BREAKING: C2FO closes $200M investment led by backer of WeWork, Uber, Slack

August 7, 2019 | Startland News Staff

Startup giant C2FO continues its climb to the top, having secured a new $200 million investment — and doubling the amount of its once-record funding raise in fewer than two years.

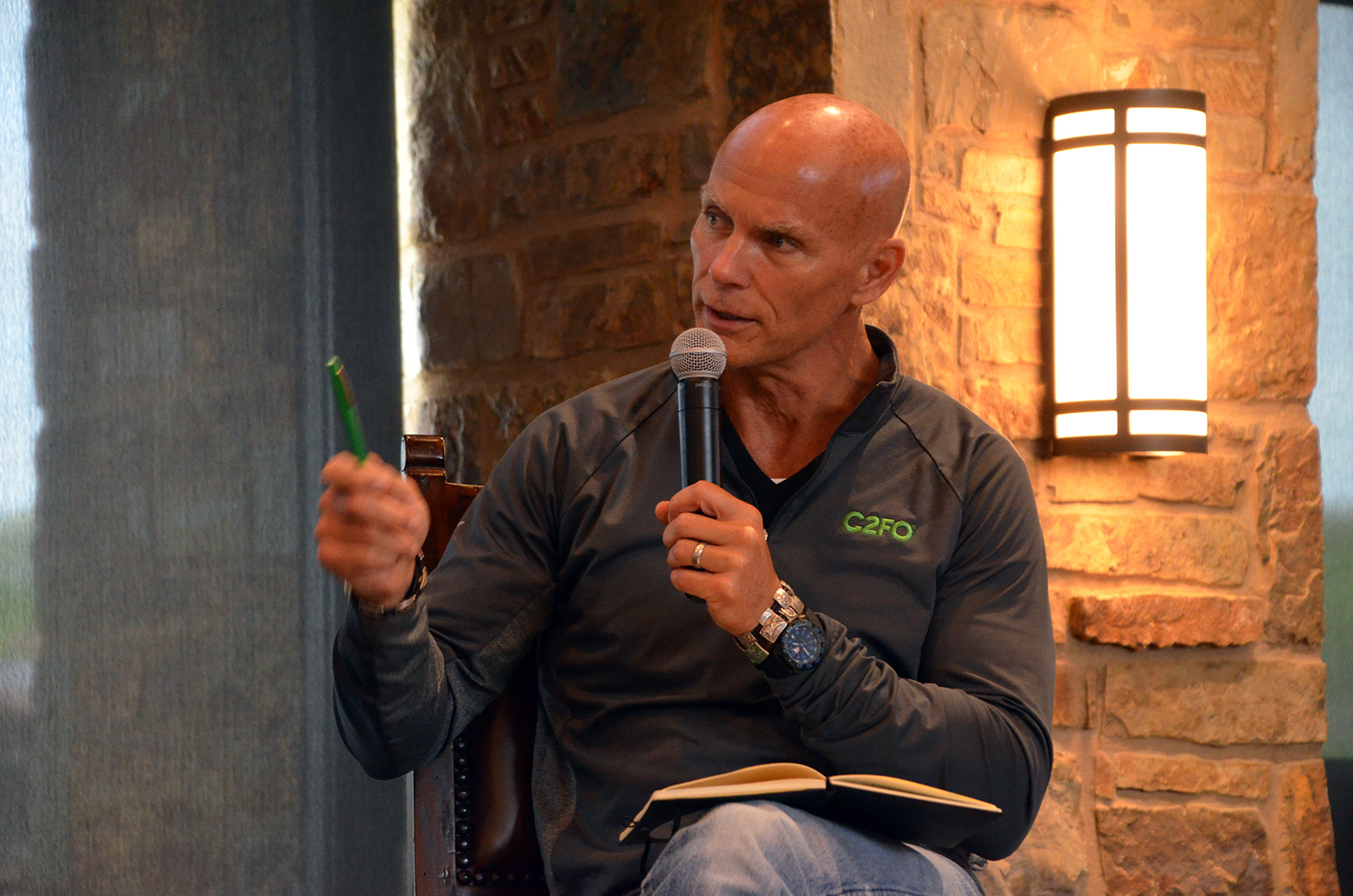

“We are very fortunate to have a team who, for years, has delivered industry-leading unit economics, extraordinary customer satisfaction, and strong global growth,” Sandy Kemper, C2FO founder and CEO, said in a release Wednesday.

