$40M Firebrand II fund strengthened by Kansas City VC’s merger with Boulder firm, leaders say

August 3, 2020 | Startland News Staff

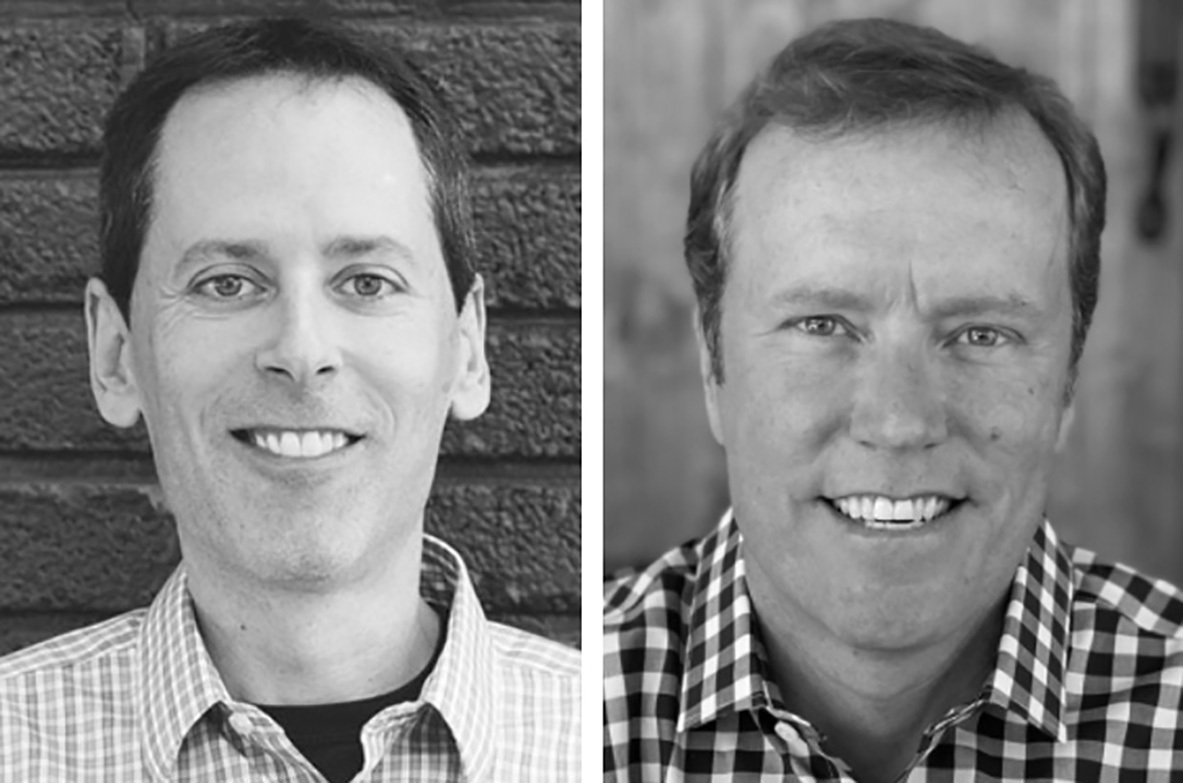

Merging two venture capital funds focused on one startup-rich portfolio is expected to create a larger platform for founders in up-and-coming markets, said Chris Marks.

“While a merger is unique in the venture world, this feels very natural based on our overlap in values, our shared commitment to supporting authentic leaders, and our similar focus on markets outside of New York and Silicon Valley,” said Marks, general partner with John Fein in Firebrand Ventures.

The firm now is investing out of the Firebrand II fund, having completed a first closing in January that successfully secured more than 90 percent of its $40 million target. The fund comes as the result of a merger between Marks’ Boulder-based Blue Note Ventures and Fein’s Kansas City-based Firebrand Ventures. The investment team also includes principal Maranda Manning.

A larger fund size means Firebrand II can often lead seed rounds, which can be hard to find for founders in these markets, said Fein, a former managing director for Techstars who invested in 30 startups during his time with the Kansas City accelerator.

“I couldn’t be more excited to be merging funds and joining forces with Chris,” he said. “Both Firebrand and Blue Note have seen great performance and the merger amplifies our strengths as we continue to support exceptional founders in up and coming communities.”

Firebrand II is expected to continue its predecessors’ focus on companies in Boulder, Denver, Chicago and Austin.

Click here to learn more about Firebrand’s investment criteria.

“Firebrand’s geographic footprint has expanded to the thriving Boulder/Denver ecosystem, serving the entire Rockies region. This enables us to meet more exceptional founders where they are,” said Fein. “Our broad network and deep experience as entrepreneurs, operators and investors helps founders build transformative companies.”

The two funds previously co-invested in several companies, he added, noting it became obvious they shared not only a similar investment strategy, but also an underlying approach to supporting entrepreneurs.

A combined portfolio includes such companies as Automox, Dwolla, Replica, FullContact, and PathSpot.

Click here to check out the portfolio.

Featured Business

2020 Startups to Watch

stats here

Related Posts on Startland News

Stackify continues global growth ahead of HQ move

Kansas City-based tech firm Stackify is posting a solid year of growth that’s leading it to hop the state line for more office space. Led by CEO Matt Watson, Stackify is moving its headquarters and 15 staff members from Kansas City’s Waldo neighborhood to Leawood, Kan., for larger and swankier offices. Watson said that Stackify…

Six Kansas City coworking studios to inspire you

Kansas City features an array of coworking spaces aimed at fostering collaboration and creativity. Below are a few of the spaces that caught our eye. Twelve coworking studios in the Kansas City area recently banded together to collectively raise their profiles to attract more businesses, entrepreneurs and individuals with the KC Coworking Alliance. The studios hope to bring awareness to their…

KC companies tap K-State LAB program

Three Kansas City area startups are honing their approaches with an array of resources at a business development program at Kansas State University. Acre Designs (Kansas City, Kan.) and AEGLE Palette (Shawnee) and Alvoru Clothing (Shawnee) were selected to participate in KSU’s Launch a Business program, which is designed to cultivate promising ventures in Kansas…