Missouri governor signs bill to end KC ‘border war,’ awaits Kansas response

June 12, 2019 | Rashi Shrivastava

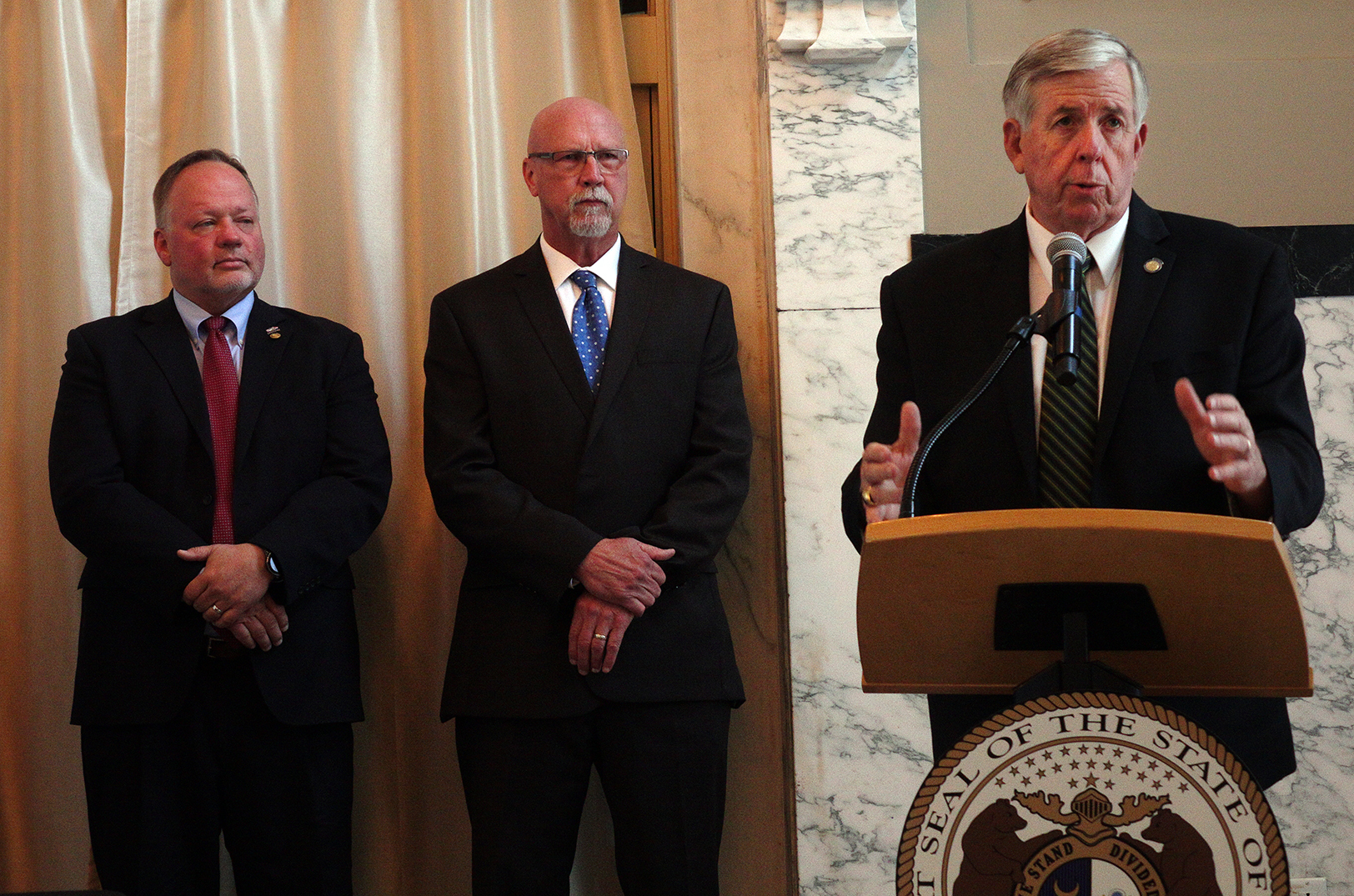

Missouri Gov. Mike Parson signed a bill Tuesday placing restrictions on tax incentives offered to businesses moving from certain counties in Kansas to Missouri. The bill represents a step toward ending the economic development “border war” between the two states.

