BREAKING: C2FO closes $200M investment led by backer of WeWork, Uber, Slack

August 7, 2019 | Startland News Staff

Startup giant C2FO continues its climb to the top, having secured a new $200 million investment — and doubling the amount of its once-record funding raise in fewer than two years.

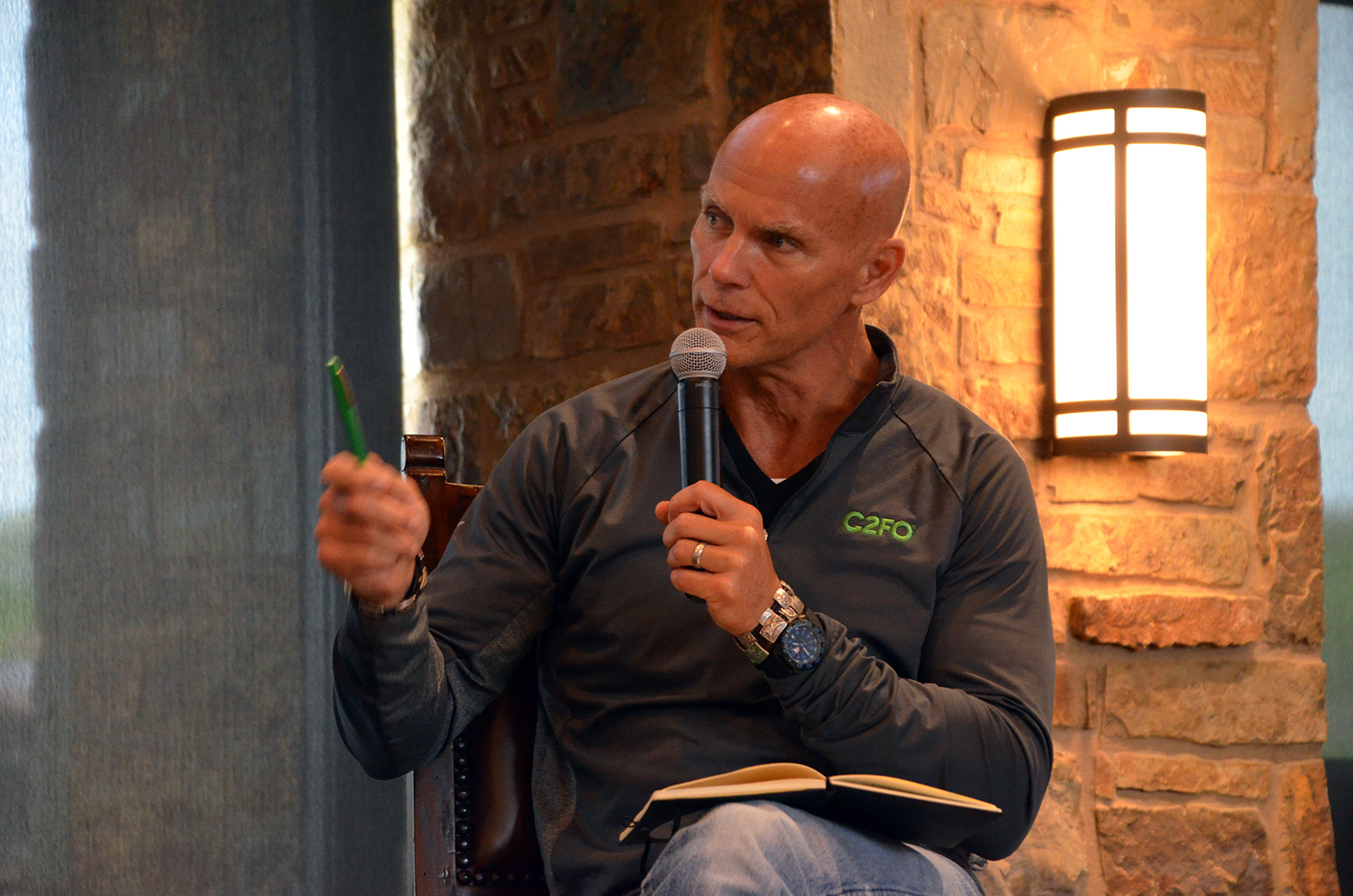

“We are very fortunate to have a team who, for years, has delivered industry-leading unit economics, extraordinary customer satisfaction, and strong global growth,” Sandy Kemper, C2FO founder and CEO, said in a release Wednesday.

