Investor survey: Angels plan to keep capital flowing to startups, but amounts likely to decline

May 18, 2020 | Startland News Staff

Editor’s note: The following is part of Startland News’ ongoing coverage of the impact of Coronavirus (COVID-19) on Kansas City’s entrepreneur community, as well as how innovation is helping to drive a new normal in the ecosystem. Click here to follow related stories as they develop.

COVID-19 won’t stop most angel investors — though they likely will rethink strategies for growing their portfolios, an Overland Park-based professional association for angels said Monday.

Patrick Gouhin, Angel Capital Association

“Angels aren’t afraid to take educated risks, and they are passionate about developing fresh entrepreneurial talent through their startup investments,” said Patrick Gouhin, CEO of the Angel Capital Association. “Communities with strong ties between their startup ecosystems and groups of angel investors will rebound faster and more meaningfully from this crisis.”

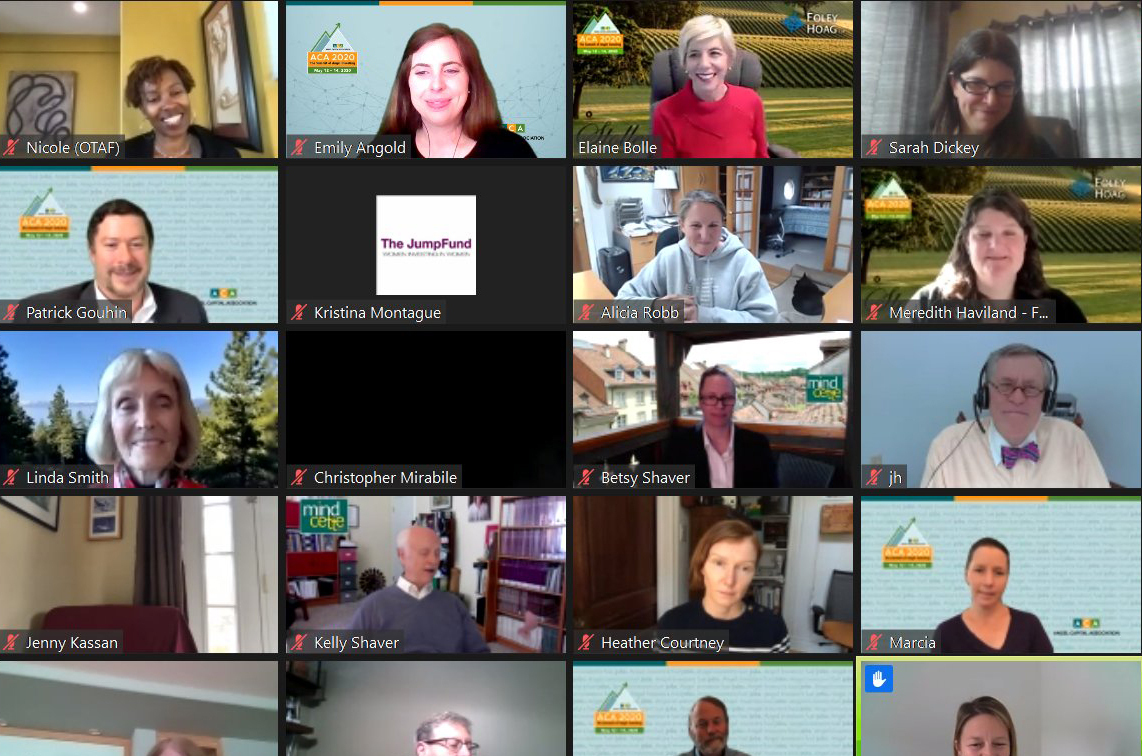

A peak pandemic April survey of leading angel investors revealed strong continued commitment to creating jobs via investment in startups, according to the ACA, which announced results of the survey last week during a virtual investment summit.

Among the findings from more than 50 major angel investing groups across the country that responded:

- Overall, angel groups (71 percent) plan on continuing to invest although level of investment might decline;

- More than 60 percent were still interested in funding a new startup company; only 32 percent said their interest has diminished;

- Support for additional investment in their existing portfolio companies was strong at 81 percent;

- 86 percent of the portfolio companies represented by respondents applied for CARES Act Funding, which includes the Paycheck Protection Program, with many reaching out to their investors for guidance and support; and

- 88 percent of portfolio companies see potential growth opportunities during the crisis.

“Early-stage financing from angel investors is critical to the success of high-growth startups,” the ACA emphasized in its release of the survey results. “Recent estimates suggest that annual U.S. angel investment activity may total as much as $24 billion each year, contributing to the growth and success of more than 64,000 startups in every region of the country.”

Those startups, in turn, created a gain of 1.7 million jobs in just one year, the ACA added, citing estimates from the US Bureau of Labor Statistics.

“The impacts of the pandemic on the investment community are significant, but angels tend to see these downturns as potential opportunities,” said Tony Shipley, chairman of the ACA. “When the stakes are high, angel investors shine.”

Click here to learn more about the Angel Capital Association, which boasts more than 14,000 accredited investors, who invest individually or through its 250-plus angel groups, accredited platforms, and family offices.

Featured Business

2020 Startups to Watch

stats here

Related Posts on Startland News

Photos: KC Coworking Day sings virtues of big ideas in startup spaces

KC Coworking Day is a celebration of people whose vision exceeds their circumstances, said Bob Martin. “If you’re an entrepreneur, and you have a vision, I hope your vision is so big that you’re uncomfortable sharing it with everybody — that there’s only a handful of people to whom you’re going to say, ‘This is…

Digital Sandbox startup Fast Democracy building non-partisan social database for tracking legislation

Today’s political climate demands not only a better-informed public, but accurate tools to help voters arm themselves with timely information, said Sara Baker, co-founder of Fast Democracy. The Kansas City-based startup — one of four early-stage businesses recently accepted into Digital Sandbox KC — aims to help people “touch their democracy” through its non-partisan web…

Tech Scouts: Your pitch ideas could help defend the US; Aug. 12 application deadline nears

The U.S. Department of Defense isn’t just bullets and bombs, said Jack Harwell. A five-day October event — “Encountering Innovation,” which is organized by the DoD and the Small Business Development Center’s Kansas office — gives entrepreneurs the opportunity to pitch innovative solutions to a panel of the DoD’s “tech scouts,” said Harwell, advisor at…

Flyover Capital celebrates $63 million sale of its second portfolio firm Agrible

In a deal that further validates the vibrancy of the Midwest tech scene, leaders at Kansas City-based Flyover Capital are lauding the sale of its second portfolio firm since its launch in 2014. Flyover — a venture capital firm whose mission is to fuel the next generation of tech startups in the Midwest — is…