BREAKING: C2FO closes $200M investment led by backer of WeWork, Uber, Slack

August 7, 2019 | Startland News Staff

Startup giant C2FO continues its climb to the top, having secured a new $200 million investment — and doubling the amount of its once-record funding raise in fewer than two years.

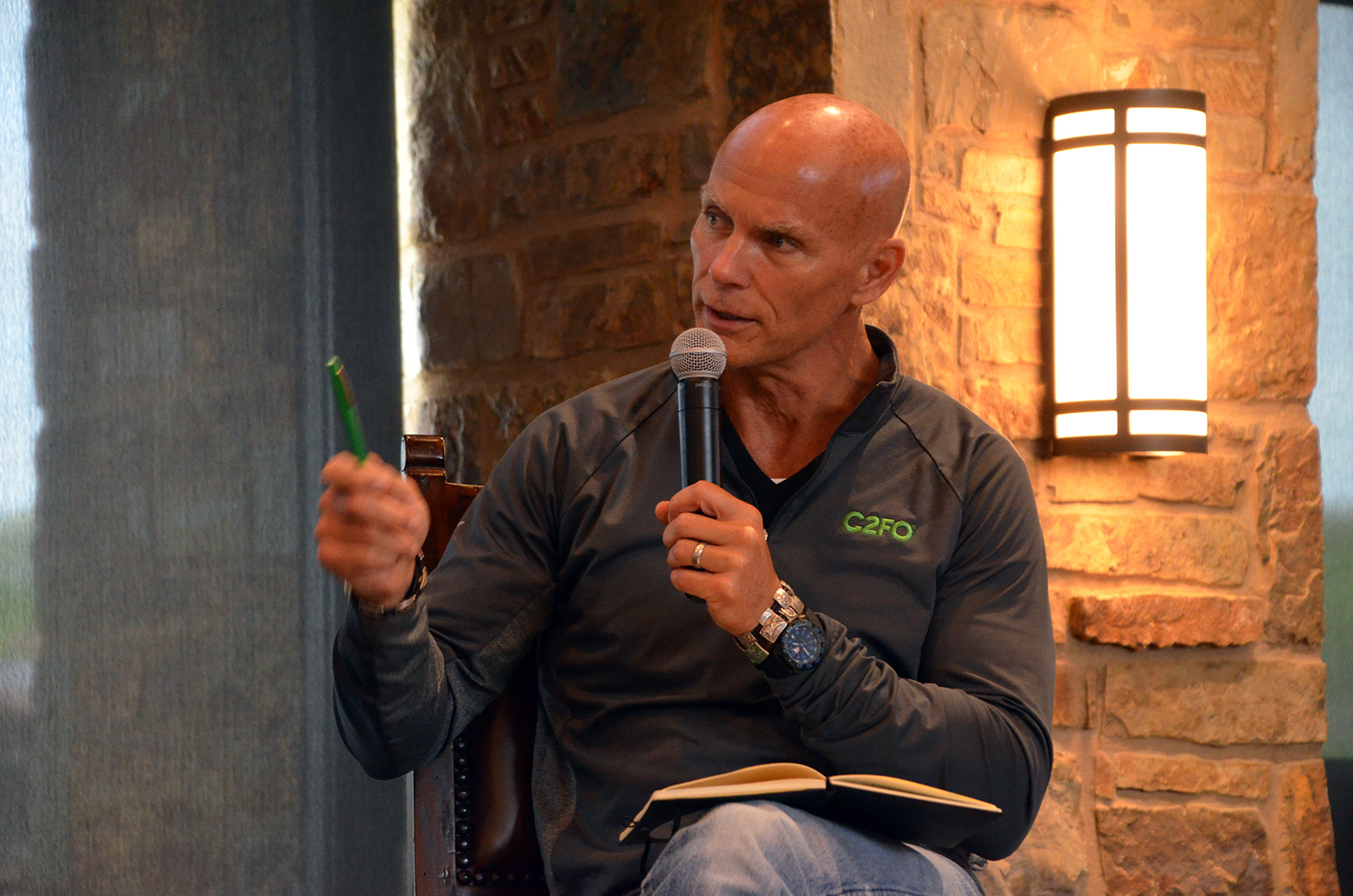

“We are very fortunate to have a team who, for years, has delivered industry-leading unit economics, extraordinary customer satisfaction, and strong global growth,” Sandy Kemper, C2FO founder and CEO, said in a release Wednesday.

