nbkc launches Entrepreneur in Residence incubator: ‘I have a whole company behind me’

June 18, 2019 | John Jared Hawks

Less than a year after its inaugural Fountain City Fintech accelerator debuted, nbkc bank has launched a new incubator program designed to tackle common banking industry problems with start-up-style ideation, problem solving, and tenacity, said Megan Darnell.

The goal: building new companies along the way, the nbkc program manager said.

“Kansas City has every single resource needed to be a fintech hub, minus a bunch of fintech startups and companies,” Darnell said. “One of the reasons we really wanted this program is the idea of building that network of financial technology companies ourselves in Kansas City.”

nbkc bank is now one month into its first-ever “Entrepreneur in Residence” program. The three-month-long incubator is designed to help both the bank and startups solve challenging business problems, according to Darnell.

“If we can open up our doors and to really find good sustainable solutions to those [problems], then we can enable our founders to scale their business to other community banks, and then on the flipside allow community banks to have their problems that aren’t necessarily ‘sexy’ be solved,” Darnell said.

Entrepreneurs currently involved with the program include Donald Hawkins, and duo Jim Starcev and Mark Calhoun. During the incubator, entrepreneurs have access to a $5,000 monthly stipend, bank data, a live testing sandbox, office space and leaders inside nbkc bank, as well as support and guidance from nbkc’s Fountain City Fintech team.

The startup founders are expected to use the resources to choose a focus area, perform problem research, develop an alpha solution, validate the solution, and then build a company around the solution.

For Hawkins, founder and CEO of Griffin Technologies, the problem of choice relates to bank-consumer interaction. (His latest venture is as-yet unbranded.)

“Banks have transaction data, they have risk analysis, they have credit scores, but when it comes to knowing when to contact their customers, they don’t know,” Hawkins explained. “Our tagline is, ‘Connecting brands to consumers in the moments that matter.’ That’s what our technology does for our banking customers.”

Hawkins’ product centers around delivering insights gleaned from banks’ apps.

“After having a conversation with Zach Pettet [nbkc vice president of fintech strategy] and Megan about possibilities and doing customer discovery, we realized that we had the ability to build software development kits that banks could embed in their mobile applications to receive insights,” Hawkins said. “Right now we are in the process of getting our products ready to ship.”

Starcev and Calhoun — co-founders of PerfectCube — are exploring ways to leverage existing industry data toward consumer credit score improvement, a well-known but muddled problem in the banking industry. The two are hoping to dust off the issue by bringing a new, entrepreneurial mindset to a typically risk-averse industry — doing business under the company name SNRM (SuperNinjaRocketMonkey, Inc.).

“The data that’s out there is scattered, some of it’s misinformation, some of it’s predatory, some of it is helpful but not necessarily readily available,” Calhoun said. “Our goal is to take all this information, all the all the data we get from consumers, lenders, and other sources, and boil it down to where we can help make somebody’s life better.”

Though they are tackling different problems, the three entrepreneurs agree: access to nbkc’s resources has accelerated their work in concrete ways.

“They really open up access to virtually anyone in the bank,” Starcev said. “The bank has been able to provide us a lot of information that would be hard for us to get otherwise.”

“Having direct access All the way up to the CEO of nbkc has been incredible,” Hawkins said. “Things that would normally take me about six months to process and ideate through, with this Entrepreneur in Residence program, we’re able to get knocked out in less than a month.”

“When you have people involved in this program who are just as focused on helping your company win as you are … as entrepreneurs, we typically don’t get that,” he added. “It’s normally us fighting the fight, and maybe a few mentors, but now I feel I have a whole company behind me.”

Featured Business

2019 Startups to Watch

stats here

Related Posts on Startland News

Couple with tech, startup background embraces risk-taking as new Pitch owners

Local ownership of The Pitch will preserve the Kansas City alternative news publication’s voice, as well as expanding digital content for readers, and promotions and services for advertisers, Stephanie Carey said. “I love the independent voice. I love the fact that we can push those boundaries, push the envelope on stories, dig a little deeper,”…

Cultural differences contribute to entrepreneur access gap, Porter House founder says

Early education about entrepreneurism and the resources available aren’t typically priorities in low- to moderate-income communities, said Daniel Smith. “A lack of access results because we don’t really have a lot of programs in our communities that focus on small business and entrepreneurism,” said Smith, founder of The Porter House KC. “It’s more focused on…

Missouri, Airbnb announce revenue-sharing state sales tax deal

As Kansas City wrangles with its own short-term rental rules, Airbnb and the Show Me State announced an agreement Wednesday that will allow the home-sharing giant to collect and remit taxes on behalf of 6,300 Missouri hosts. Effective Feb. 1, the tax agreement with the Missouri Department of Revenue adds a state sales tax — now…

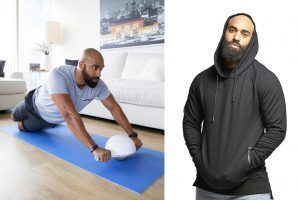

FEWDM drops high-tech fitness devices, pivots to workout apparel

Not every promising startup venture can keep the ball moving toward the end zone. It’s a lesson FEWDM founder Tommy Saunders says he’s blessed to have learned — despite the bittersweet turn for the former Detroit Lions receiver’s company. “We have a strong brand that our customers connect with and have grown to love,” Saunders…