Investor survey: Angels plan to keep capital flowing to startups, but amounts likely to decline

May 18, 2020 | Startland News Staff

Editor’s note: The following is part of Startland News’ ongoing coverage of the impact of Coronavirus (COVID-19) on Kansas City’s entrepreneur community, as well as how innovation is helping to drive a new normal in the ecosystem. Click here to follow related stories as they develop.

COVID-19 won’t stop most angel investors — though they likely will rethink strategies for growing their portfolios, an Overland Park-based professional association for angels said Monday.

Patrick Gouhin, Angel Capital Association

“Angels aren’t afraid to take educated risks, and they are passionate about developing fresh entrepreneurial talent through their startup investments,” said Patrick Gouhin, CEO of the Angel Capital Association. “Communities with strong ties between their startup ecosystems and groups of angel investors will rebound faster and more meaningfully from this crisis.”

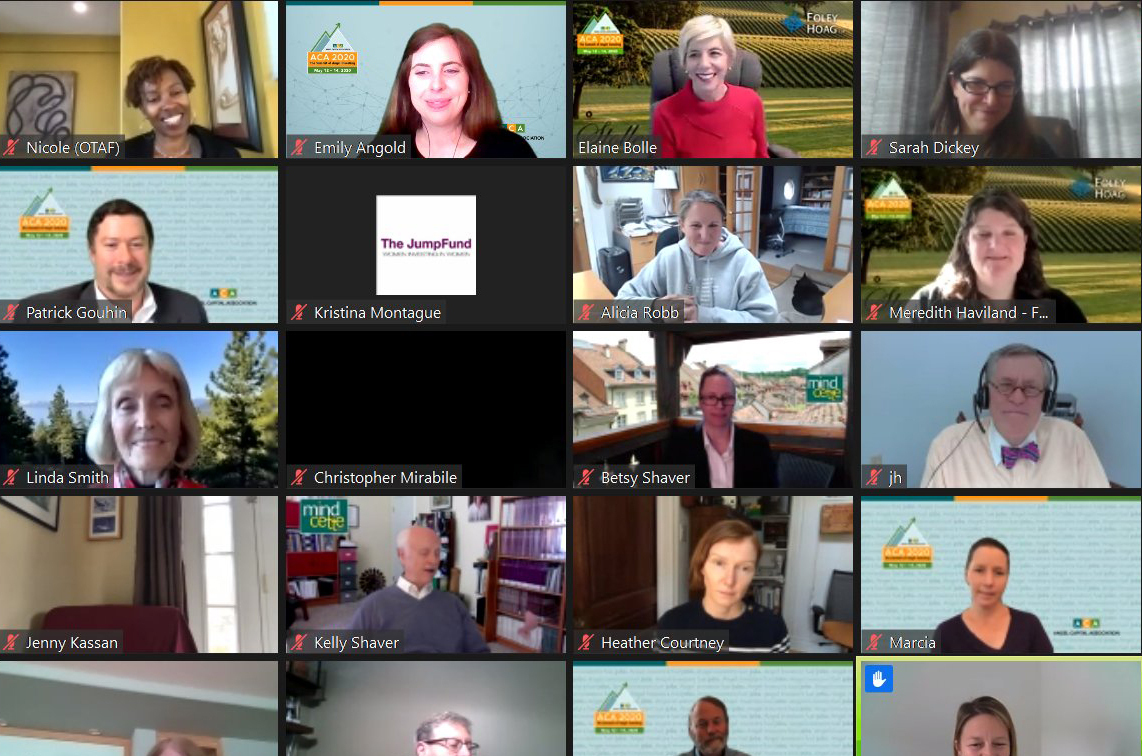

A peak pandemic April survey of leading angel investors revealed strong continued commitment to creating jobs via investment in startups, according to the ACA, which announced results of the survey last week during a virtual investment summit.

Among the findings from more than 50 major angel investing groups across the country that responded:

- Overall, angel groups (71 percent) plan on continuing to invest although level of investment might decline;

- More than 60 percent were still interested in funding a new startup company; only 32 percent said their interest has diminished;

- Support for additional investment in their existing portfolio companies was strong at 81 percent;

- 86 percent of the portfolio companies represented by respondents applied for CARES Act Funding, which includes the Paycheck Protection Program, with many reaching out to their investors for guidance and support; and

- 88 percent of portfolio companies see potential growth opportunities during the crisis.

“Early-stage financing from angel investors is critical to the success of high-growth startups,” the ACA emphasized in its release of the survey results. “Recent estimates suggest that annual U.S. angel investment activity may total as much as $24 billion each year, contributing to the growth and success of more than 64,000 startups in every region of the country.”

Those startups, in turn, created a gain of 1.7 million jobs in just one year, the ACA added, citing estimates from the US Bureau of Labor Statistics.

“The impacts of the pandemic on the investment community are significant, but angels tend to see these downturns as potential opportunities,” said Tony Shipley, chairman of the ACA. “When the stakes are high, angel investors shine.”

Click here to learn more about the Angel Capital Association, which boasts more than 14,000 accredited investors, who invest individually or through its 250-plus angel groups, accredited platforms, and family offices.

Featured Business

2020 Startups to Watch

stats here

Related Posts on Startland News

Profit and purpose: Innovators share 5 social entrepreneurship lessons

It’s been said that the best things in life are free. But what social entrepreneurs know well, is that it’s not that simple — nearly everything in life comes at a cost, including the positive impact they’re trying to make. And at Thursday’s Conquer for Good conference, a variety of innovators shared how they’re working…

KC tech innovators deliver mindset and personal development advice

For many, starting a business may sound like the dream — being your own boss, making your own rules and devising your own schedule. But the reality is that the entrepreneurial life isn’t all sunshine and roses. Like most good things in life, it comes with risk and challenges. And on Wednesday a panel of…

Darcy Howe’s hustle grows, guides KCRise Fund in first year

Kansas City may not realize its good fortune with the tenacious manager of a relatively new fund that’s investing in early-stage firms. Self-described as a builder that’s competitive and impatient, Darcy Howe is weaving her years of determined leadership into the KCRise Fund, which just wrapped up its first year with $14 million in the…

Deadlines approach for BetaBlox, EY awards; LaunchKC opening soon

Kansas City abounds with growth opportunities for startups and entrepreneurs — sometimes the trick is just finding them. To that end, here are a variety of opportunities for founders and supporters of Kansas City’s entrepreneurial ecosystem whose deadlines are approaching. Thanks to our friends at KCSourceLink for aggregating these opportunities! BetaBlox Deadline: March 1 Kansas City-based accelerator…