Updated: Click here to read more of Kemper’s thoughts on the massive funding round, including C2FO’s big challenge: proving it’s worth of Kansas City’s biggest investments.

The chart smashing round — believed to be the largest yet for a venture capital-backed startup in Kansas City — was led by the $108 billion SoftBank Vision Fund, which also has stakes in WeWork, Uber, Slack and DoorDash. The investment places Nahoko Hoshino, vice president of investment at SoftBank Investment Advisers, on the C2FO board of directors.

Click here to read about C2FO’s previous record setting, $100 million funding round.

Investment firms Temasek and Union Square Ventures returned to the table and placed new bets on C2FO, the company said of the round’s additional participants.

“This infusion of capital from the Vision Fund and existing investors will be used to further our expansion as we strive to build a new world wherein the increased liquidity provided by the C2FO platform helps companies and in turn, entire economies, grow more rapidly,” Kemper said.

Streamlining the world of working capital, C2FO’s online marketplace has amassed over 300,000 clients in 173 countries — helping them control their cash flow and manage more than $1 billion in funding on a weekly basis, the company explained.

Such reach and the ability to shake the industry helped attract SoftBank to the energy-rich startup, said Ashkay Naheta, managing partner.

“We invested in C2FO because we think their disruptive innovation offers a solution to an industry that has traditionally lacked cost-efficient alternatives for businesses of all sizes looking to free up cash quickly,” Naheta said.

Cash injections and the ability to rapidly scale wouldn’t be possible without the C2FO team, Kemper noted.

“Due to their work, we have now grown to match over $1.2 trillion of accounts receivable and accounts payable,” he said.

SoftBank believes C2FO and its leaders are equipped with vision that could help the company — which is expected to reach a $1 billion valuation — become the global exchange for working capital, Naheta said.

Startland will have more on this story as it develops.

Featured Business

2019 Startups to Watch

stats here

Related Posts on Startland News

Bo tell it on the mountain: Thou Mayest founder reveals spirit driving his brand of business

Your spirit makes you alive — don’t ignore its voice when it speaks to you, Bo Nelson advised a captive audience gathered to hear how his entrepreneurial experience at Thou Mayest Coffee Roasters has enabled Kansas Citians to reach their highest good. Nelson read Tuesday from a personal journal he kept during a significant time…

Former ECJC exec Melissa Roberts joins Kauffman Foundation grant making team

Everyone has potential if given the right resources, said Melissa Roberts. “Everybody has great ideas if given the right education. Everybody has the potential to be an economic contributor in our society if given the right motivation and support,” she continued. These aren’t her words and values alone, Roberts said. They’re the legacy of Ewing…

Health scare forced KC’s colorful wax guru to get serious: ‘This is Crumble growing up with me’

Brandon Love is keeping his iconic, brightly-colored hair, but melting away distractions that could be holding back his already wildly successful, but evolving lifestyle brand, Crumble Co., he said. The first to go: Some of the eye-catching candle and wax product names that first caught customers’ attention because of their tongue-in-cheek innuendos and four-letter words,…

Insecure phones, devices creating largest-ever sensor grid (for China) in US homes, says Pepper cyber security report

As an industry, the state of cyber security is a “hot mess,” Scott Ford said candidly. “Frankly, its at a point where it ought to be concerning to everybody,” Ford, CEO of Pepper IoT, said in response to a new report that examines the state of the IoT space and released as part of a…