Updated: Click here to read more of Kemper’s thoughts on the massive funding round, including C2FO’s big challenge: proving it’s worth of Kansas City’s biggest investments.

The chart smashing round — believed to be the largest yet for a venture capital-backed startup in Kansas City — was led by the $108 billion SoftBank Vision Fund, which also has stakes in WeWork, Uber, Slack and DoorDash. The investment places Nahoko Hoshino, vice president of investment at SoftBank Investment Advisers, on the C2FO board of directors.

Click here to read about C2FO’s previous record setting, $100 million funding round.

Investment firms Temasek and Union Square Ventures returned to the table and placed new bets on C2FO, the company said of the round’s additional participants.

“This infusion of capital from the Vision Fund and existing investors will be used to further our expansion as we strive to build a new world wherein the increased liquidity provided by the C2FO platform helps companies and in turn, entire economies, grow more rapidly,” Kemper said.

Streamlining the world of working capital, C2FO’s online marketplace has amassed over 300,000 clients in 173 countries — helping them control their cash flow and manage more than $1 billion in funding on a weekly basis, the company explained.

Such reach and the ability to shake the industry helped attract SoftBank to the energy-rich startup, said Ashkay Naheta, managing partner.

“We invested in C2FO because we think their disruptive innovation offers a solution to an industry that has traditionally lacked cost-efficient alternatives for businesses of all sizes looking to free up cash quickly,” Naheta said.

Cash injections and the ability to rapidly scale wouldn’t be possible without the C2FO team, Kemper noted.

“Due to their work, we have now grown to match over $1.2 trillion of accounts receivable and accounts payable,” he said.

SoftBank believes C2FO and its leaders are equipped with vision that could help the company — which is expected to reach a $1 billion valuation — become the global exchange for working capital, Naheta said.

Startland will have more on this story as it develops.

Featured Business

2019 Startups to Watch

stats here

Related Posts on Startland News

Photo gallery: With a Boulevard in hand, Techweek pours into KC

Hundreds of techies, innovators and entrepreneurs converged in Kansas City for the third annual Techweek KC conference, which launched Monday and runs through Friday. The Chicago-based conference series, which focuses on innovation and entrepreneurship, returned to the City of Fountains for a five-day conference, expo and festival. It is one of nine such events across…

Greitens eyes private investment dollars to fill MTC budget gap

A new, privately-managed innovation fund could replace a popular startup investment program that was dramatically slashed for 2018 amid Missouri’s budget crunch. The potential strategy change comes as a suggestion from the Hawthorn Foundation’s report to Missouri Gov. Eric Greitens, following the months-long work of an innovation task force charged with assessing the current state…

Prospect to prosperity: Blue Hills boosting neighborhood entrepreneurs (Video)

Economic development along Prospect Avenue requires a chain reaction across the community, Edgar Palacios said. “People need jobs to afford homes, so we need to create those jobs. We need to create some catalysts in this community,” said Palacios, Blue Hills Community Services executive director. “If we can have storefronts along Prospect, that attracts other…

10 BetaBlox firms to know before demo day

Kansas City-based accelerator BetaBlox announced the 10 companies pitching their companies during the program’s Sept. 23 demo day at The GRID. BetaBlox recently received a grant from the Ewing Marion Kauffman Foundation, as part of the KC Accelerator challenge. The 2017 demo day is sponsored by the foundation, BetaBlox founder Wes Bergmann said. This year’s…