Updated: Click here to read more of Kemper’s thoughts on the massive funding round, including C2FO’s big challenge: proving it’s worth of Kansas City’s biggest investments.

The chart smashing round — believed to be the largest yet for a venture capital-backed startup in Kansas City — was led by the $108 billion SoftBank Vision Fund, which also has stakes in WeWork, Uber, Slack and DoorDash. The investment places Nahoko Hoshino, vice president of investment at SoftBank Investment Advisers, on the C2FO board of directors.

Click here to read about C2FO’s previous record setting, $100 million funding round.

Investment firms Temasek and Union Square Ventures returned to the table and placed new bets on C2FO, the company said of the round’s additional participants.

“This infusion of capital from the Vision Fund and existing investors will be used to further our expansion as we strive to build a new world wherein the increased liquidity provided by the C2FO platform helps companies and in turn, entire economies, grow more rapidly,” Kemper said.

Streamlining the world of working capital, C2FO’s online marketplace has amassed over 300,000 clients in 173 countries — helping them control their cash flow and manage more than $1 billion in funding on a weekly basis, the company explained.

Such reach and the ability to shake the industry helped attract SoftBank to the energy-rich startup, said Ashkay Naheta, managing partner.

“We invested in C2FO because we think their disruptive innovation offers a solution to an industry that has traditionally lacked cost-efficient alternatives for businesses of all sizes looking to free up cash quickly,” Naheta said.

Cash injections and the ability to rapidly scale wouldn’t be possible without the C2FO team, Kemper noted.

“Due to their work, we have now grown to match over $1.2 trillion of accounts receivable and accounts payable,” he said.

SoftBank believes C2FO and its leaders are equipped with vision that could help the company — which is expected to reach a $1 billion valuation — become the global exchange for working capital, Naheta said.

Startland will have more on this story as it develops.

Featured Business

2019 Startups to Watch

stats here

Related Posts on Startland News

Amid expansion, Tom’s Town redesign inspired by optimism of those thirsty for a better life

Kansas City-distilled Tom’s Town is pouring expansion into the headlines as the company’s spirits quench a national thirst for craft liquor, said Steve Revare. “[Our success] has really exceeded our expectations,” said Revare, founder factotum, describing Tom’s Town’s coming 10-state rollout. “With the quality of our spirits, the packaging, and the rich story behind it…

Women hold key to overcoming innovation gap, talent shortage, says OneKC for Women

OneKC for Women designed its November event for men, said Rania Anderson. “Winning at Work” is a chance for male business owners and entrepreneurs to improve results by changing the way they interact with women in the workplace, she added. “There is an opportunity for business leaders in Kansas City to get some ideas on…

New investor report: Women-led startups more likely to get angel support than VC backing

Angel investors support 10-times more women-led companies than venture capital-backed investors, revealed a first-of-its-kind report by the Kansas City-based Angel Capital Association. “It didn’t shock us,” said Marianne Hudson, executive director of the ACA, the world’s largest cohort of angel investors. Hudson cited previous ACA research that indicated 21 percent of angel investors had been…

KC Bier Co. brewing regional expansion one tap handle at a time, founder says

Rapid growth in the craft brewing market has tapped out, said Steve Holle, founder of KC Bier Co. A solid understanding of the reasons behind such an overdraught industry has so-far saved the Kansas City-based, German-style brewing company from being caught in the same weeds as recently closed Manhattan-brewed competitor, Tallgrass Brewing Co., Holle said.…