Show Me Capital: 6 key goals can help fill funding gaps for early-stage Missouri companies

December 20, 2019 | Sarah Mote

Missouri is leaving millions of dollars on the table that could fuel early-stage startups, which create nearly 80 percent of net new jobs in the state.

A new report from MOSourceLink, a program of the UMKC Innovation Center, reveals Missouri is lacking in alternative loans, access to resources, early-stage capital and locally activated venture capital. The good news: It’s clear what needs to be done to fill the gaps in the early-stage financing for startups.

MOSourceLink’s Show Me Capital: Financing Early-Stage Companies in Missouri maps the state’s capital landscape. The report reveals key gaps in both the debt and equity finance systems, draws on funding and financing activity across the state and analyzes data from more than 30 loan programs, 600 grant and equity investments and 50 venture capital firms. The report reflects the state of capital as of December 2019.

“At MOSourceLink, we not only connect entrepreneurs to resources, we also build collaborations to fill gaps in entrepreneurial services,” said Alexces Bartley, network builder for MOSourceLink, a statewide network of 500+ entrepreneurial service providers. “Show Me Capital reveals what’s really happening with loans and equity for early-stage businesses in Missouri and, more importantly, what we can do together to improve the situation.”

Findings for Missouri’s capital landscape (available for download at mosourcelink.com/capital)

- Missouri needs more alternative loans, especially in rural areas: While a number of organizations have alternative loan funds, many of those resources are underutilized and/or underfunded.

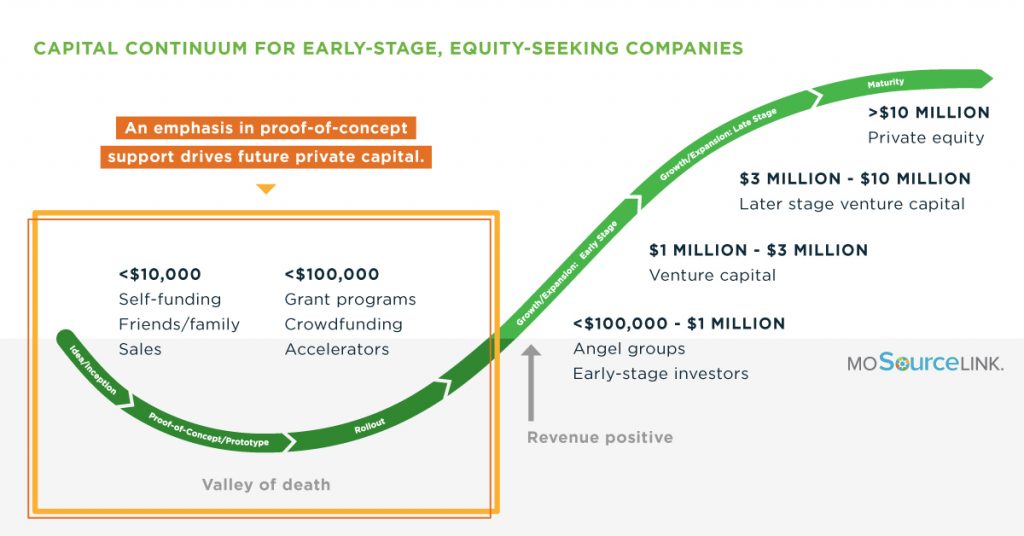

- The pipeline of growth companies needs support at the early stages. Grants play a critical role by fueling companies too new for investors who often expect immediate returns. Data from programs like Digital Sandbox KC prove that investing in companies’ earliest stages helps them survive the “valley of death” and leads to follow-on funding. Federal grants are one avenue for early-stage funding, but Missouri lags compared to leading states in taking advantage of federal research grants (SBIR/STTR).

- Missouri companies need better access to equity-stage investment. While Missouri compares favorably to some neighboring states in venture capital raised, it lags behind others. Also, Missouri-based VC funds invest in early-stage companies, but not necessarily those based in Missouri.

