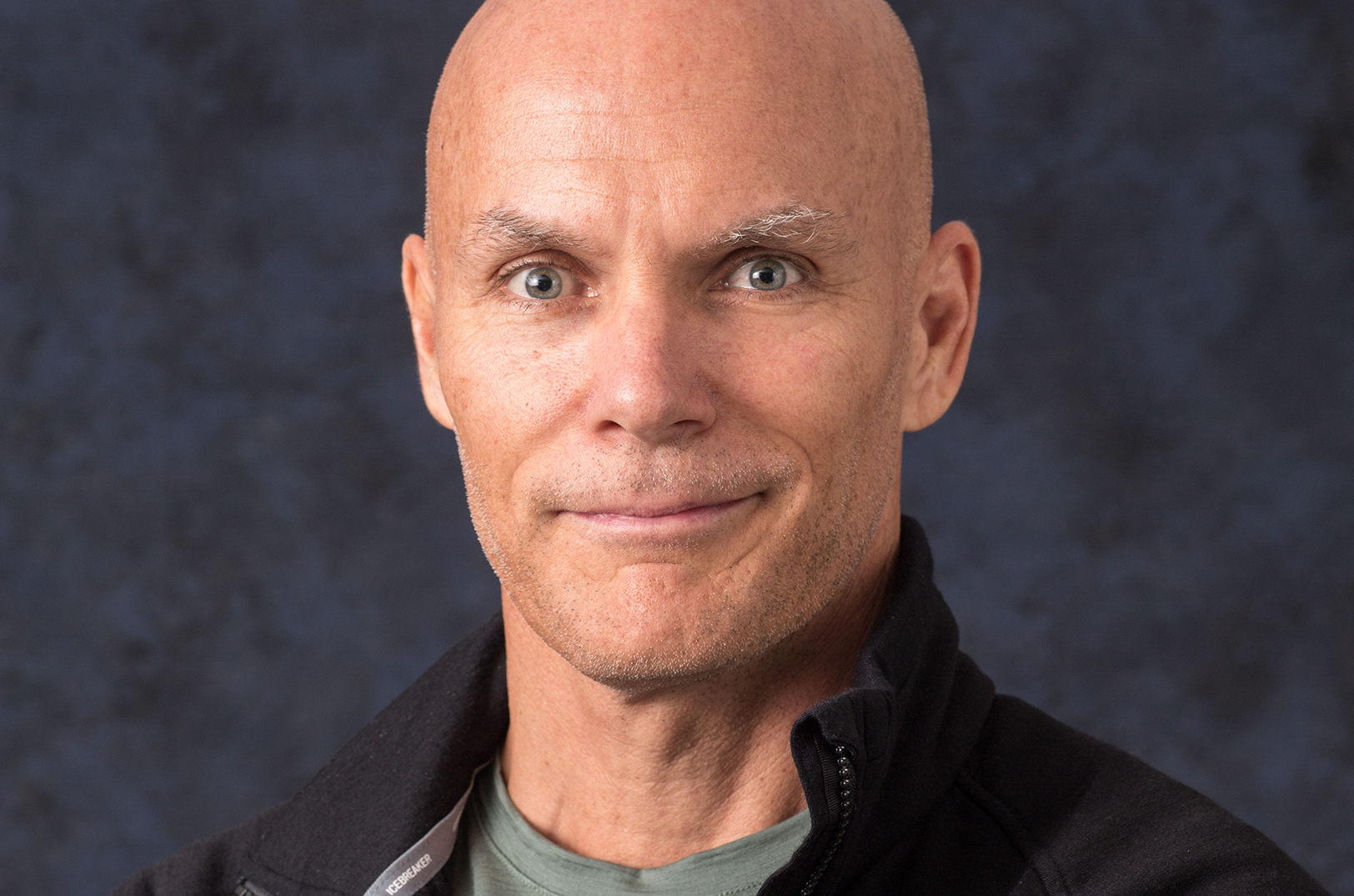

Sandy Kemper: How to solve the $16 trillion small business liquidity trap

April 8, 2020 | Sandy Kemper

Editor’s note: The opinions expressed in this commentary are the authors’ alone. Sandy Kemper is founder and CEO of C2FO. This open letter was originally published on LinkedIn and targeted to governments and central banks of the world. C2FO and the Kemper Family Foundation are financial supporters of Startland News and its parent organization, STARTLAND.

Earlier payment is better than borrowing.

The greatest financial relief we can give small and mid-sized businesses in this economic crisis is faster payment of their outstanding invoices — liquidity. The lending programs being launched by the world’s governments and central banks and directed to small and mid-sized businesses are extraordinary, needed and laudatory, but will fall short not just in terms of dollars, but more critically, they will not arrive soon enough for tens of millions of the world’s small and mid-sized businesses in dire need.

