Bellwethr grows $2.5M in seed funding, building two-city talent base between KC, Manhattan

June 12, 2019 | Austin Barnes

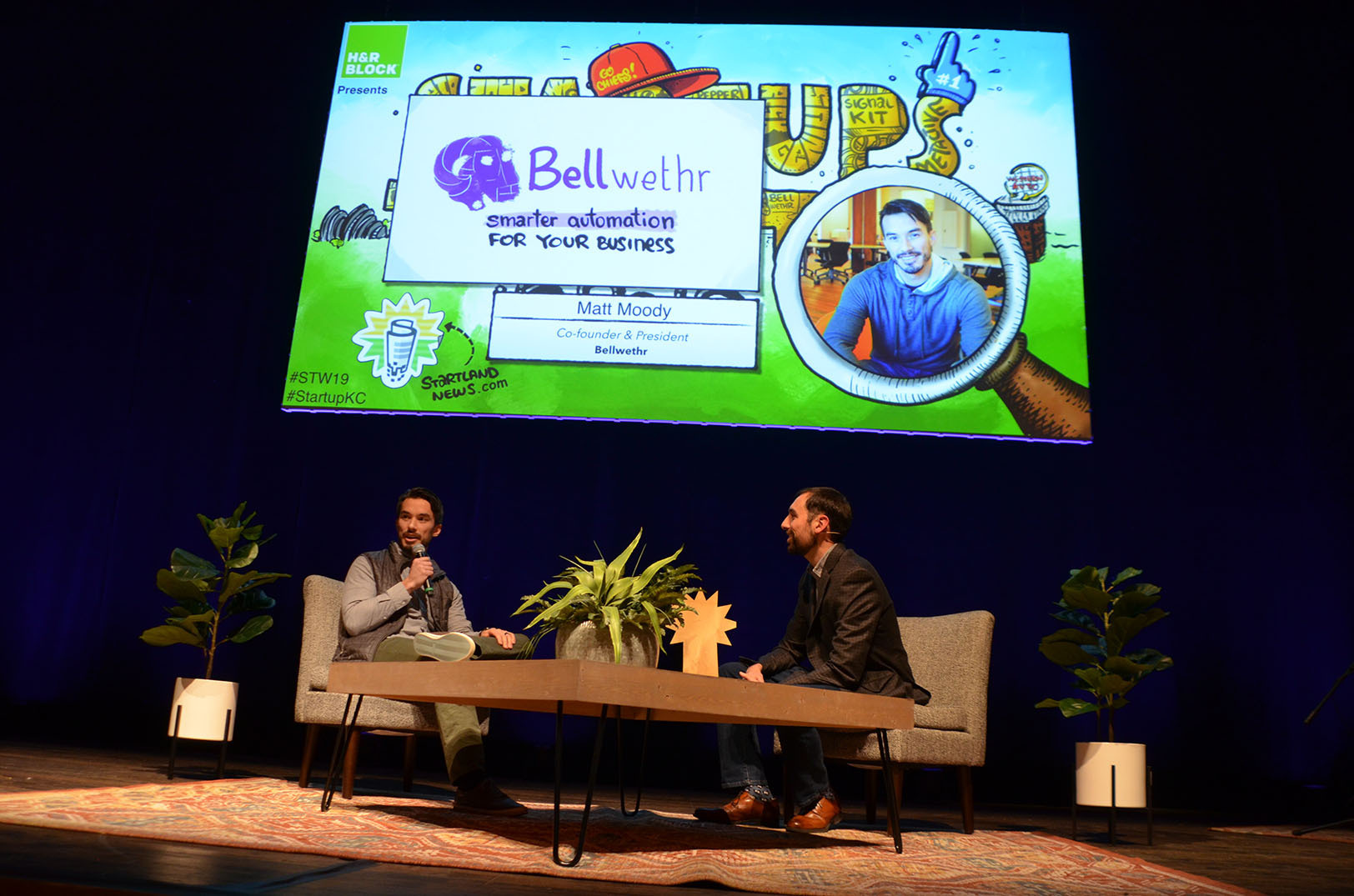

A $2.5 million seed funding round will infuse Bellwethr with more than cash, said Matt Moody.

“We’ve been able to find some high quality talent and the big thing now is to apply that, build out the product more and start selling even faster,” Moody, founder and CEO, said of Bellwethr’s alignment for rapid growth.

Bellwethr’s elevator pitch: Software firm using artificial intelligence and machine learning to eliminate the need for technical expertise in web development and the inevitable site adjustments that have to be made to tailor to customers.

Previously, Bellwethr had amassed $120,000 in funding, Moody revealed at the time the company was named one of Startland’s 2019 Kansas City Startups to Watch.

Click here to find out where Bellwethr ranks on the annual Startland list.

The seed round was led by Royal Street Ventures, a Utah-based venture capital firm with a heavy Kansas City presence, Moody noted.

Other noteworthy investors include KCRise Fund, Techstars — the accelerator program Bellwethr successfully completed in 2018 — and angel investor Beth Ellyn McClendon, along with Karen and Paul Fenaroli, through the Minerva Fund, Moody said.

Moving beyond the raise, Bellwethr will work to build out its engineering and sales teams, while developing new products, Moody said.

Among such products and services is Retention Engine — a service designed to handle the cancelation of consumer accounts or subscriptions and work to solve problems while offering solutions that help companies avoid subscriptions, the company outlined in a release.

Much of the Bellwethr’s current engineering talent has joined the company — dually located in Manhattan and Kansas City — from K-State, Moody explained.

“It seems like the trend is, you know, after graduation to head towards Kansas City,” said Moody, who hails from the neighboring city of Wamego. “It’s a nice thing for us to be able to kind of handle the two. We can have people start with us and then if they decide they want to move, we’ve got the team in Kansas City as well.”

Mounting momentum, Moody said the injection has greatly impacted Bellwethr’s ability to onboard two VFA fellows in 2019.

Click here to read more about the VFA fellows set to join Kansas City companies over the summer.

“We closed on some of the money earlier in May and so we started hiring. We surprisingly had a lot of talent coming in even before the VFA process opened up,” he said. “They have their masters, experience in machine learning. We’ve been able to find some high quality talent!”

Bellwether has doubled its revenue since graduating the Techstars program in 2018, Moody said, noting that he expects the company to maintain upward momentum.

Featured Business

2019 Startups to Watch

stats here

Related Posts on Startland News

Silicon Valley accelerator 500 Startups invests in KC tech firm

A Kansas City firm planning to transform the world with its artificial intelligence tech recently landed in a highly-esteemed startup accelerator in Silicon Valley. Mycroft announced Wednesday that it’s in the latest cohort of 500 Startups, a global venture capital seed fund and startup accelerator that manages $200 million in assets and has invested in…

Kansas City hosting NIST national smart cities conference

Kansas City’s smart city creds are on the national stage. The National Institute of Standards and Technology selected Kansas City as the first city to host a national conference that encourages collaboration and establishes standards for smart cities. On Tuesday and Wednesday, Think Big Partners and the City of Kansas City, Mo. will host Global…

With investors clamoring for more, Blooom raises $9.15 million

One of the area’s top startups, finance tech firm Blooom has landed a significant round of financing to accelerate its online tool to boost users’ retirement savings. The firm announced Monday that it raised $9.15 million in an oversubscribed Series B round that features some behemoths in finance tech investing. The round was co-led by…