Startland News Staff

Editor’s note: The Ewing Marion Kauffman Foundation is a financial sponsor of Startland News. This report was produced independently by Startland News’ nonprofit newsroom.

A new $100,000 fund is expected to help minority-owned Kansas City businesses — left out of initial rounds of COVID-19 relief — to build resiliency and come back stronger as the pandemic persists.

“COVID-19 has negatively impacted our entire small business community. However, entrepreneurs of color haven’t been able to access disaster financing and relief funding at the same rate as other business owners,” read an announcement of the Kansas City Minority Business Resiliency Grant.

The fund is expected to award up to $5,000 to at least 20 racial/ethnic minority-owned businesses. The grants are funded by the Ewing Marion Kauffman Foundation and administered by the UMKC Innovation Center in partnership with local financial institutions.

Applications for the fund open noon Monday, Aug. 17. Click here for application details.

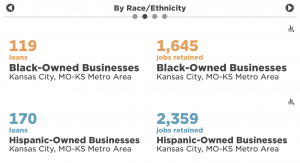

A report produced in June by mySidewalk on behalf of the Kauffman Foundation emphasized the COVID-19 relief gap, specifically examining Paycheck Protection Program recipients. Of the 32,705 loans given to Kansas City businesses, only 119 were awarded to Black-owned businesses and 170 to Hispanic-owned businesses, according to the mySidewalk data.

Click here to review mySidewalk’s PPP findings.

Only businesses that are majority owned by racial/ethnic minority entrepreneurs, as defined by federal regulations, are eligible for the Kansas City Minority Business Resiliency Grant. Click here for guidelines on groups designated as socially disadvantaged.

Eligibility also is based on a business’ location with the Kansas City Metropolitan Statistical Area; documented sales in 2019 that don’t exceed $250,000; negative impact from COVID-19; and no ongoing or previous relationship with the UMKC Innovation Center, UMB Bank, Bank of Blue Valley, Alt-Cap, Bank of Labor, Central Bank of the Midwest or the Kauffman Foundation.

Click here for more information on eligibility and application guidelines.

Recipients can use the funds to help them reopen their businesses, buy supplies to keep their customers and employees safe, open an online shop or channel for their businesses, organize their back office, and otherwise build future resiliency, according to UMKC’s Innovation Center.

Grant awardees will have zero financial repayment — the funds are not a loan — but they will be expected to report on how the funds impacted their businesses. Those results will help incent future financial support for similar grant projects, administrators of the fund said.

Featured Business

2020 Startups to Watch

stats here

Related Posts on Startland News

Kauffman Foundation dishes $840K to 8 area accelerators

The Ewing Marion Kauffman Foundation is hitting the gas on its support of area accelerator programs. As part of the 2016 KC Accelerator Challenge, the Kauffman Foundation announced Tuesday that it’s awarded a total of $840,000 in grants to eight local venture accelerator programs. “Our goal is to increase entrepreneurial success in Kansas City through…

Efficiency, innovative home construction are cornerstones for Prairie Design Build

David Schleicher was just looking for something to get back on track. In 2012, the president of Prairie Design Build, a house building company located in Kansas City, had watched his then six-year-old business begin to suffer because of the recent recession. Schleicher was desperately seeking a way to keep his head above water, not…

Listen: When the grind gets gloomy, experts discuss mental health challenges and entrepreneurship

About 72 percent of entrepreneurs have self-reported mental health concerns, according to a study done by the University of California San Francisco. More specifically, about 30 percent of entrepreneurs experience depression and about 30 percent experience ADHD, the same study found. In recognition of Mental Health Awareness Month, Startland News and Think Big’s May Innovation…

6 tips and tricks to stay sane while scaling fast

Frequently taking on more demands and shirking personal care, entrepreneurs’ work-life balance often skews toward work. Deadlines, finding clients, making payroll and dozens of other stressors can put entrepreneurs at risk of mental illness or compound existing challenges. Furthermore, entrepreneurs are disproportionately affected by such issues as ADHD, bipolar disorder and depression, according to studies…