Elite investors at exclusive CEO retreat: Don’t waste time; sell us on your billion-dollar idea

May 3, 2019 | Austin Barnes and Tommy Felts

Trying to land the backing of a venture capital firm? Throw your pitch deck out the window, Chris Olsen advised a select group of Kansas City CEOs.

“A lot of times founders will come and give us their pitch and they’ll start going through it and [they’re telling us] they’re profitable in 18-months. And we’ll look at them and be like, ‘Do you have another pitch?’ and they’ll say ‘What do you mean? This is the pitch my adviser told me to give,’” Olsen, co-founder and partner at Columbus-based Drive Capital, told a room of C-Suite executives and startup leaders who’d gathered Thursday in seclusion at a ranch outside the metro for the KC Tech Council’s annual CEO Retreat.

“If you’re really serious about this, you should be telling us this is a billion-dollar company,” Olsen said matter-of-factly.

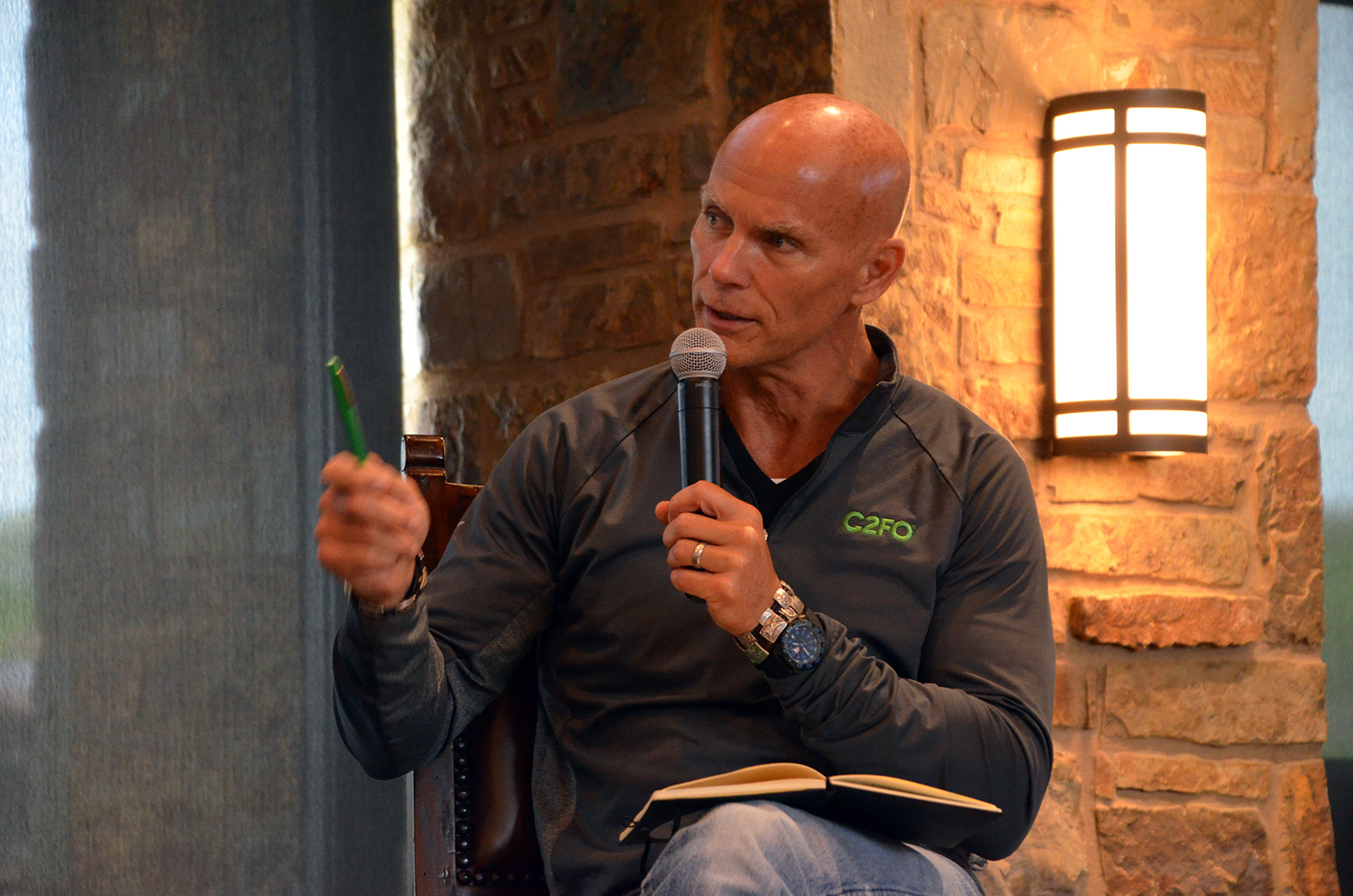

An “Invest in the Best’ panel conversation moderated by C2FO’s Sandy Kemper featured Olsen, alongside Laura Brady, managing director at Kansas City’s Royal Street Ventures; Will Kohler, partner at Lightspeed Venture Partners in the San Francisco Bay Area; and John Buttrick, partner at Union Square Ventures in New York.

