C2FO’s $200M challenge: Prove the fintech startup is worthy of KC’s biggest investments

August 7, 2019 | Austin Barnes

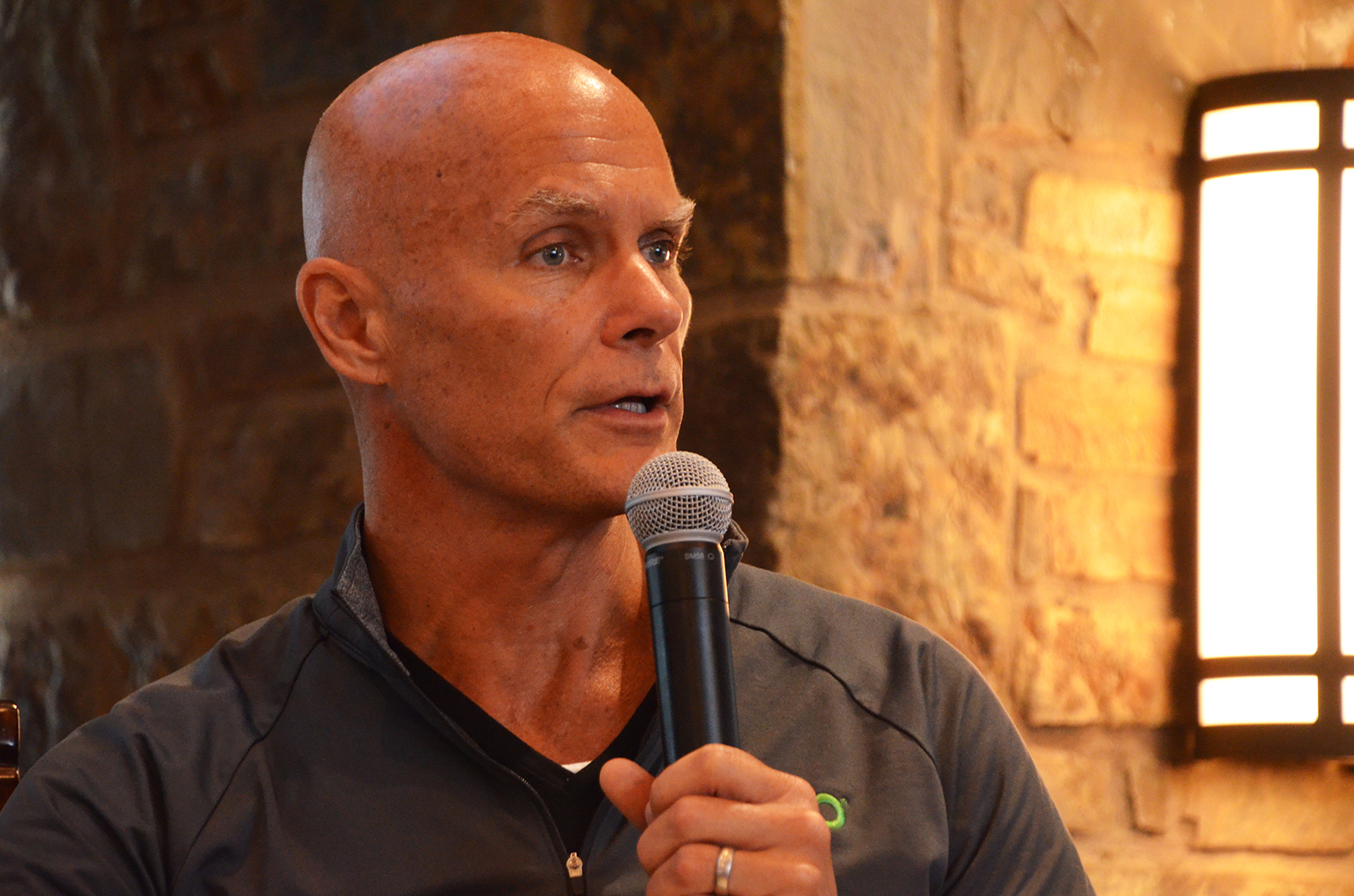

A record-busting $200 million investment announced Wednesday easily tops C2FO’s previous headline-grabbing funding rounds, but now the Kansas City fintech mega startup must live up to the hype, said Sandy Kemper.

“Investments are always forward-looking,” said Kemper, founder and CEO of C2FO. “Our job is to make sure that we’re living up to our ability to expand this company in a way that is deserving of this type of attention, this type of investment.”

