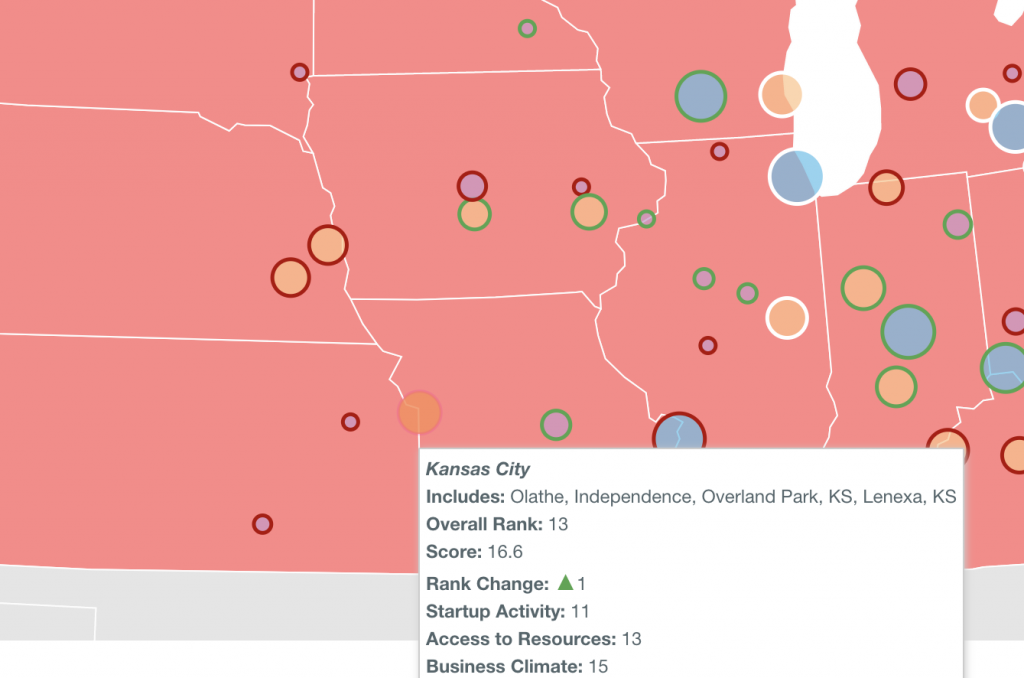

Is KC getting lapped? Kansas City scores No. 13 among Top 25 Midwestern cities in M25 ranking

October 8, 2019 | Tommy Felts

Kansas City is maintaining a spot firmly in the middle of the pack among the top 25 Midwestern startup cities — in large part thanks to a $100-plus million growth equity investment in PayIt earlier this year, according to a new ranking by M25.

The mega-round for Kansas City’s leading GovTech startup kept the City of Fountains above water as M25 — an influential venture fund in Chicago with Kansas City portfolio companies like backstitch, Super Dispatch and Zohr — examined 54 Midwest cities based on startup activity, access to resources and business climate.

Kansas City (including Olathe, Overland Park, Lenexa and Independence) ranked No. 13 on M25’s 2019 Best of the Midwest list — up from No. 14 in 2018.

Neighboring St. Louis scored No. 5.

Click here to see the Top 25 in the ranking.

“Each Midwest city is in a race to attract, grow and retain tech startups — and some are ahead in that race while others are… getting lapped,” said Victor Gutwein, founder and managing partner at M25. “Our goal has been to provide an analytical, objective benchmark to help entities and individuals determine how ecosystems are performing relative to each other.”

Leawood-based C2FO’s $200 million round in August was not counted for the 2019 ranking because it missed the June 30 data pull off, Gutwein noted, which should boost Kansas City’s standing in 2020.

Click here to read Gutwein’s and others’ thoughts on momentum building in KC.

Within M25’s rankings, Kansas City scored most dramatically lower on business climate — a measure of how conducive the city’s economic environment is to attract and scale a business. Kansas City was dinged particularly on quality airport access and population reach. Tax climate, cost of living and gross domestic product were among more significant strengths in this area.

Areas where KC is weak (according to M25’s findings):

- No significant university ecosystem

- Few large (Fortune 500) companies

- Techstars Kansas City wasn’t active in 2019 (a Techstars program carries more weight than an average accelerator in M25’s list because of the rankings incorporated from the Seed Accelerator Rankings Project)

- Neither Kansas nor Missouri are considered competitive in direct state investment programs (whether it be a tax credit program, a fund-of-funds focused on the state, or direct investment arms like InvestNebraska or Elevate Ventures in Indiana)

- Airport quality and population reach are weaker than other cities of similar size

Areas where KC is strong:

- The tax climate is better relative to other Midwest states

- Educated workforce (not as high as a college town like Ann Arbor, Michigan, or Madison, Wisconsin, but stronger than most others in the Top 25)

- Fares well on “Big Outcomes,” which factors in exits over $50 million and fund raises over $50 million

- Scores well on creating liquidity, with a good rank in number of exits and percent of deals that exit

“Candidly, I felt Kansas City was more vibrant than the rankings showed,” Gutwein said. “But this could also be because I am an early stage digital technology investor, and Kansas City may be (and to me anecdotally is) stronger in this category than some other cities ranked above it — probably because these cities have a more mature ecosystem and/or have deep strengths in some areas we (as an investor) don’t look at, like life sciences, but still would register on these rankings.”

Tommy Felts

Tommy is editor-in-chief for Startland News, a Kansas City-based nonprofit newsroom that uses storytelling to elevate the region’s startup community of entrepreneurs, innovators, hustlers, creatives and risk-takers.

Under Tommy’s leadership, Startland News has expanded its coverage from a primarily high-tech, high-growth focus to a more wide-ranging and inclusive look at the faces of entrepreneurism, innovation and business.

Before joining Startland News in 2017, Tommy worked for 12 years as an award-winning newspaper journalist, designer, editor and publisher. He was named one of Editor & Publisher magazine’s top “25 Under 35” in 2014.

Related Posts on Startland News

C2FO named top fintech by CNBC; leaders celebrate win, pushing toward $500B funding milestone

A Kansas City fintech’s award-winning efforts to boost working capital access for businesses across the globe not only has built trust among the world’s top enterprises, said Sandy Kemper; it’s positioned C2FO for even greater impact as it transforms the financing landscape for previously overlooked ventures. The company was honored this month as one of…

He retired after an exit; now this govtech veteran is back in a CFO role for KC-scaled PayIt

As Kansas City-built PayIt scales across North America, a new financial leader is expected to help guide the company in its game-changing efforts to help government agencies modernize, serve their residents, and improve operating efficiency. Steve Kovzan, a nearly 30-year veteran of leadership across government technology and finance spaces, is now chief financial officer at…

‘Volatile times’: C2FO targets capital access to businesses rattled by global tariff disruptions

Companies — especially small businesses with limited banking options — need liquidity during times of global economic uncertainty, said Sandy Kemper, detailing C2FO’s fruitful efforts to meet growing demand for fast capital amid unpredictable tariff-related disruptions. Kansas City-based C2FO funded $18 billion through its global working capital platform to businesses worldwide during the first quarter…

C2FO accesses $30M investment with World Bank-backed IFC to expand KC firm’s working capital platform

A just-announced capital infusion for Leawood-built C2FO reflects a shared commitment with global partners to boosting jobs and strengthening economic opportunities — notably for micro, small and medium enterprises in emerging markets worldwide. The $30 million funding round features investment from the International Finance Corporation (IFC), a member of the World Bank Group, and existing…