Check out a photo gallery at the bottom of this story.

John Buttrick, Union Square Ventures; Will Kohler, Lightspeed Venture Partners; Chris Olsen, Drive Capital; and Laura Brady, Royal Street Ventures; KC Tech Council CEO Retreat

Union Square Ventures — an investor in C2FO along with Lightspeed Venture Partners and others — has seen at least one billion-dollar exit each year, Kemper emphasized during the KC Tech Council gathering, challenging conventional thinking on “unicorns.”

Click here to see Union Square’s full portfolio, as well as its exited investments, which run the gamut from Etsy and Indeed to Twitter and Zynga.

“Start over with what’s possible,” Olsen instructed the room of startup and company leaders, many of whom are searching for the keys to the perfect pitch as they look for the kinds of funding the heavyweight panel could provide, he noted.

“The mentality needs to be ‘You can do anything.’ … You can change industries! You are changing industries! Nobody’s going to believe it unless you believe it!” Olsen said.

If founders want to break the mold and attract the kind of funding that Buttrick has bestowed on leading companies like Twitter and Kohler has with Snapchat, they have to stay confident, Olsen said of Midwestern values that can slow a startups hustle.

“People in the Midwest … I think lose the encouragement. They need to understand that maybe people here don’t understand that what you’ve built is really special — that it is important on a global basis,” Olsen explained of his theory. “If you were to look around, you’d start to understand that you actually are [important], you just might not get [that reinforcement.]”

Founders should push themselves beyond landlocked stereotypes if they want to attract VC attention, the funding phenom continued.

Perhaps better thought of as “adventure” capital, VC funds are eager to take the risk, he added.

“It’s actually really hard to lose money in the Midwest — as an investor,” Olsen revealed. “… I look at our loss ratio of investments in Silicon Valley. [We would see] 50, 60 percent of the fund go to zero and it would go to zero within the first 18-months of that investment cycle.”

The reason: Startups on the coast run on high burn, either smashing through walls or into them, he explained.

“Our loss ratio on our first fund … ran out at 10 percent and I’d be surprised if it gets up to 20 percent,” Olsen said. “So we look at that and we’re like, ‘Huh! Maybe we’re not taking a risk. Maybe we need to believe in crazier ideas that are out there.’”

Laura Brady, Royal Street Ventures, and Sandy Kemper, C2FO

If entrepreneurs want to play at the level of current Kansas City ecosystem giants such as C2F0 and PayIt — or legacy startups such as EyeVerify — they have to be bold, Olsen said. Closing in on his thoughts, he added that the efficiency found in the Midwest startup space could be the security blanket founders need to risk it all.

“A lot of our companies that don’t work out, the founders are able to cut the burn — if [there’s profitability] — and sell the business,” he said. “It’s not a great outcome, but it’s better than the alternative.”

Laura Brady, Royal Street Ventures

Olsen and his team at Drive Capital use such a line of thinking to push their founders to keep going, he added.

“We’ve got a safe landing for this,” he said. “Let’s really try and see what’s possible!”

Kansas City founders have optionality, added Brady, whose Royal Street Ventures fund prides itself on making local investments.

“The market’s not adopting as fast,” Brady said. “You can [slow] your burn, survive for a couple more months, raise more capital, exit …”

Although an all-in mindest can have its pitfalls, Olsen added, taking a risk in Kansas City could provide a wealth of rewards.

Growing the startup ecosystem and increasing its output are dependent on founders rolling up their sleeves and deciding which side of the line they’re ready to ride, he said.

Featured Business

2019 Startups to Watch

stats here

Related Posts on Startland News

Hunting unicorns: C2FO spotlighted as startup likely to reach $1B valuation

Leawood-based C2FO is among the nation’s highest-momentum startups, according to CB Insights and The New York Times, which teamed up to name 50 “future unicorns.” The U.S. companies on the list — which analysts involved predict will eventually be valued at $1 billion or more — largely are based on the coasts. Twenty-two are in…

Thou Mayest sprouts fresh coffee concept in the suburbs; new Crossroads flagship percolating

Coffee needn’t be melancholy or monochromatic, said Thou Mayest founder Bo Nelson, bathed in warm sunlight at Cafe Equinox. “We have to wake people up,” said Nelson. “We’re trying to celebrate the diversity of life — humanity, plants, music, art — so many collisions. It’s not a distraction. It’s not a means to an end.…

Atonix Digital using predictive analytics to tackle Black & Veatch first, then the world

Black & Veatch offshoot Atonix Digital is re-engineering the future of its parent company’s customer base, said Paul McRoberts. Developed to offer software solutions to customers from Black & Veatch’s existing market sectors — power, water, and telecommunications — Atonix has the opportunity to move beyond its specific corporate origins to service other industries, said…

K-State institute’s expanded focus: Boost Kansas companies launching new tech

Every Startup A Wildcat? The Technology Development Institute at Kansas State University is evolving its role and services to improve the economic competitiveness of Kansas companies. Broadening activity at the institute — formerly known as the Advanced Manufacturing Institute — reflects a focus on developing, protecting and launching new technologies for a range of partners,…