Led by the $108-billion Softbank Vision Fund — which also has backed such top names as WeWork, Slack, Uber and DoorDash — C2FO’s big funding round follows a record set in March 2018 when the startup secured a $100 million investment: believed to be a first for the Kansas City ecosystem.

“You don’t necessarily work to top [funding milestones] … you work to deserve it,” Kemper emphasized, crediting the massive investment to his dedicated team, which has worked to scale C2FO into a Kansas City-based startup with a 173-country reach in fewer than 12 years.

What is C2FO?

Streamlining the world of working capital, C2FO’s online marketplace has amassed over 300,000 clients in 173 countries — helping them control their cash flow and manage more than $1 billion in funding on a weekly basis.

“Working capital is water for commerce and it’s as important to business life as water is to biological life. The problem is that much of this liquidity is trapped.”

An infusion of $200 million makes speeding up expansion easier, he admitted, but with a non-negotiable caveat: C2FO must check its pride.

“We must balance that to make sure that the culture, which is the differentiator for our company isn’t diluted by this expansion,” Kemper said. “So we will work to expand wisely and we will work to expand aggressively — but we will work to always maintain the culture of the company.”

That culture is why Kemper won’t ever stop thinking of C2FO as a startup, he explained, despite the realistic potential the company could reach unicorn status — a valuation of $1 billion or more.

“[C2FO is still a Kansas City startup] and it better continue to be,” he said through laughter when asked if the company had outgrown the title. “If you’re going after this … you’re going up against the entrenched, established. It’s the startup mentality that is the biggest differentiator.”

Great products and great tech won’t change the world alone, he said. It’s teams of people, empowered by startup culture that embody innovation, Kemper noted.

“[Acting as a startup] allows us to, in our or any company’s eyes, take on the incumbents. So I would argue that once a startup, one should always try to continue to be a startup,” he said.

Wielding a rapidly expanding, global reach doesn’t mean C2FO isn’t committed to Kansas City — but it does indicate a need for more local startups to leave their hometown allegiances behind if they’re looking to build billion-dollar companies, Kemper explained.

“If you see yourself as a local company attracting global customers, you’re going to fail,” he said of the need for founders to maintain confidence and view their companies as Kansas City-built heavy-hitters batting with the same average as companies such as Uber or Twitter — both of which funders of C2FO have taken chances on, indicating venture capital interest isn’t always based on geographic location.

With news of C2FO’s massive funding round making headlines across the country, Kemper wants those outside of Kansas City — and those eyeing a return through programs such as Back2KC — to see the community for its collective ingenuity and relentless hustle, not just the ability of its homegrown startups to secure cash, he said.

“This is as vibrant an environment for entrepreneurs and companies as we have ever seen in Kansas City — whether you have big rounds or little rounds or in-between rounds … in many ways, our funding is irrelevant,” he said. “The ecosystem of entrepreneurship in Kansas City is extraordinary. And having some success raising money, I suppose, is a nice thing … but I don’t think it means that much to the community because the community is already doing so much great stuff.”

Featured Business

2019 Startups to Watch

stats here

Related Posts on Startland News

2017 Under the Radar: Venture360 powers globe-spanning investment

Editor’s note: Startland News picked 10 early-stage firms to spotlight for its annual Under the Radar startups list. The following is one of 2017’s companies. To view the full list, click here. Four billion dollars. It’s a massive hunk of investment change spread across the globe through 4,000 transactions tracked on Venture360’s platform. The Kansas…

2017 Under the Radar: Dunami filters out noise to find influencers

Editor’s note: Startland News picked 10 early-stage firms to spotlight for its annual Under the Radar startups list. The following is one of 2017’s companies. To view the full list, click here. Who really matters? For a businesses, the answer can be key in refining focus and needed action, as well as managing resources. Overland…

2017 Under the Radar: Happy Food Co meals loaded with local

Editor’s note: Startland News picked 10 early-stage firms to spotlight for its annual Under the Radar startups list. The following is one of 2017’s companies. To view the full list, click here. Trends are fleeting. The ability to easily craft locally sourced meals at home shouldn’t be, Jeff Glasco said. “Food is a dynamic market,”…

ECJC boot camp arming startups for angel investment round

Startups enlisted in the war for capital know the struggle: a perilous gap between seed and success. The Enterprise Center in Johnson County’s new investment boot camp aims to arm them for battle. The Pitch Perfect mini-accelerator program focuses on helping established startups advance to the next round of development by teaching such skills as…