$40M Firebrand II fund strengthened by Kansas City VC’s merger with Boulder firm, leaders say

August 3, 2020 | Startland News Staff

Merging two venture capital funds focused on one startup-rich portfolio is expected to create a larger platform for founders in up-and-coming markets, said Chris Marks.

“While a merger is unique in the venture world, this feels very natural based on our overlap in values, our shared commitment to supporting authentic leaders, and our similar focus on markets outside of New York and Silicon Valley,” said Marks, general partner with John Fein in Firebrand Ventures.

The firm now is investing out of the Firebrand II fund, having completed a first closing in January that successfully secured more than 90 percent of its $40 million target. The fund comes as the result of a merger between Marks’ Boulder-based Blue Note Ventures and Fein’s Kansas City-based Firebrand Ventures. The investment team also includes principal Maranda Manning.

A larger fund size means Firebrand II can often lead seed rounds, which can be hard to find for founders in these markets, said Fein, a former managing director for Techstars who invested in 30 startups during his time with the Kansas City accelerator.

“I couldn’t be more excited to be merging funds and joining forces with Chris,” he said. “Both Firebrand and Blue Note have seen great performance and the merger amplifies our strengths as we continue to support exceptional founders in up and coming communities.”

Firebrand II is expected to continue its predecessors’ focus on companies in Boulder, Denver, Chicago and Austin.

Click here to learn more about Firebrand’s investment criteria.

“Firebrand’s geographic footprint has expanded to the thriving Boulder/Denver ecosystem, serving the entire Rockies region. This enables us to meet more exceptional founders where they are,” said Fein. “Our broad network and deep experience as entrepreneurs, operators and investors helps founders build transformative companies.”

The two funds previously co-invested in several companies, he added, noting it became obvious they shared not only a similar investment strategy, but also an underlying approach to supporting entrepreneurs.

A combined portfolio includes such companies as Automox, Dwolla, Replica, FullContact, and PathSpot.

Click here to check out the portfolio.

Related Posts on Startland News

Ideem locks in $2.4M seed round for trust tech spinout driven by Toby Rush, startup veterans

The Ideem team has a clear vision for how to make two-factor authentication easy and invisible for users, serial tech entrepreneur Toby Rush said, noting an early investment round will help the rapidly emerging startup double-down. Ideem announced a $2.4 million seed round Tuesday, backed by Sovereign’s Capital, Quona Capital, Everywhere Ventures, Hustle Fund, Oread…

KC-based Jayhawk startups earn cut of $570K from Oread Angel Investors pitch event

LAWRENCE, Kansas — Four Kansas City-area startups with ties to the University of Kansas recently took home funding infusions from a newly formed network of Sunflower State investors — part of a rapidly advancing initiative led by KU Innovation Park. Members of the Oread Angel Investors network, which launched in September and now has about…

KC investors power $4.5M round for OP startup poised to ‘unlock billions’ for its customers

Overland Park-based Realto has closed a $4.5 million funding round — thanks in large part to the backing of Kansas City-based investors. “We’re excited to welcome these important investors as we continue to expand our robust trading capabilities across the universe of alternative products,” Brian King, co-founder and CEO, said in announcement of the funding round which…

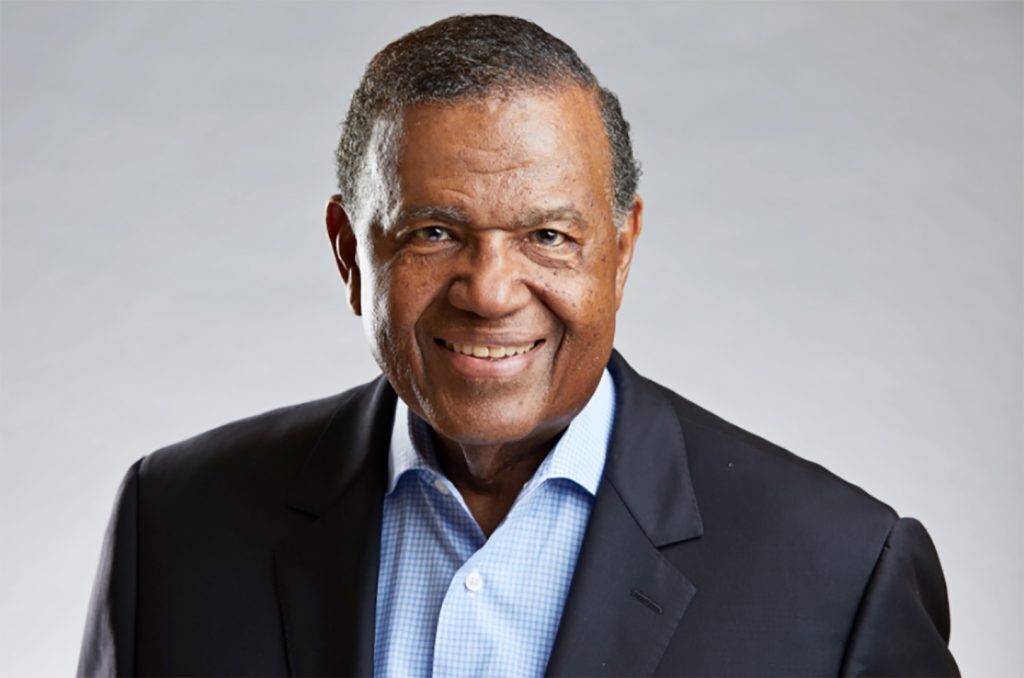

Firebrand Ventures closes $40M seed fund for ‘authentic’ founders in emerging communities; adds Leo Morton as advisor

A year after two prominent venture capital firms announced their merger, the consolidated Firebrand Ventures II is officially closed — reaching its $40 million target and having already invested in startups from Detroit, Seattle and Toronto. “Several years ago we raised our first funds — Boulder-based Blue Note Ventures and Kansas City-based Firebrand Ventures I —…