Mayor’s ‘lifeline’ arrives: EDCKC opens applications for small biz relief fund pledged by Lucas

May 2, 2020 | Startland News Staff

Editor’s note: The following is part of Startland News’ ongoing coverage of the impact of Coronavirus (COVID-19) on Kansas City’s entrepreneur community, as well as how innovation is helping to drive a new normal in the ecosystem. Click here to follow related stories as they develop.

Funds from a small business relief loan program teased by KCMO Mayor Quinton Lucas in March are one step closer to entrepreneurs, with administrators of the fund on Friday opening applications for COVID-19 relief.

“While it may be awhile before we know the full impact of COVID-19 on the Kansas City economy, the mayor, city council and the EDC recognize that small businesses are the lifeblood to our city, and sometimes these businesses don’t have access to the same resources as larger ones,” said T’Risa McCord, president and CEO of the Economic Development Council of Kansas City, which has been tapped to manage the Kansas City Missouri Small Business Relief Loan Fund.

“Through our LoanUP program, our team has experience and expertise providing loans to businesses that have had challenges working with traditional banks,” McCord continued. “We intend to help them through this time.”

The fund is expected to provide loan-based assistance to help small businesses, within the city limits of Kansas City Missouri, continue to finance operational expenses amid the COVID-19 pandemic. The fund allows for low interest rate loans, deferred payments for the first six to 12 months, with extended amortization periods of up to five years, no minimum credit score, and flexible collateral requirements.

Click here for eligibility requirements and loan terms.

Click here to apply for the Kansas City Missouri Small Business Relief Loan Fund.

“My heart breaks for all of our small, local businesses and their employees who are suffering during this public health crisis,” Lucas said March 24, informally pledging $500,000 toward a fund that would serve as a “lifeline” to entrepreneurs. “I applaud the painful steps our small businesses have already taken to protect our community — now, it’s our turn to step up and protect them.”

The KCMO City Council ultimately provided the EDC with $500,000 as a loan loss reserve fund to help create the relief loan program. Small business advocates and members of the media have been critical of the fund’s slow rollout, with applications opening nearly six weeks after the mayor’s announcement and two months after COVID-19 began impacting Kansas City.

Lucas declared a state of emergency March 12, preceding the cancellation of the Big 12 tournament and KCMO St. Patrick’s Day parade, as well as the eventual establishment of state and local Stay at Home orders.

By contrast, a $5 million community-backed small business relief loan fund led by AltCap launched applications March 31 and already has deployed more than $1 million to Kansas City entrepreneurs on both sides of the state line.

Featured Business

2020 Startups to Watch

stats here

Related Posts on Startland News

$20M project expected to remove key barrier to unlocking 18th & Vine vibrancy: parking

It’s more than just a parking garage, said Pat Jordan, revealing a plan to develop a state-of-the-art, transit-oriented parking facility in the heart of the historic 18th & Vine District is about opening a gateway to the entertainment and cultural hub. “Limited parking has historically been a barrier for visitors, especially during peak hours and…

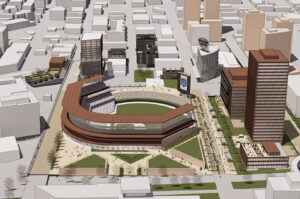

Downtown KCMO ballpark remains in play as Kansas aggressively pursues Royals

Editor’s note: The perspectives expressed in this commentary are the author’s alone. Gib Kerr is the chair of the Downtown Council of Kansas City, Missouri, managing director at Cushman & Wakefield, and an author. This piece was first published by the Downtown Council. Where should the Royals play baseball? Last year, the debate was whether…

Daupler closes $15M Series B to boost real-time responses to energy, water emergencies

A Kansas City company’s latest funding round will help the startup manage critical infrastructure provided by utilities and municipalities — driving its growth within the electric utility market and accelerating international expansion into utilities in the United Kingdom and European Union. Daupler on Thursday announced an oversubscribed $15 million Series B round led by Aqualateral,…

Betty Rae’s opening OP ice cream shop in May, deepening Johnson County scoop-print

Local favorite Betty Rae’s Ice Cream is expanding in Johnson County — taking a coveted corner spot in the Shoppes at Deer Creek Woods in sprawling Overland Park. A May opening is scheduled at 6936 W. 135th. St. It will be the sixth Betty Rae’s for the metro. (Hen House Market is an anchor tenant in…