“This is really about being competitive with real competitors,” said Parson, who was in Kansas City for a ceremonial bill signing at Union Station’s Jarvis Hunt Room.

Both Missouri and Kansas City have spent over $100 million of taxpayer money on incentive programs, Parson said. Such money should be put to better use than shuttling companies from one side of the border to another, he said.

The true competition is with cities like Dallas, Nashville and Denver, not between the two neighboring states, said Joe Reardon, president and CEO of the Greater Kansas City Chamber of Commerce.

“Resolving this issue has been a longtime priority for the KC Chamber of Commerce and those in the business community,” Reardon said.

The bill, SB 182, will only take effect if similar actions are taken by Kansas. Kansas Gov. Laura Kelly has showed her support for the bill and encouraged mutual cooperation between Kansas and Missouri.

“We need to work together, and not be at odds, when it comes to bringing businesses to the region,” Kelly said.

In the Kansas City area, incentive programs are not driving net job creation and regional economic growth because companies are lured by similar incentives introduced by Kansas, said Sen. Tony Luetkemeyer, R-Parkville, who co-sponsored the bill.

“The economic development impact is very short-term, because as soon as those incentives run out, the company looks to see if they can get a better deal, and then come back to Missouri or Kansas,” Luetkemeyer said.

The bill received bipartisan support and is the result of a long haul of legislative work, said Rob Dixon, director of the Missouri Department of Economic Development. Businesses that are already in Kansas City, on either side of the border, will not be affected by the bill, he said.

“A lot of people have been working on this for a very long time, not just this year, but we’re excited to be able to get it done,” Dixon said.

A few months ago, Thirsty Coconut, a beverage product distributor and retailer, made a 30-minute move across the Kansas City metro area, from Miami County in Kansas to Jackson County in Missouri.

Though the tax incentives offered by Missouri were the cherry on the top for the company, they were not the main driving force behind the move, said Luke Einsel, CEO and founder of Thirsty Coconut.

“I think it’s actually good that they’re repealing this,” Einsel said. “It’s kind of silly, you know, to get somebody to move maybe a mile or a couple of miles to hop over the border.”

Einsel said governments are focusing on the wrong companies through tax incentives. He would rather see funding used to help young businesses create jobs instead of incentivizing established companies to relocate jobs.

“Do something that takes a company that’s got five employees to 50 instead of moving 100 employees from one side of the state line to the other,” he said.

This story was produced through a a collaboration between Missouri Business Alert and Startland News.

Featured Business

2019 Startups to Watch

stats here

Related Posts on Startland News

Rightfully Sewn founder stitches a vision for Kansas City’s fashion future

Poised, posh and purposeful, Jennifer Lapka Pfeifer sits straight as a board at Kaldi’s coffee shop with unwavering eye contact. Donning a contoured-floral blue and white dress, Lapka smiles as she poetically recalls painting in high school and learning to sew with her grandmother in rural Kansas. Those experiences fostered a love for fashion, art…

By the Numbers: A look at Midwest tech investment in 2015

Startland News recently distilled a report by Lead Bank and investment research firm CB Insights that analyzed the Midwest tech investing scene. Here are a few more of the findings from the nearly 40-page report, as presented by Startland’s Kat Hungerford.

Shawnee tax incentives aim to lure startups to the ‘burbs

The City of Shawnee is poised to kick off a tax incentive program that hopes to attract “high-growth” tech companies to the area by alleviating initial startup costs. Shawnee City councilman Brandon Kenig said that the “Startup Workforce Relocation and Expansion Program” will encourage job growth and innovation in one of Kansas’ fastest growing cities.…