Small businesses rarely have more than a few weeks of cash on hand, yet many have considerable accounts receivable, often representing 60 to 90 days of sales that are yet to be collected from their customers. A small business with $4 million in annual sales and terms of 90 days has nearly $1 million trapped in accounts receivable. Moreover, with the pandemic, payment terms are extending rapidly as even the largest companies in the world look for ways to increase cash on their balance sheets.

The World Bank estimates that there are more than 150 million small and mid-sized businesses globally, employing 60 percent of the world’s working population and generating nearly 50 percent of the world’s GDP. Using that data and 60-day payment terms, these businesses are owed more than $16 trillion by their customers, half of which are large companies.

What if we created low-cost funding specifically for larger companies to pay their small and mid-sized suppliers immediately?

We would eliminate the need to credit underwrite, generate loan documents and approval processes for tens upon tens of millions of businesses which are already vastly overwhelming traditional finance channels. Instead of borrowing, businesses would now simply be paid more rapidly by their large company customers, something that likely is much preferred over borrowing by all small business owners. Do this at scale and we can create $8 trillion of immediate relief for the world’s small and mid-sized businesses without causing them to have to borrow a penny. A fund designed to move money to large buyers of small suppliers’ goods and services not only eliminates the need for the small businesses to borrow, but likely more effectively protects the loans made because they are to larger, higher credit-rated businesses. Further, a typical large company has thousands of suppliers, the majority being small and mid-sized businesses. So, for one credit facility to a larger company with a sizable supply chain, you can advance funds to upwards of 1,000 small and mid-sized businesses, a 1:1000 amplifier effect.

Funding help is needed even by larger companies in this crisis; central banks and government treasuries have stepped in to help stabilize the debt markets on which many large companies rely. All are being challenged by the global economic downturn. And, importantly, even before this crisis the average large company had much more accounts payable than cash, which is why a fund to pay their accounts payable more rapidly to their small and mid-sized suppliers is so necessary right now.

Ten years ago, I helped found a small business that was born from the liquidity trap I had faced in another company struggling to survive in a previous economic crisis. The idea for our new business was simple: everyone’s account payable is someone else’s account receivable. Our vision at C2FO was to build a platform that matches accounts payable and accounts receivable, and let suppliers order their cash payment earlier from their customers at rates they name. No borrowing, no advance rates, collateral or personal guaranties; just earlier payment. Today we are fortunate to have more than 1 million businesses around the world on our platform. These businesses generate $10.5 trillion of annual sales and more than 90 percent of them are small businesses. Last month, we surpassed $100 billion in lifetime early payment funding to our customers, but they need much more help than we can give them, and they need it now.

Over the last few weeks we have heard from so many businesses that are in such great need. I hope that this letter gives voice and a possible solution to their concerns.

Click here to read our further analysis of this pressing challenge and download the full white paper.

Sandy Kemper is founder and CEO of C2FO.

2020 Startups to Watch

stats here

Related Posts on Startland News

Ho-ho-hometeam gifts: Your guide to KC’s best sports-inspired gifts (and how to get ’em before the holidays)

As a lifelong Kansas City Chiefs fan, Donnell Jamison stood by the team during the grim years when the playoffs were just a prayer and Chiefs shirts weren’t necessarily a hot holiday item, he shared. “I’m a die-hard Chiefs fan,” continued Jamison, owner of Deep Rooted, a KC streetwear brand with a brick and mortar…

Kauffman Foundation adds chief IT officer to CEO’s cabinet; role will use tech to open access, opportunities

A Kauffman Foundation tech veteran is expected to help align the organization’s technology priorities in support of its mission to reduce barriers in college access, workforce development, and entrepreneurship, said Dr. DeAngela Burns-Wallace. Donell Hammond, who joined the Ewing Marion Kauffman Foundation in 2018, has been named chief information technology officer and a member of…

Kansas secures $8.2M for digital equity plans; part of Biden’s ‘Internet for all’ initiative

New grant funding is expected to boost efforts to empower Kansans and Sunflower State communities with the digital tools and skills necessary to meaningfully benefit from high-speed Internet service. The U.S. Department of Commerce’s National Telecommunications and Information Administration (NTIA) on Wednesday announced funding pathways for Kansas, Mississippi, North Carolina, Pennsylvania, and Virginia, allowing the…

Made in KC crowns first-ever ‘Maker of the Year’ (plus the local-first retailer’s best new product)

Kansas City’s thriving maker community received a festive boost this holiday season as Made in KC unveiled its first-ever Made in KC Awards — a celebration of creativity and entrepreneurial spirit. The awards highlight more than a dozen standout makers and innovative products, with two big winners — KC New Maker of the Year and…