PayIt gains $25M follow-on investment from early backer Weatherford Capital

May 31, 2019 | Tommy Felts

A Tampa-based venture capital firm run by three brothers sees investing in Kansas City’s PayIt as part of its long-term strategy.

Weatherford Capital first backed PayIt in 2016, through a $4.5 million Series A round led by New York-based Advantage Capital Partners, and followed by Weatherford, Royal Street Ventures, the Missouri Technology Corporation and Five Elms Capital.

The firm confirmed to Startland this week a follow-on investment of $25 million for the Kansas City GovTech innovator, which is led by co-founders John Thomson and Michael Plunkett.

Specializing in GovTech applications that better connect government to its constituents, PayIt made news in 2018 thanks to major partnerships with the State of Kansas and the Unified Government of Kansas City, Kansas. Its iKan app notably allows Kansas to skip the line at the Department of Motor Vehicles.

PayIt was named one of Startland’s 10 Kansas City Startups to Watch in 2017 and 2018.

“As investors, we seek out quality teams, leaders, and healthy cultures, not just assets and good ideas,” reads the investment firm’s website. “We believe that through long-term partnerships with purposeful capital and high-quality companies we will produce outcomes that promote human flourishing.”

Driven by Will, Sam, and Drew Weatherford, the firm has a nationwide focus on middle market firms with enterprise value of $50 million or more.

In March, PayIt made headlines with a more than $100 million investment by New York-based Insight Partners, which provided an exit for investors within the KCRise Fund.

Click here to read about the game-changing investment for PayIt and Kansas City.

“The company [PayIt] happens to be in Kansas City — Investors expect a return. They’re looking for big, scalable, durable businesses,” PayIt’s Thomson said at Startland’s May Innovation Exchange event. “You’ll hear the phrase ‘escape velocity’ — those that can turn into the next Fortune 500 company in a market or a category. It’s all about the execution of the business, the growth trajectory and how investable is that team and business.”

Meeting with more than 85 firms in its most recent funding push, however, PayIt saw rising interest not only in its GovTech offering, but in its hometown backing, he acknowledged.

“There’s a broad awareness of Kansas City, this ecosystem and this environment — and that it’s been on the rise,” Thomson said.

Featured Business

2019 Startups to Watch

stats here

Related Posts on Startland News

DevOpsDays brings two-day grassroots tech conference back to Kansas City

DevOpsDays KC is returning this week with an open spaces concept wherein audience members at the two-day conference vote on the topics to cover in real time, said Ryan McNair. Topics with the most votes create zones in the space in which the audience can flow freely from each area. “If you don’t like it,…

Privacy in practice: Responding to daily cyber threats sharpens Polsinelli tech team

Editor’s note: The following content is sponsored by Polsinelli PC but independently produced by Startland News. We see the fallout nearly every day. Another company, government or celebrity that’s been technologically compromised, prompting officials to scramble on how to best calm customers, citizens and stakeholders. And when you lead one of the nation’s top cybersecurity…

Pint-sized perspective: KC’s Little Hoots takes nostalgia-capturing tech to MIT

From the cute and comedic to the whimsical and wise, every parent can pinpoint a Little Hoots moment that relates to their personal adventure in child-rearing, said Lacey Ellis, founder and CEO of the Kansas City-birthed mobile app that recently turned heads at MIT. “If a picture is worth a thousand words, a hoot is…

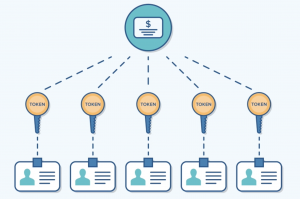

LaunchKC winner bringing cryptocurrency into the investment game with Liquifi

A blockchain-enabled solution from Venture360, called Liquifi, aims to unfreeze startups paralyzed by a lack of access to capital, Rachael Qualls said with excitement. “The main reason more people don’t invest in private companies is there is no way to get money out,” said Qualls, CEO of Venture360. “On average money is tied up for…