BREAKING: C2FO closes $200M investment led by backer of WeWork, Uber, Slack

August 7, 2019 | Startland News Staff

Startup giant C2FO continues its climb to the top, having secured a new $200 million investment — and doubling the amount of its once-record funding raise in fewer than two years.

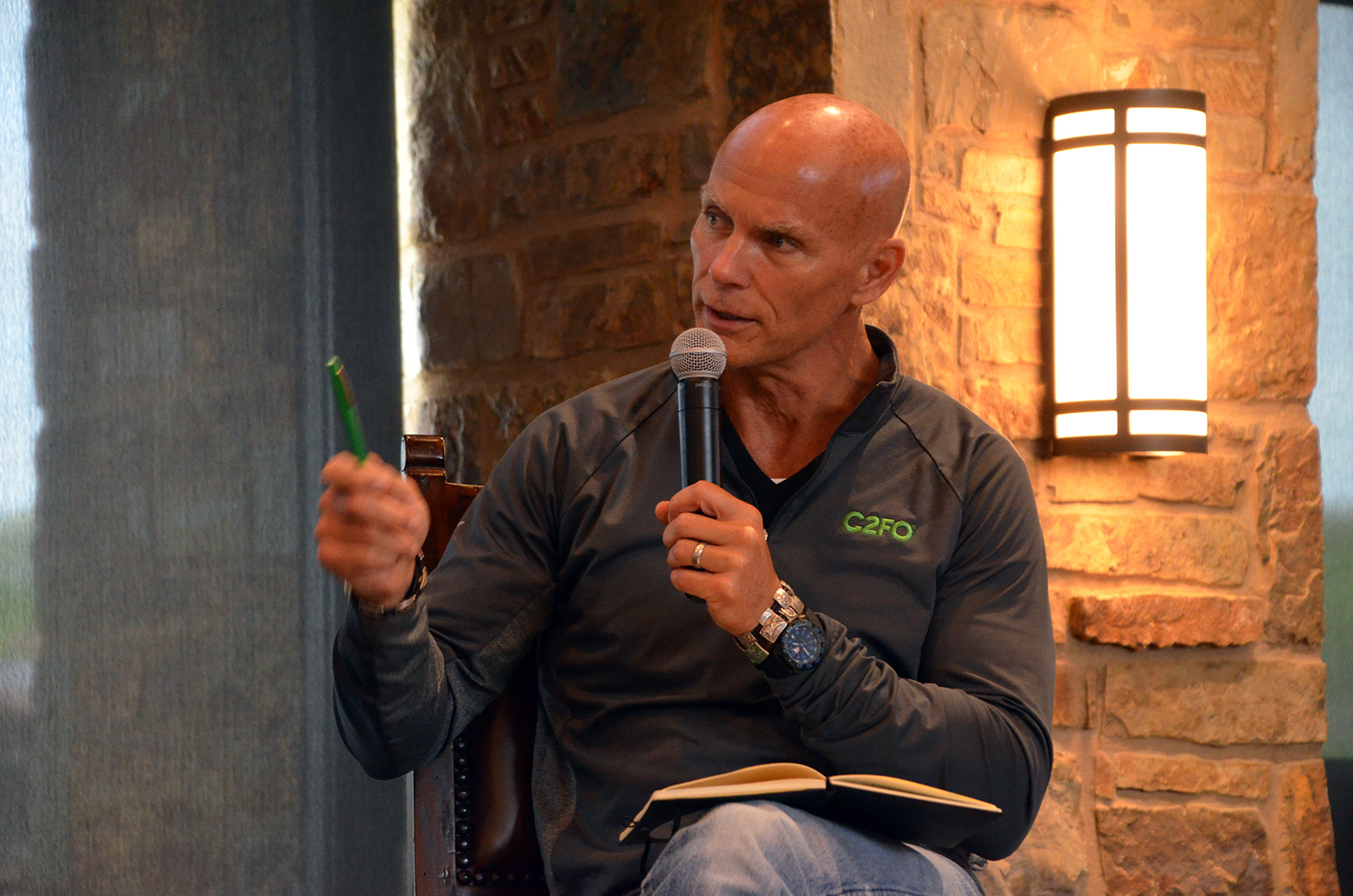

“We are very fortunate to have a team who, for years, has delivered industry-leading unit economics, extraordinary customer satisfaction, and strong global growth,” Sandy Kemper, C2FO founder and CEO, said in a release Wednesday.