“Capital is critical to get innovations off the ground and get customers in the door. Nearly 60 percent of new business owners bootstrap their business with personal savings, which leaves out those aspiring entrepreneurs who don’t have personal wealth to lean into,” said Jim Boyle, co-founder of Justine PETERSEN, the largest player in microlending in Missouri. “Increasing the accessibility of microloans removes a barrier to the hope and economic mobility of entrepreneurship.”

In 2015, KCSourceLink published a similar study of data and action steps for the Kansas City market, We Create Capital. The community rallied around those goals and in less than five years, Kansas City saw a 61 percent increase in early-stage deals, a 290 percent increase in available capital for KC entrepreneurs and gathered critical data on the impact early-stage funding mechanisms have on later-stage funding.

“Investment in innovation is critical to Missouri’s economic development strategy,” said Rachel Anderson, director of efactory, an entrepreneurship and business resource center in Springfield, Missouri. “Networking capital across the state – connecting investors and entrepreneurs together and making the mechanisms to do that more visible – will help bridge the gap between rural and urban entrepreneurship and continue to raise the profile of Missouri.”

Six goals to improve access to capital for early-stage companies

The study sets out six bold goals and supporting action that, if the community embraces, can drive significant dollars to support Missouri startups:

- Increase the availability of alternative loans for early-stage businesses in Missouri that are not yet eligible for traditional bank loans from $18 million in 2018 to $31 million by 2025.

- Secure $2 million per year of proof-of-concept grants to support a minimum of 80 Missouri proof-of-concept projects per year by 2025.

- Increase the amount of Missouri SBIR funding from $20 million to an average of $25 million per year by 2025.

- Double seed capital investments (under $1 million) from $13 million in 2018 to more than $26 million per year by 2025

- Increase venture capital investments ($1 million to $10 million) from $122 million to more than $250 million per year by 2025.

- Activate the statewide network of resources for entrepreneurs and small businesses to improve access to capital; connect with and educate residents on how to access available capital.

“The message is clear: we need to connect and activate capital of all types at all stages to support our Missouri businesses, especially those in the very early-stages,” said Ben Johnson, vice president, programs at BioSTL, a collaborative group of St. Louis civic, academic and business leaders who support medical and plant science innovation. “Access to the right capital at the right time is often the critical difference between those who survive the ‘valley of death’ to generate revenues—and those businesses that fold.”

For a complete copy of the executive summary and the 100+-page action plan, go to www.mosourcelink.com/capital.

Sarah Mote is marketing director for KCSourceLink.

2019 Startups to Watch

stats here

Related Posts on Startland News

Survival rates for new biz in MO, KS lag national average; What’s getting in their way?

Editor’s note: The following story was originally published by Flatland, the digital magazine of Kansas City PBS and a fellow member of the KC Media Collective. Click here to read the original story or here to sign up for the weekly Flatland email newsletter. Colorful balloons, ribbons, unlimited drinks, food and of course music. There was everything at the ribbon cutting…

NMotion adds ‘concierge’ investment accelerator for early-stage founders; applications close May 30

Editor’s note: This article is sponsored by the NMotion startup accelerator, but was independently produced by Startland News. Following NMotion Venture Studio’s successful launch in 2020, Nebraska’s largest and only startup accelerator is adding a new high-touch opportunity to its lineup: NMotion Growth Accelerator. “Five out of the 10 companies that came through the NMotion…

Donations honoring late podcast host, comedian fund ‘place of peace’ for young creators; recording studio dedicated to Mathew George

Friends and family of the late podcast host Mathew George gathered to celebrate the dedication of Operations Breakthrough’s newly-debuted recording studio on what would have been Mathew’s 27th birthday. “What could have been a really depressing day was more celebratory, like it would have been if he were still here,” shared Mary Ann George, mother…

Pipeline Innovators gala adds glamour, top honors back into the mix for celebration of fellows

A remixed Pipeline Innovators gala honored veteran and emerging fellows from within the elite startup founder network Friday — returning the full live celebration to a stage in Kansas City for the first time since 2018 and crowning two new Innovator of the Year recipients. Marking the first Innovators gala for Pipeline executive director Melissa…