Updated: Click here to read more of Kemper’s thoughts on the massive funding round, including C2FO’s big challenge: proving it’s worth of Kansas City’s biggest investments.

The chart smashing round — believed to be the largest yet for a venture capital-backed startup in Kansas City — was led by the $108 billion SoftBank Vision Fund, which also has stakes in WeWork, Uber, Slack and DoorDash. The investment places Nahoko Hoshino, vice president of investment at SoftBank Investment Advisers, on the C2FO board of directors.

Click here to read about C2FO’s previous record setting, $100 million funding round.

Investment firms Temasek and Union Square Ventures returned to the table and placed new bets on C2FO, the company said of the round’s additional participants.

“This infusion of capital from the Vision Fund and existing investors will be used to further our expansion as we strive to build a new world wherein the increased liquidity provided by the C2FO platform helps companies and in turn, entire economies, grow more rapidly,” Kemper said.

Streamlining the world of working capital, C2FO’s online marketplace has amassed over 300,000 clients in 173 countries — helping them control their cash flow and manage more than $1 billion in funding on a weekly basis, the company explained.

Such reach and the ability to shake the industry helped attract SoftBank to the energy-rich startup, said Ashkay Naheta, managing partner.

“We invested in C2FO because we think their disruptive innovation offers a solution to an industry that has traditionally lacked cost-efficient alternatives for businesses of all sizes looking to free up cash quickly,” Naheta said.

Cash injections and the ability to rapidly scale wouldn’t be possible without the C2FO team, Kemper noted.

“Due to their work, we have now grown to match over $1.2 trillion of accounts receivable and accounts payable,” he said.

SoftBank believes C2FO and its leaders are equipped with vision that could help the company — which is expected to reach a $1 billion valuation — become the global exchange for working capital, Naheta said.

Startland will have more on this story as it develops.

Featured Business

2019 Startups to Watch

stats here

Related Posts on Startland News

UMKC joins campus network’s student Entrepreneur Quest accelerator competition

A final showdown of student startups has been set, as budding entrepreneurs from across the University of Missouri campus network compete for financial support. “It brings a lot of those best practices together from all four campuses and really showcases all the great work that’s going on in the system to promote entrepreneurship,” said Andy…

Mom-and-popping it: Nounou platform curates trusted babysitters for JoCo families

Nounou Neighbors takes the fear out of the surprisingly cutthroat babysitting industry, said Molly Smalley, noting her online platform raised 200 percent client base growth in 2018. “As a mom, finding [a babysitter] is exhausting and friends never want to give you their sitter,” laughed Molly, founder of the Kansas-based babysitting service with her husband,…

Doob in doubt: 3D-printed action figures fighting to secure a paying audience in KC

Business isn’t what it should be for a company as innovative as Doob 3D, Nick Nikkhah said openly, seated on a leather couch that looked out across the Overland Park retail store’s showroom. “People don’t know what to do with [Doob]. They’re just like, ‘Whoa, what is that?’ … It’s a new thing for me.…

Reports: St. Louis startup scene surging while KC struggles to keep pace with past wins

Founders hoping to launch a new startup or move into a fresh market might have better success in St. Louis, rather than Kansas City, according to Inc. magazine’s Surge Cities Index. Inc. placed St. Louis at No. 33 on its 50 Best Places in America for Starting a Business list. Kansas City was positioned at…